How We Invest

Most people are familiar with traditional stocks and bonds, but how much should you own? Are there other investments that might help you achieve your investment goals? We believe there are.

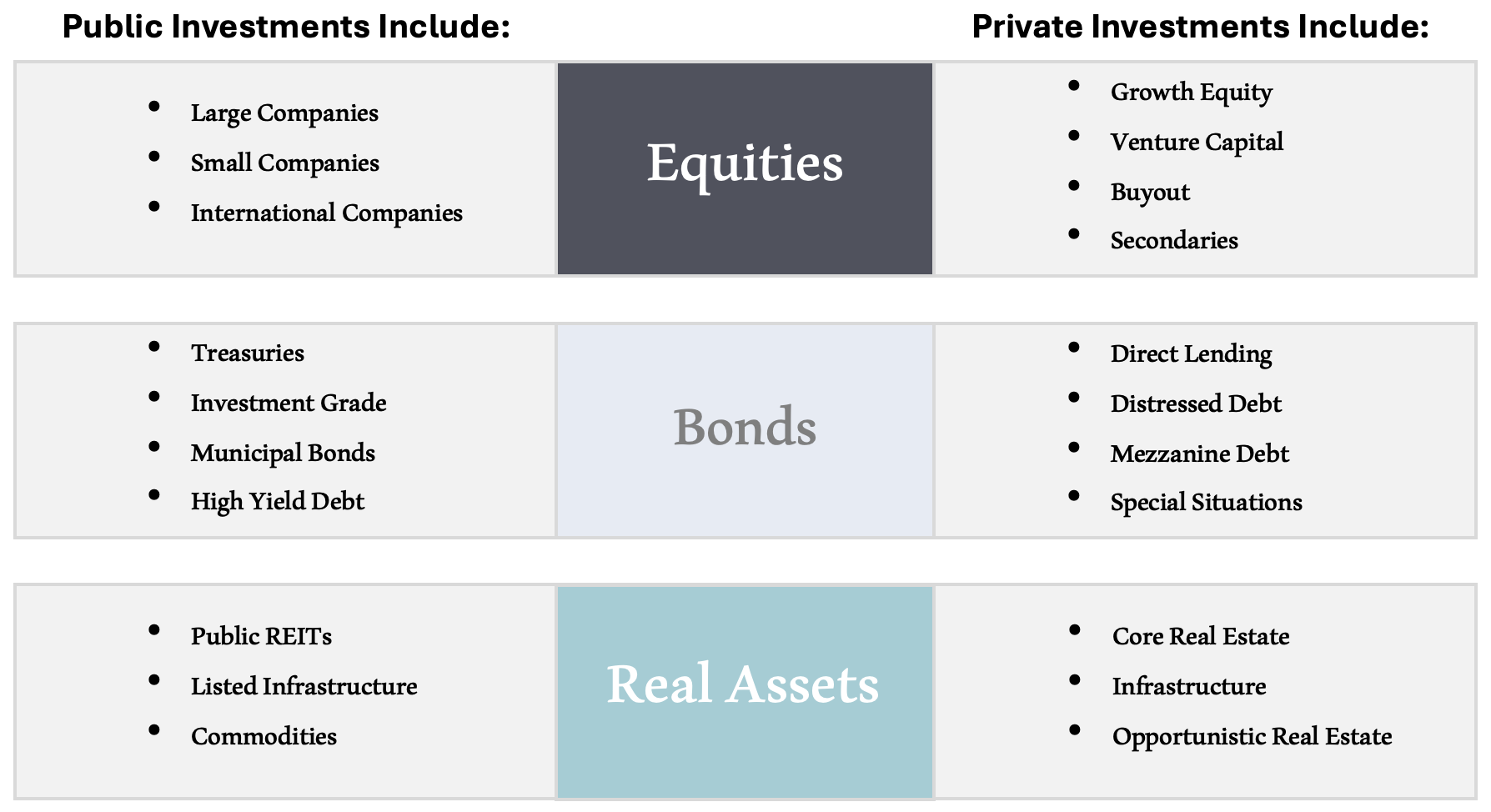

To help guide our investment approach, we bring rigorous academic research to the process, which also includes utilizing alternative investment strategies when appropriate. These solutions may include both public and private opportunities to better manage risk.

Helping Investors Build a Robust Investment Framework

Investors may pursue specific objectives using both public and private markets, such as:

- Income generation

- Growth of wealth

- Diversification

- Tax advantages

- Inflation protection

By understanding both public and private markets, eligible individual investors can see the benefits of how these types of strategies may fit into one’s portfolio to pursue specific goals.

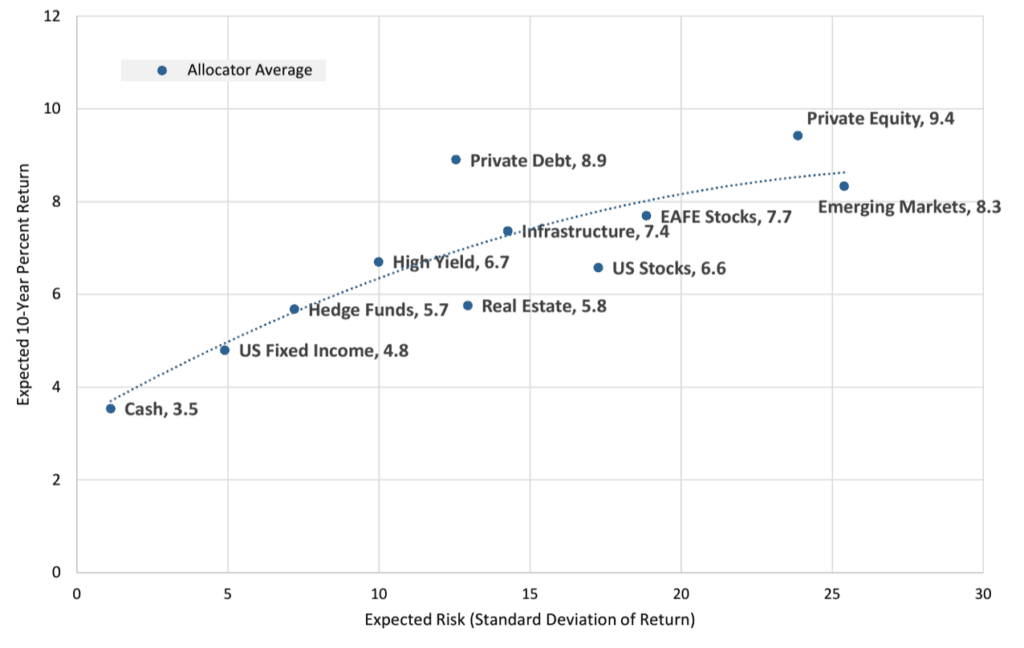

While some face a challenging environment to meet their performance objectives, we bring an evidence-based approach to our clients.

Our structured, yet flexible approach is the driver as we look to own higher expected return assets for our clients.

Our clients come to us with a large range of investment needs and challenges. To help our clients achieve their goals: