Asset Management

Growing and protecting your family’s wealth often depends on how you invest and manage risk. Do you have a process that can stack the odds in your favor? Do you accept the right types of investment risks that also provide you with a high probability of achieving your goals?

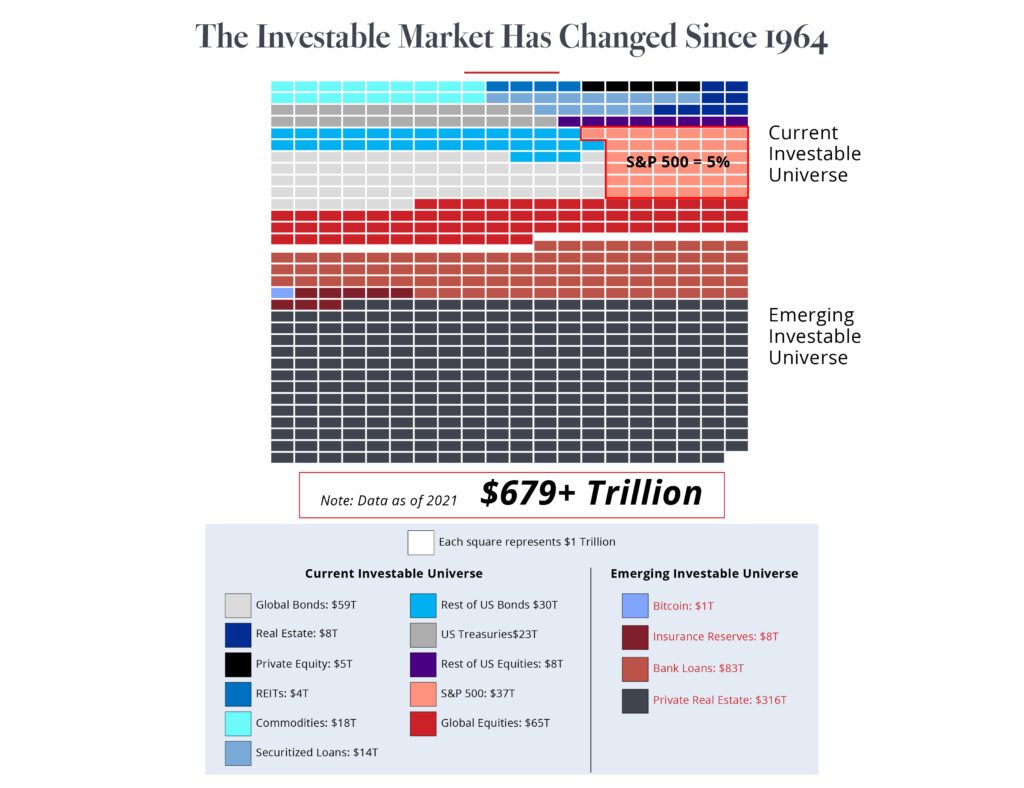

Good diversification is one of the last free lunches available to investors and therefore we prefer an academic framework that allows us to think about the asset allocation problem differently. Our research shows us that since 1964, in the early days of Modern Portfolio Theory and the 60/40 portfolio, the investable market has significantly changed:

As you can see by the chart above, large public U.S. stocks (i.e. S&P 500) no longer make up as much of the investable market as they once did. Not only have foreign stock markets, global real estate, and fixed income grown in size, so have other asset classes. Therefore, there are now more asset classes available to investors. Given the growth and evolution of today’s capital market structure, this suggests that additional diversification and wealth creation opportunities exist.

As a result, we believe that both public and private investment opportunities should be considered when managing investment risk for clients.

There’s plenty of attention on AI.

- But there’s another, even smarter information processing machine: the market.

- We partner with institutional managers that use information in prices to put the power of the market to work for investors every day.

- In this short video, we share some ways how clients’ can benefit from our investment approach.

What’s the right asset mix for you? Everyone’s risk tolerance and goals are different. Let us help you determine yours.