How We Listen

We all have busy lives and are moving at an enormous pace. With so much to do and respond to: work, our health, family, our child’s education…who has time to just think or stop to listen. Unfortunately, many things go unfinished such as personal goals or planning for the future. Or worse, we lose focus on family, our emotions, and maintaining good habits.

In our industry, we see and hear the same thing. Many financial advisors and investment firms get busy. And often when it matters most, they may fail to truly listen to what their clients need and when they need it most.

At CAM, we want to hear all that is most important to you and whom you care about most. We want to help you slow down, think and really identify your goals, make smart decisions, manage emotions, and maybe laugh a little too. The ultimate goal: allow you to be in control of your time so you can make work optional or do whatever you desire for the future.

Telling Your Story

- Goals – what do you want to do or accomplish? Creating a plan will help you achieve your goals.

- Values – what is important to you? Use your money to support your interests that have the greatest impact on your life.

- Relationships – WHO is important to you? We help you understand why this matters so much in the planning process.

- Process – how do you want to work with us? This allows us to provide you with a great client experience.

- Advisors – we’re here to work with you and anyone else on your team.

- Assets – its important to align this with your financial planning needs.

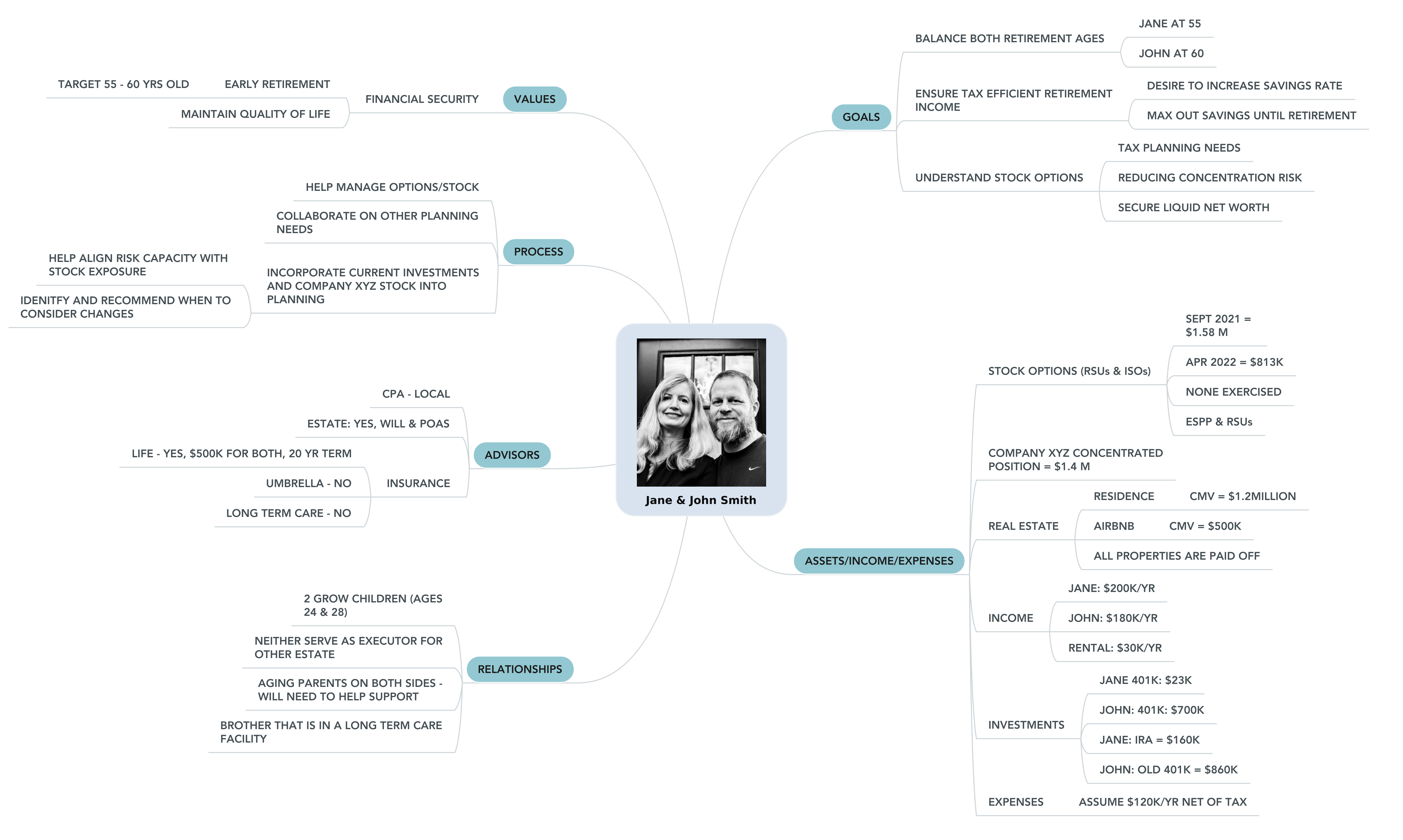

Total Wealth Profile

All clients and their financial journeys are different. Below is just one example of a client to demonstrate how we truly listen.

By listening we are able to get to know them, their needs and look for ways we can help.

Trust the Process: What the First Year with CAM Looks Like

Goal Setting

Helps prioritize your most important financial needs and collect all information necessary to work together.

Planning & Investment Meeting

We create and review your Total Client Profile to align your most important values, goals, and relationships. This serves as a road map to help maximize the probability of achieving what is most important to you.

Implementation Meeting

Discuss key questions and provide a comprehensive summary of your financial needs. This may include our recommendations and areas of priority for cash flow projections, tax planning, estate review, education funding, or risk management needs to name a few. We will also prepare to execute our 2nd Opinion investment recommendations in line with your Investment Policy Statement (IPS).

Initial Check-in and Feedback Session

Set up your personal financial planning portal and check-in to respond to your initial questions. We also request your feedback on your experience and our progress to date in helping you achieve your goals. We are always grateful to hear from you on how to improve our client service process.

Client Review

Discuss your progress towards goals. Continue to execute advanced planning strategies based on previously identified short, medium, and long-term objectives.