CAM Core Income Strategies

Growing and protecting your family’s wealth often depends on how you invest and manage risk. Do you have a process that can stack the odds in your favor? Do you accept the right types of investment risks that also provide you with a high probability of achieving your goals?

You Deserve More Income and Better Performance

Do you remember what you did to generate income from your investments when interest rates were very low?

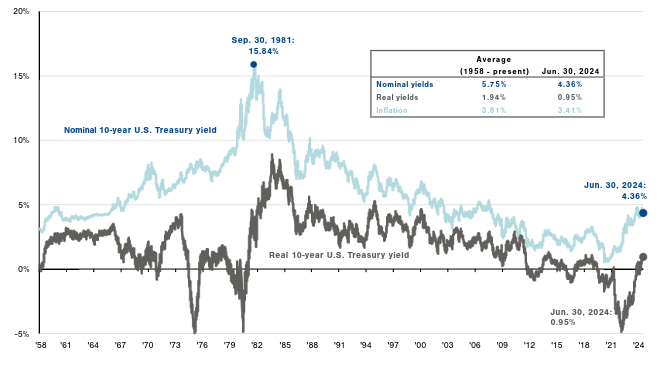

Here’s a few interest rate facts to consider:

- Interest rates are considered “high” compared to just a few years ago.

- You may find it interesting to know that the long-term historical annualized return for traditional fixed income is somewhere between 3 – 4%.

We believe this is a problem, and here’s why.

Since launching the firm, we’ve spent a lot of time in growing our approach beyond traditional solutions in order to help clients achieve their long-term financial planning and investment objectives.

CAM Core Income Strategies – Purpose & Investment Objective

- Diversification: Strategies are designed to increase diversification and manage interest rate volatility.

- Yield: Target higher and more consistent yields over traditional fixed income or bond fund solutions.

- Inflation: Can help protect against higher inflation and rising GDP, while still helping investors achieve long-term investment returns.

- Income: Designed to help provide investors with steady and attractive income while also employing more institutional capabilities.

- Legacy: Additional yield can also provide supplemental retirement income, gifting opportunities, or satisfy other financial planning needs.

*Portfolio management fee for Core Income Strategies is 0.50% of assets under management. Strategy is for accredited investors only.

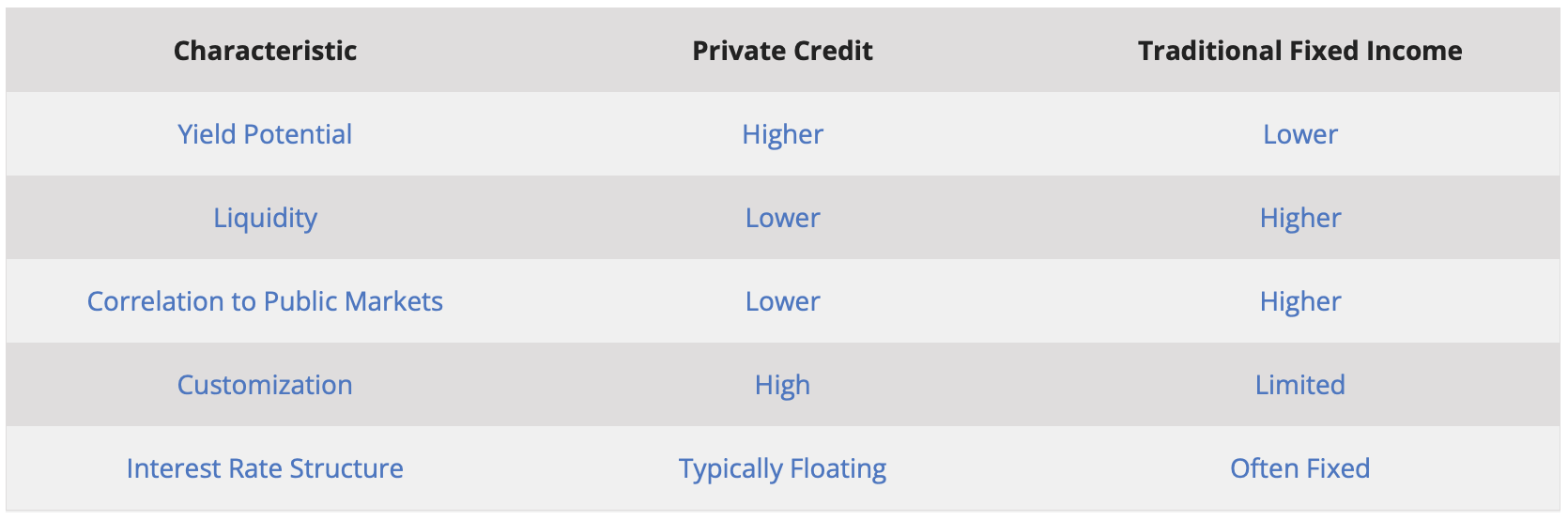

Not all Bonds are created equal.

Over the last decade, we believe structural shifts in the lending landscape have created opportunities.

Post-global financial crisis regulations have led banks and institutions to reduce traditional lines of business, therefore creating a gap and opportunities for others.

By considering alternative asset classes along with traditional investments, investors may be able to further diversify risk as they pursue their long-term investments goals.

What’s the right asset mix for you? Everyone’s risk tolerance and goals are different. Let us help you determine yours.

Investors Pursue Income in Different Ways