CAM Investor Solutions has announced the release of their new Core Income Strategy. This strategy aims to help clients earn more income.

“The 3.2% Problem” – The Average Fixed Income Return

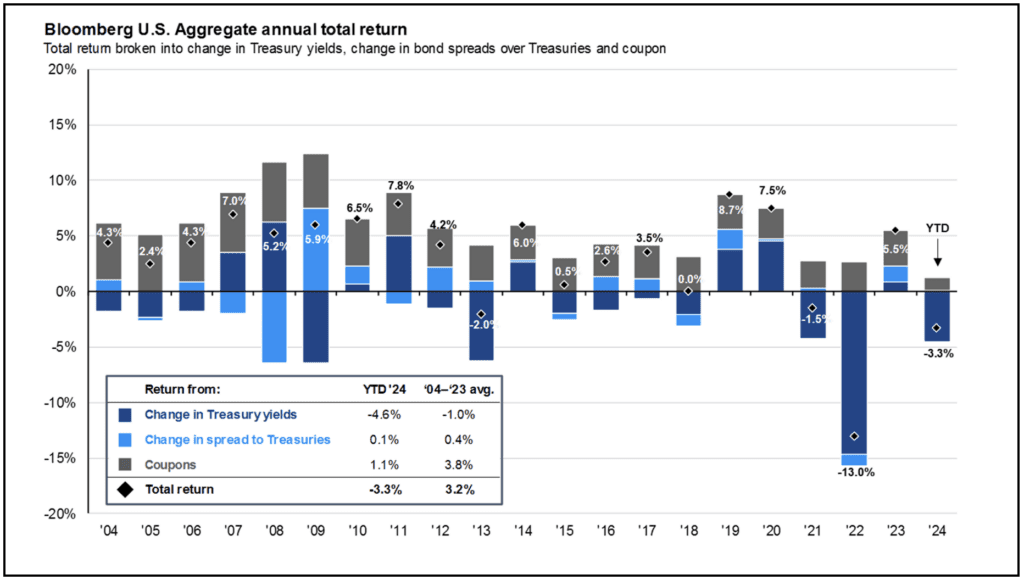

Sometimes it’s really hard to recall how we felt or what life was like many years ago, or even just a few months ago. The present can be so overwhelming that the past can easily be downplayed in our memories. This is called recency bias. Do you remember what you did to generate income from your investments when interest rates were very low? Right now they are currently “high” compared to our recent past so you may not be thinking about what to do when they get low again. You may find it interesting to know that the long-term historical average fixed income return is 3.2%. We believe this is a problem, and here’s why.

Real 10-year Treasury yields are calculated as the daily Treasury yield less year-over-year core CPI inflation for that month. For the current month, we use the prior month’s core CPI figures until the latest data is available.

Guide to the Markets – U.S. Data are as of March 31, 2024.

What is the 3.2% problem?

As shown in the chart above, you can see that over the past 20 years, the average total bond market return has been 3.2% from 2004 to 2023. This number is all-encompassing. It includes coupons, changes in yields and pricing. During this same time period the average inflation rate was 2.55%. If all your assets were invested in the total bond market, you’d barely be ahead of where you started in 2004. When you’re on a fixed income, this can become a big problem.

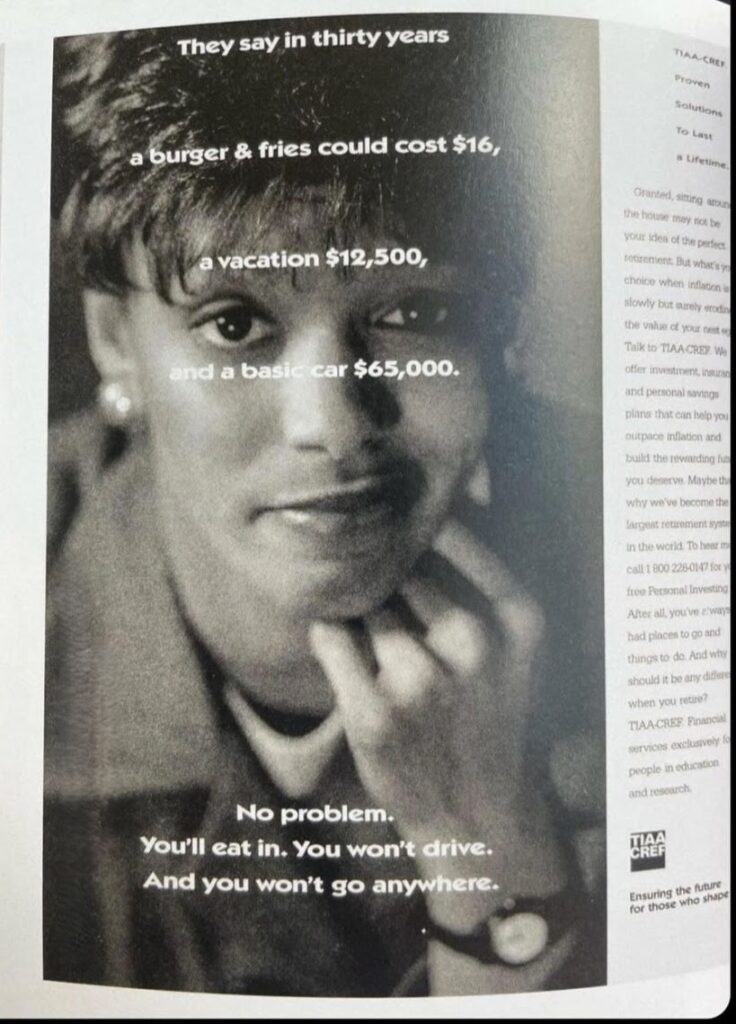

Why is this a problem? Why does this matter? The ad below was published by TIAA CREF in 1996 and it has nearly been 30 years. They weren’t too far off on their predictions for the cost of a these items.

While most people are not invested 100% in fixed income, it does start to make up a great amount of an investors portfolio as they age. Fixed income can provide stability when markets are volatile and rocky. But they should also help keep your portfolio ahead of inflation.

What’s the solution?

Since launching the firm, fixed income is just one asset class where we’ve spent a lot of time in growing our approach beyond traditional solutions in order to help clients achieve their long-term objectives. In addition to understanding the impact of rising GDP and higher inflation on purchasing power, we believe our clients deserve more income and better performance from the fixed income world (also known as someone’s less risky bucket of assets).

Look at your 401(k) or retirement accounts and see what you’re invested in. Research your holdings and learn more about those assets. Learn what a target date fund is, if that’s what you hold. These investments may be too conservative or “safe” for you. They may not be keeping up with inflation. If you have a 401(k) with limited investment options, you may be able to coordinate these holdings with your personal accounts to balance the two so you can maximize your return where you can.

We’ve been helping clients take advantage of higher yields in both traditional and non-traditional investments, as well as both public and private investments. We are not being complacent and waiting for rate changes. Interest rates will come down eventually and our clients portfolios will be positioned to take advantage of those changes.

Disclosure

Sources: J.P. Morgan Asset Management. TIAA CREF

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.