We’ve said before that the most dangerous four words in investing…

Those Four Nasty Words in Investing

“This time it’s different.”

One of the great ironies of being wealth advisors is that we hear this exact same phrase in every single bear market. It’s the phrase investors use to rationalize why they are bailing out of stocks.

To be sure, there are unique aspects to every economic crisis and stock decline. The world evolves and events never combine in quite the same way as they did in the past. In that sense, then, it’s always different this time.

But that relates more to temporary circumstances, not to the essential functionality and health of the free-enterprise system and global capital markets. They are not the same thing, but investors in the midst of an existential panic aren’t much inclined to subtle distinctions.

The current “this time it’s different” rationale is that inflation is hopelessly out of control because of the unprecedented amount of money central banks dumped into the global monetary system in 2020 to combat the economic shock caused by the pandemic.

Before we do a deeper dive into that, let’s take a brief look back at some of the more notable “this time it’s different” cases that were made in prior bear markets and economic shocks:

- 2020: “This time it’s different because we’ve never had the entire global economy locked down for weeks and months.”

- 2008: “This time it’s different because subprime mortgage derivatives have poisoned the entire global financial system.”

- 2001: “This time it’s different because the U.S. hasn’t suffered an attack of this magnitude since Pearl Harbor.”

- 2000: “This time it’s different because the largest asset bubble in history just popped.”

- 1997: “This time it’s different because unprecedented Asian currency devaluations are going to cause a contagion that will collapse economies around the world.”

- 1987: “This time it’s different because computerized program trading has completely destabilized the global financial system.”

(We could go on all the way back to the Dutch Tulip Crisis of 1637, but we don’t have space for that.)

Notice the common theme in all of these prior hot takes? They all involve unprecedented events that have a global impact and appear impossible for stocks to overcome for many years, if ever.

And yet…stocks did overcome every single one of them, and all the other ones, too. The period of time varies, but the outcome is always the same: the short-term downturns are temporary, and the long-term upward trajectory of stocks is permanent.

In the middle of an economic crisis, though, emotional investors can’t see the long-term forest for the short-term trees. They fall victim to recency bias, which is the brain’s tendency to fixate on recent events and trends and project them into the future indefinitely. They extrapolate the current knowns into an unknowable future and convince themselves things aren’t going to improve any time soon.

Which brings us to the current environment, with inflation at a 40-year high, major stock benchmarks in or near bear-market territory, and the Fed and other sovereign banks struggling to drain the ocean of easy money that was dumped into the global economy in recent years.

How long it takes for the Fed to get inflation under control is anyone’s guess (including the Fed’s), but we can look to the past for a precedent. In 1980, in an effort to get double-digit inflation under control once and for all, the Fed hiked the prime lending rate to an unheard of 20%. That triggered a deep recession, and the stock market plunged accordingly, with the S&P 500 declining 28.5% from March 1981 to July 1982.

But the Fed’s dramatic rate hike also quickly knocked inflation down, with the inflation rate plunging from 13.55% in 1980 to just 3.21% by 1983. Stocks responded in kind, beginning a roaring bull market in 1982 that continued for the next five years.

Hopefully the Fed won’t have to resort to the draconian measures it used in 1980 to tame inflation, but the point is that it was, in fact, tamed much quicker than most believed possible. It’s also worth noting that stocks began their rally in 1982 – with the economy still in recession and inflation still historically high.

As we said above, it’s anyone’s guess as to when stocks bottom out and the panic selling turns to panic buying – as it inevitably will. One thing we know for certain, though, is that the talking heads in the financial media have no clue, either, despite their constant claims to the contrary.

Besides, their job isn’t to be right about the future direction of the market – it’s to keep as many eyeballs glued to their shows and web sites as they possibly can. The more anxiety investors have, the more ad revenue they make.

These two headlines on CNBC – just two trading days apart – make the point better than we can. We’re not exactly sure which charts they’re looking at, but it seems to us they aren’t very good:

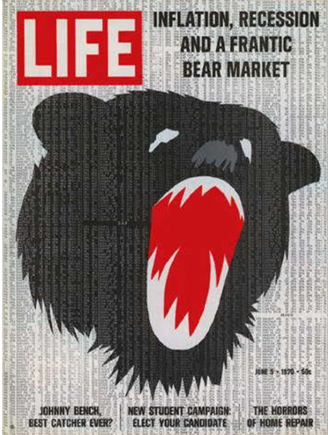

Along those lines, we’ll leave you with the below Life magazine cover from June 1970 that someone recently passed on to us, one that certainly evokes our current economic environment:

For the record, from that issue’s date of publication, the S&P 500 index gained 121% over the next 10 years, 996% over the next 20 years, and 21,059% through 9/30/22.1

It is times like these that your financial plan is of utmost importance. The financial planning we do for our clients includes the assumption that we will endure a bear market(s) like the one we are currently experiencing. If you feel like something in the plan, other than recent investment returns, has changed then it’s time to revisit the plan. We stand at the ready to assist you with a tune up to your plans.

Source: 1 Morningstar Direct; CNBC; Life Magazine; Bloomberg. M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees. This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.