Discover the power of strategic financial planning. Invest with purpose, avoid speculation, and achieve your financial goals with tailored strategies.

The Non-financial Aspects of Retirement

So, you’ve met with your financial advisor and put together a comprehensive financial plan—a roadmap, if you will—on how to successfully retire, avoid running out of money, and feel confident about your investments. The hard part is over, right? Well, maybe not. We might be just getting started.

After helping people transition to a successful retirement for more than two decades, I’ve learned that while financial security is crucial, it’s only part of the equation. Many retirees face challenges beyond finances, such as a loss of identity, lack of purpose, and uncertainty about how to spend their time.

Non-financial retirement transitions

Retirees who lack a sense of purpose are at a higher risk of experiencing early mortality. Retiring without a purpose can significantly impact your health and longevity. Studies show that without mental stimulation, social engagement, and physical activity, a person can experience cognitive decline, depression, and other health issues. So thinking beyond the numbers and financials of retirement isn’t just a “nice to do” – it should be a the top of your list of “must do’s”!

As you prepare for retirement, consider how you will stay active and engaged beyond managing your finances. A comprehensive retirement strategy should include plans for maintaining social connections, pursuing passions, and finding new ways to contribute to your community. This holistic approach can help ensure that your retirement years are not only financially secure but also fulfilling and healthy. Below you will find common topics and questions to review as you take your retirement preparations to the next level.

Retirement exploration

Let’s say your financials are in good order and your fee-only advisor says you can retire in the next year or two. What else should you be thinking about? Begin to think beyond the financials with the following questions:

- What do I want to do with my time/life?

- What excites you?

- What are you good at?

- What are your natural gifts?

Your answers don’t have to be numerous or exhausting. Just think of at least one answer for each and over time, you may come up with more answers. This is just the warm-up exercise, like stretching.

Social connections

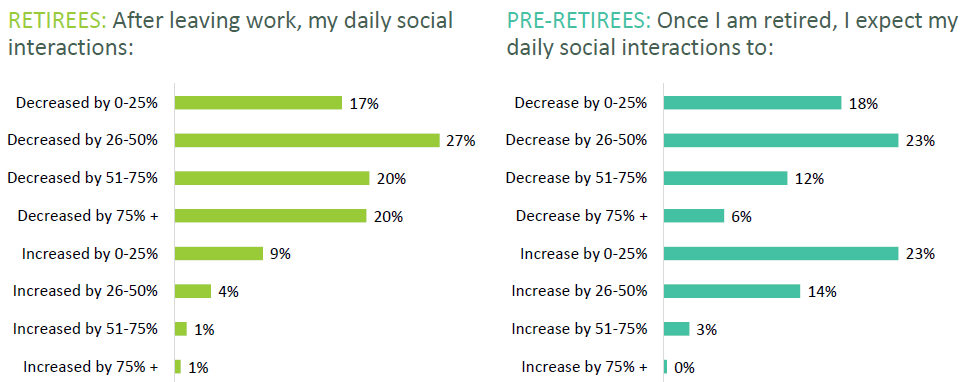

Retirement most likely means a shift in your social landscape. You will no longer see your “work family” daily. Sometimes it’s hard to know what those relationships mean to us when we are in the thick of working. Take some time to “step back” and view your social circles. Don’t get caught off guard thinking you’ll social life will be the same, like some of these survey participants:

- Who are the people I interact with regularly, and how do these relationships make me feel? What do the fulfill for me?

- Which social connections bring me joy and fulfillment, and which ones might need reevaluation?

- How do I envision my social life in retirement, and what steps can I take now to make that vision a reality?

Maintaining and developing social connections is vital for mental health and happiness. Even having pets counts as a social connection and has proven to help peoples longevity.

Health and wellness

Physical and mental health play a critical role in enjoying retirement. Now is a great time to establish a wellness routine. Most people are living longer and good health leads to not only lower healthcare costs which can ease the financial burden, but also a better quality of life.

- What does my ideal day look like in retirement?

- How can I create a balanced schedule that includes physical activity, mental stimulation, and relaxation?

- What types of physical activities do I currently enjoy?

- How often do I engage in physical exercise each week?

- Are there any physical activities I’ve always wanted to try but haven’t had the time for?

Many even merge health and wellness with social connections. Maybe you join a tennis league or gardening club. Others in these groups can help fill in social gaps that are no longer there from work.

Giving back and your legacy

Beyond just distributing assets, many retirees are interested in leaving a legacy. This can involve charitable giving, imparting values to the next generation, or other forms of meaningful contributions. These are great conversations to have with your advisor. Meaningful conversations with your advisor can help inspire ideas for leaving your best legacy in a structured way.

- What core values and beliefs do I want to impart to my family and future generations?

- How have these values shaped my life and decisions?

- What causes or organizations am I passionate about?

- How do I want to support these causes—through financial contributions, volunteering, or other means?

Whether you become involved with a non-profit in your community or you take care of your grandkids, giving back will help others and help you fulfill several needs from purpose, socialization to mental wellness.

Housing and lifestyle choices

Deciding where to live — whether it’s downsizing, moving to a retirement community, or staying in your current home — can significantly impact your quality of life. These are important conversations to have and hopefully your advisor is creating space to discuss these things regularly. Not only getting to the point of if you should do this, but once you do make some of these decisions, having the network to facilitate help with downsizing will make these changes a lot easier.

- How well does my current home meet my needs?

- Is my home near the things I want to do or the people I want in my social circles?

- Are there any modifications needed to make my home more comfortable and accessible as I age?

- Would downsizing to a smaller home reduce my maintenance responsibilities and costs?

Why you need a comprehensive fee-only advisor

Given these multifaceted needs, it’s clear why retirees look to financial professionals for more than just investment advice. A comprehensive fee-only advisor understands that retirement planning is about crafting a life plan, not just a financial plan.

A comprehensive advisor will consider your entire life picture, helping you integrate your financial resources with your life goals. Look for a fee-only advisor that offers holistic planning. You are more than just numbers and investment accounts. Work with someone who sees you and wants to help with the non-financial pieces of your life.

A holistic advisor can connect you with a network of professionals, including healthcare advisors, lifestyle coaches, and social planners, to support all aspects of your retirement. It’s so hard to trust everything we find via searches online. Holistic advisors have rolodex of professionals they trust and know will support you ethically.

Working with a fee-only holistic advisor will ensure you get personalized advice and care. They will take the time to understand your unique situation and tailor their advice to meet your specific needs, ensuring that you feel supported and confident in your retirement decisions.

Real Financial Planning is a process, not a collection of investment products.

Carl Richards, NYT

Taking the next step towards retirement

If you’re thinking about your next stage, now is the perfect time to start thinking about these non-financial aspects of retirement. Answering these questions could also impact some of your finances too, so it is important to partner with a fee-only holistic financial professional who can provide you with the guidance and resources you need to navigate this significant life transition successfully.

At CAM Investor Solutions, we pride ourselves on offering comprehensive retirement planning services that address both the financial and non-financial aspects of retirement. Our goal is to help you achieve a fulfilling and well-rounded retirement, ensuring that your golden years are truly golden.

CAM Disclosure

The Great Retirement Disconnect – Retirement Coaches Association 2023

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.