Looking back at the market or stock "winners" makes it seem easy to predict the future winners. But how easy is it really?

How will stocks perform after the election?

Beyond the sort of post-election, apocalyptic thinking that sometimes causes investors to flee the stock market entirely, there are also temptations to try and guess the winners and losers based on which party gains the White House.

The conventional wisdom is that each political party has its own pet agendas that will guide its policies, and the performance of certain stocks going forward will be heavily influenced by the economic impacts of those policies on their specific sectors.

Reality, however, is often more complicated than that.

What affects a companies stock price?

The long-term performance of any particular company’s stock often has a lot more to do with intrinsic factors than extrinsic factors. The ability of a company to evolve, pivot and innovate as the competitive landscape changes is often much more important in the long run than how its particular industry is faring in the moment.

What’s the vison of its leadership? How innovative is its Research & Development (R&D)? How strong is its brand? Those are the factors that often determine how well a particular company adapts to a challenging economic landscape.

Blockbuster vs Netflix

In 2000, the founders of a startup video subscription service called “Netflix” were trying to navigate the shifting economic landscape of the dot-com collapse. Its founders offered to sell 49% of their company to video rental giant Blockbuster for $50 million. Blockbuster passed on the offer, believing that its own network of thousands of brick-and-mortar locations was its most valuable asset and that video subscription was a “fad.”

Blockbuster filed for Chapter 11 bankruptcy in 2010. Meanwhile, Netflix today has a market capitalization of more than $300 billion.

Clearly, the ability of a company to assess the future, adjust its direction accordingly and seize opportunity has a lot more to do with its future success – or lack thereof – than short-term circumstances.

Does political policy affect stock prices?

But what about companies that are squarely in the crosshairs of a particular administration’s policies and appear poised to be either a big winner or loser from those policies?

Here, again, the answer is not as clearcut as many people want to believe.

In a recent webinar hosted by Savant Wealth Management, Apollo Lupescu, vice president of Dimensional Fund Advisors, provided two enlightening examples of this, one from each of the two most recent presidential administrations.

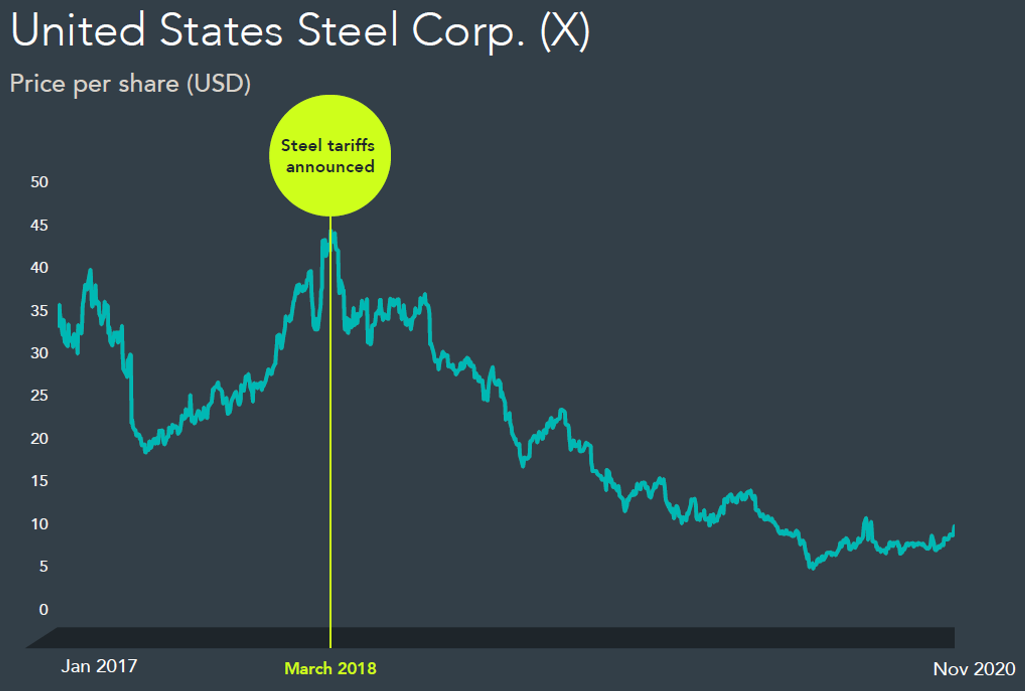

Example 1: Policy Affects on U.S. Steel

The first, U.S. Steel, appeared to be a big winner when the Trump Administration implemented its steel tariffs in 2018. After all, what company would benefit more from those tariffs than one of the largest domestic steel producers?

And yet, U.S. Steel’s share price did a complete nosedive almost immediately after the announcement of the steel tariffs:

recommendation to buy or sell a particular security. Source: fianncia.yahoo.com

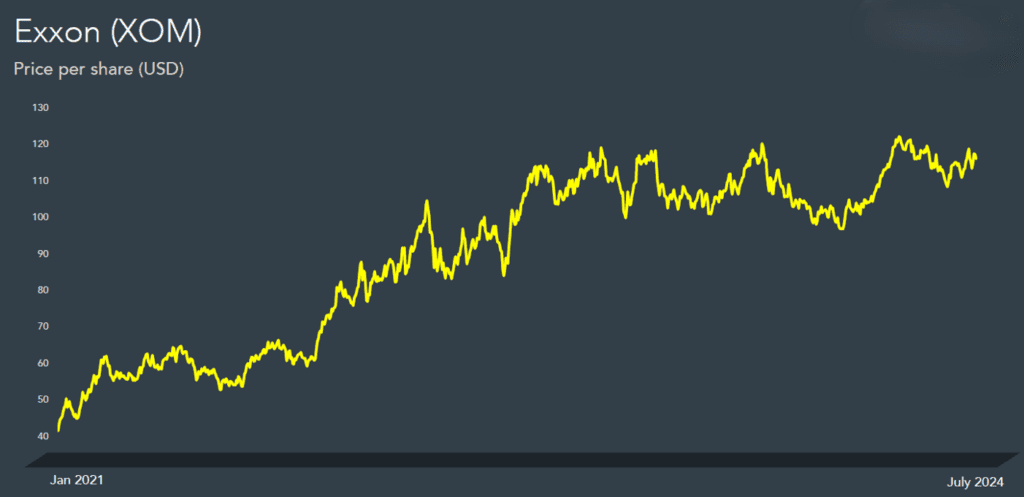

Example 2: Policy Affects on Exxon

Then there’s the case of oil-producing giant Exxon, which was clearly out-of-favor with the Biden administration’s focus on shifting the U.S. from fossil fuel dependency to renewable “green” energy resources.

Despite this momentous shift in policy, Exxon’s share price has soared during the Biden years:

recommendation to buy or sell a particular security. Source: fianncia.yahoo.com

Should I be invested in the market right now?

Zig Ziglar, the legendary sales trainer, once famously said:

People buy with emotion and justify with logic.

Unhappy investors often do a variation of this: They sell on emotion and justify with rationalization.

Emotions run high in presidential election years, and they seem to get more acute with each successive election cycle. Whatever the results of the election are in a few weeks, one thing is certain: A large percentage of this country is going to be unhappy with the outcome.

The bottom line to all of the above is that the capital markets work because they are based on free enterprise. Investors are far better off harnessing that free enterprise through a globally diversified, evidenced-based portfolio strategy than they are letting their emotions lead them into assumptions that may seem logical and rational on the surface, but often aren’t proved out in reality.

CAM Disclosure

Source: Dimensional Fund Advisors, Yahoo Finance

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.