Weight Watchers, the iconic American health and wellness giant, filed for…

They Said This Time Was Different—Then Came the Tariffs

When last we left “As the Stock Market Turns” in early April, chaos was the order of the day on Wall Street—driven in large part by a wave of new tariffs from the Trump administration that caught many investors off guard.

Tariffs Trigger Market Volatility

The Trump administration put sweeping tariffs in place, sending shockwaves through the global markets. The market, which seemed to believe the tariffs would never actually be implemented, quickly lowered stock prices (most of them downward) in response to the news.

As a result, investors began panic selling, with the VIX index (a benchmark of stock-market volatility) climbing above 50 for the first time since the market disruption in March 2020. For perspective, any level above 30 in the VIX is considered a sign of extreme fear in the market.

The financial press and Wall Street analysts told us we were in (yet another) unprecedented historical time for stocks and the global economy, with tariffs expected to bring far-reaching and long-lasting consequences. For example, the S&P 500 index of large U.S. stocks came within an eyelash of bear market territory the first week of April, and the Russell 2000 small stock index moved well beyond that threshold.

The Market Recovers After the Tariff Shock

However, as of this writing, at least, markets stabilized and have since rebounded. The Trump administration abruptly changed course in mid April, rolling back some of the tariffs and delaying the implementation of others. This reversal came just weeks after the tariffs shook investor confidence, highlighting how sensitive markets can be to sudden policy shifts. The market breathed an immediate sigh of relief. Just as quickly as stocks declined, they reversed course and began to soar. An upward climb that continued for the rest of the quarter.

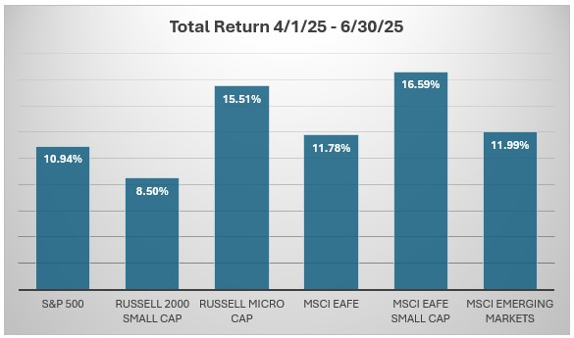

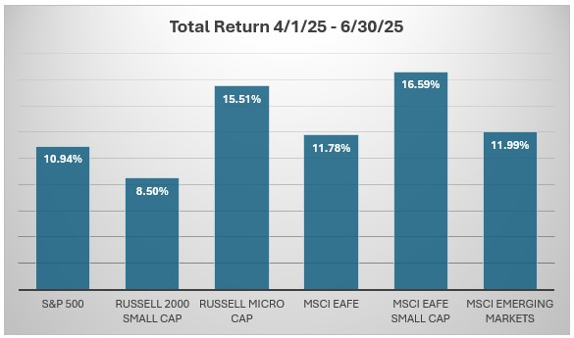

By quarter’s end, the major market indices recovered from their early April declines.

2nd Quarter Index Returns

Source: Morningstar Direct. Past performance is no guarantee of future results. Indices are unmanaged and not available for direct investment.

The Problem with Timing the Market

In this space three months ago, we stated the following:

“However long the current selloff takes to run its course, there are two things in which we feel confident about:

- Stocks will likely start their recovery before the economic outlook begins to improve or even stabilize.

- Once the market starts moving upwards again, ‘panic buying’ often ensues. This is why historically the biggest gains in a stock recovery have typically come early in the cycle.”

This is exactly what we saw in the market’s big turnaround this past quarter. However, stocks surged again, unexpectedly and without warning, catching many investors off guard. Alas, it’s a lesson some individual investors never seem to learn as they jump in and out of stocks, selling low and buying high and wondering why their returns don’t track the market. As Vanguard founder John Bogle put it so eloquently many years ago:

“The idea that a bell rings to signal when investors should get into or out of the market is simply not credible. After nearly 50 years in this business, I do not know of anybody who has done it successfully and consistently. I don’t even know anybody who knows anybody who has done it successfully and consistently.”

This cycle of emotional buying and selling was amplified by the sudden announcement of tariffs. For instance, one of the themes we heard repeatedly in April was that stocks were tanking because of “overvaluation” and the impact of new tariffs. This concept receives frequent attention in financial media and among investors. The basic idea is that you should bail out of stocks when they’re overvalued and jump back in when they’re undervalued. In other words, that gets us back to the futility of market timing that Mr. Bogle referenced above.

How the Market Reflects Real-Time Valuation

There’s another angle investors often overlook when thinking about whether stocks are over or undervalued, one that investors often fail to consider in today’s world of frenzied trading and instantaneous information.

Now more than ever, the stock market is a turbocharged information-processing machine. Consider that the average daily trading volume for global equities in 2023 was 11 billion shares, and there are “only” about 53,795 publicly traded stocks worldwide. That means, on average, traders reprice the average stock about 204,000 times.

Every. Single. Day.

Therefore, it seems hard to argue that stocks don’t stay fairly valued for long without new information. After all, if you recruited 204,000 people to tour a house for sale every day and give their estimate of its worth, wouldn’t you agree you’d arrive at a pretty good estimate of its fair market value?

Why should we view the stock market any differently? The answer is that we shouldn’t. The market fairly values stocks at any given time using all known information. Once company data becomes public, investors immediately factor it into stock prices. The market often swings wildly in the short term, driven by speculation and incomplete information.

Ultimately, the market sorts out the noise and gradually affects the underlying long-term value for every stock. Even with periods of uncertainty and volatility caused by economic news or tariffs, the market still reflects long-term value.

Whether it’s tariffs, earnings reports, or unexpected market shifts, CAM Investor Solutions is here to help you navigate with clarity and confidence.

CAM Disclosure

SOURCE: Morningstar Direct; Wall Street Jounral.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.

This is intended for informational purposes only. Past performance is no guarantee of future results. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results.