We’ve said before that the most dangerous four words in investing…

Investors are Fleeing to Cash and Gold

The S&P 500 has seen more than $10 trillion added to its market capitalization in just the past few months. Thousands of cash investors fled to stocks, seeking higher returns. Calm swept the capital markets as long-term stock investors stayed the course and were rewarded for their emotional discipline.

How many news reports about the stock market have you read like that recently? If you answered “none”, then join the club (We made up the one above). The thought of finding a report like that in the financial press actually induces a sensible chuckle, doesn’t it? It’s hard to even imagine a story like that in the headlines.

The reason: good news is, well, boring. When things are calm, we go about our lives, focusing on the day-to-day mundane stuff. We may give the daily stock report a glance as it scrolls through our news feed, but we rarely click on it.

But when some event occurs that sends stocks into a tailspin, the media drama machine springs to life. Stories fill the headlines about how stocks have “shed trillions in market value” and investors are “fleeing to safe havens like cash and gold.” Fear grips the market – clicks abound and ad revenues soar.

This starts the emotional rollercoaster for many investors, who pile into stocks when the environment feels safe and bail out when things feel scary. This is investing at the extremes, and it’s the reason so many investors have a negative experience with stock investing.

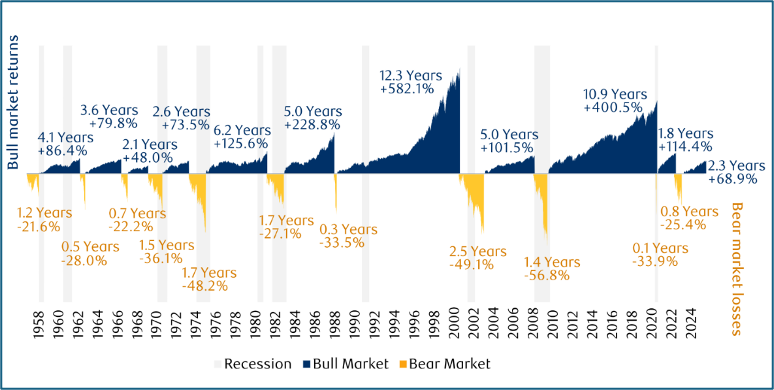

This reality is that stock investing (at least successful stock investing) is generally a much more mundane experience than the media would have us believe. Consider this chart, which shows both the length and extent of bull and bear markets over the past 70 years:

Source: RBC GAM, Bloomberg

While occasionally extreme, bear markets have historically been much shorter in duration than most bull markets, which can sometimes run more than a decade. Major market declines are akin to wildfires that burn through the market when distortions occur, such as the bursting of the dot-com bubble in 2000 and the collapse of the subprime mortgage industry in 2008.

On the other side of these major downturns, stocks have historically had a strong rebound that comes quickly and unexpectedly. After that, equilibrium returns to the market and long periods of relative calm typically ensue.

When the calmer times come in the market cycle, it’s important to remember such times are the rule, not the exception. They may not be dramatic or good nourishment for headlines, but they are the days that stocks slowly and persistently deliver their equity premiums to investors.

About CAM Investor Solutions

CAM Investor Solutions, a fee-only independent Registered Investment Advisor, has offices located in Colorado, Florida, and Texas. As a growing wealth management firm, we focus on the needs of our clients to improve their quality of life. Our firm’s commitment to innovation through rigorous academic research enhances how we serve a multi-generational audience.

CAM’s Specialties Include:

- Managing concentrated wealth

- Planning for stock and option compensation / company IPOs

- Advanced tax managed investment strategies

- Custom retirement income strategies

- Cash management

Contact:

CAM Investor Solutions

info@caminvestor.com

1-844-247-0787

https://caminvestor.com

CAM Disclosure

SOURCE: Bloomberg; RBC GAM; Dimensional Fund Advisors.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.