We’ve said before that the most dangerous four words in investing…

New Technologies Can Quickly Become Major Players

Weight Watchers, the iconic American health and wellness giant, filed for bankruptcy in May.

Of itself, the bankruptcy filing isn’t particularly notable. Big companies go bankrupt every year for a wide variety of reasons. However, Weight Watchers sob story is interesting from an investment perspective, because it underscores just how risky it is to be a stock picker in today’s volatile market.

From Oprah’s Investment to a Soaring Stock

After floundering for much of the 2000s, Weight Watchers received a massive shot in the arm in 2015 when Oprah Winfrey announced that she had acquired a 10% stake in the company and joined its board of directors. As a result, Weight Watchers stock took off following the announcement, soaring to more than $100 a share by 2018.

Then Came the GLP-1s

But in May 2021, the FDA announced the approval of the weight loss drugs Ozempic and Wegovy. Suddenly, Americans had a choice between counting points or taking a prescription to lose weight. Unsurprisingly, millions have opted for the latter. From that point on, Weight Watchers stock price went into a tailspin, culminating in its bankruptcy filing in May. It was a rapid decline for a once well-regarded company.

Weight Watchers’ fate is a cautionary tale for investors. External developments can, and do, have major negative implications for individual stocks. In just the past 25 years we’ve seen the implosion of the dot-com bubble, 9/11, the 2008 financial crisis, the Covid pandemic and the tariff impositions create major disruptions in the stock market. Each of these events blindsided otherwise stable, well-run companies. Many didn’t survive.

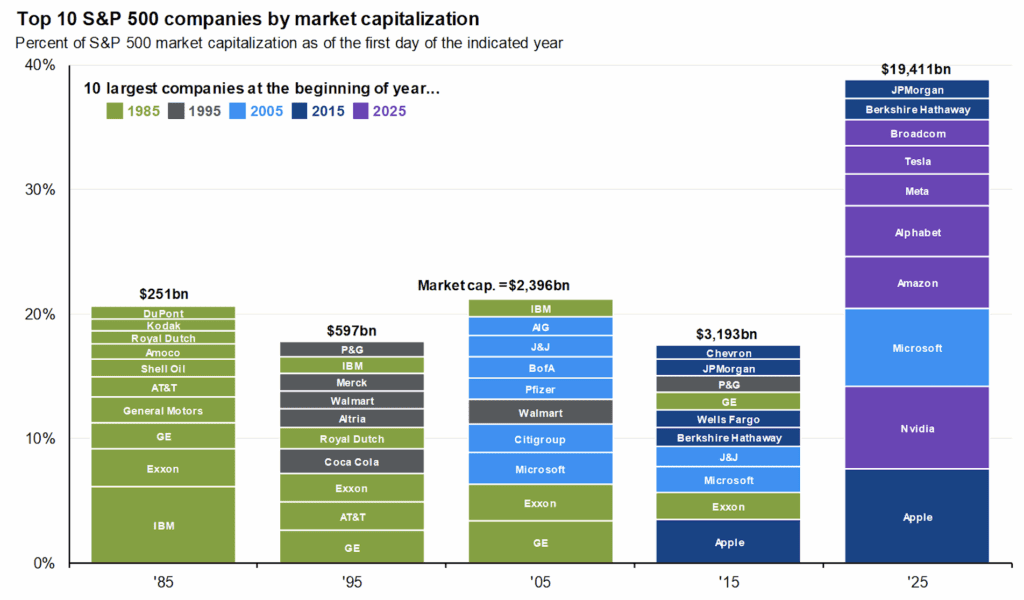

TOP 10 COMPANIES BY DECADE

Source: J.P. Morgan Asset Management. Companies are organized from highest weight at the bottom to lowest weight at the top. Past performance is no guarantee of future results. Guide to the Markets – U.S. Data are as of September 30, 2025.

At the same time, though, new companies emerge and take advantage of new technologies to become major players in just a few years, or even months. However, who these players are and when they emerge, though, is anyone’s guess.

Why Diversification Still Wins

Good luck trying to guess the future winners and losers in this fast paced, unpredictable economic environment. That’s why it makes much more sense to own the broad market through diversified funds instead of piling into individual stocks.

It’s similar to investing in today’s fast paced stock market craze with every company board room throwing money at all things AI. Overall the pieces may come and go, but its hard to know which company will win the race let alone survive.

The bottom line: Know what you own, ensure you are taking the right kinds of risk for your situation, and don’t forgot to take profits along the way.

About CAM Investor Solutions

CAM Investor Solutions, a fee-only independent Registered Investment Advisor, has offices located in Colorado, Florida, and Texas. As a growing wealth management firm, we focus on the needs of our clients to improve their quality of life. Our firm’s commitment to innovation through rigorous academic research enhances how we serve a multi-generational audience.

CAM’s Specialties Include:

- Managing concentrated wealth

- Planning for stock and option compensation / company IPOs

- Advanced tax managed investment strategies

- Custom retirement income strategies

- Cash management

Contact:

CAM Investor Solutions

info@caminvestor.com

1-844-247-0787

https://caminvestor.com

CAM Disclosure

SOURCE: Bloomberg; Standard & Poor’s; J.P. Morgan Asset Management.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.