Weight Watchers, the iconic American health and wellness giant, filed for…

A Comprehensive Guide to Year-End Financial Planning

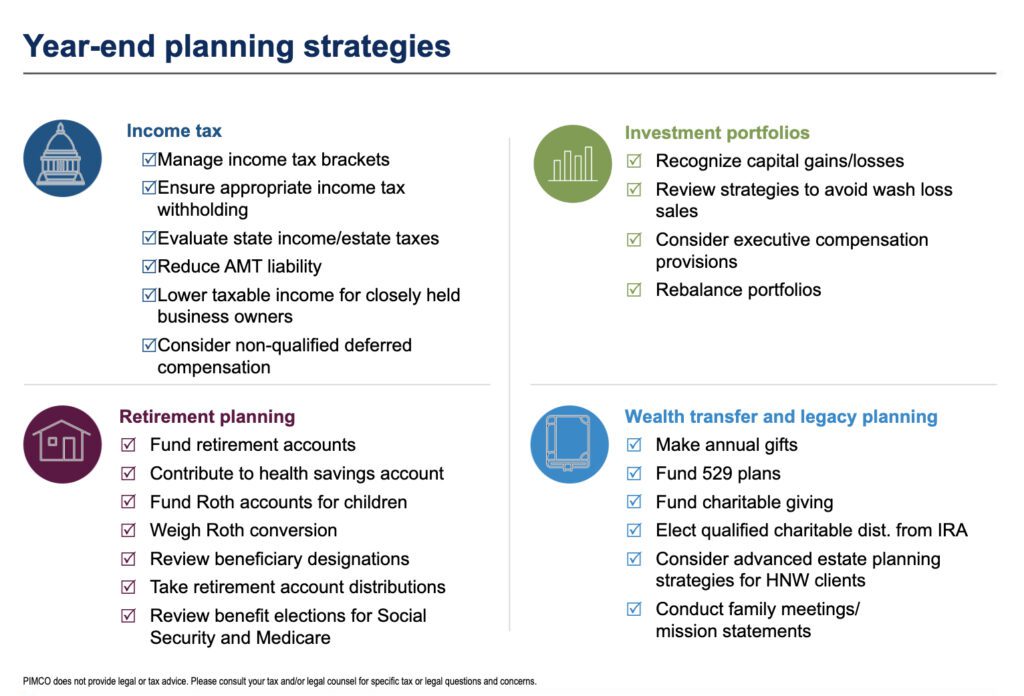

As the year comes to a close, this is a great time to review your financial situation and make informed decisions that will set you up for success in the coming year. Year-end planning is not just a wrap-up activity; it’s an opportunity to strategically position your finances for success. Our year-end planning goes beyond checking a couple boxes in IRA contributions or investment rebalancing. The list is quite extensive and should be part of your financial planning. We suggest you explore four key areas that should be part of your year-end financial planning: Income Tax, Investment Portfolios, Retirement Planning, and Wealth Transfer/Legacy Planning.

Income Tax Planning

Defer or Accelerate Income

One of the first things to consider is whether to defer or accelerate your income. If you anticipate being in a lower tax bracket next year, you might want to defer some of your income to take advantage of the lower rates. Conversely, if higher rates are expected, accelerating income into the current year could be beneficial. This applies to both business owners and individuals who may be taking IRA or 401(k) withdrawals.

Bunch Deductions

“Bunching” deductions is another strategy to consider. This involves timing your deductible expenses so they fall into one tax year, thereby maximizing your itemized deductions for that year. This can be particularly useful if you’re close to the threshold where itemizing becomes more beneficial than taking the standard deduction. This may look like doing your charitable contributions on January 1st to count towards the next year, instead of doing them on December 31st. Take the standard deduction this year and save those contributions for 2024 so your itemization will go over the standard deduction limit.

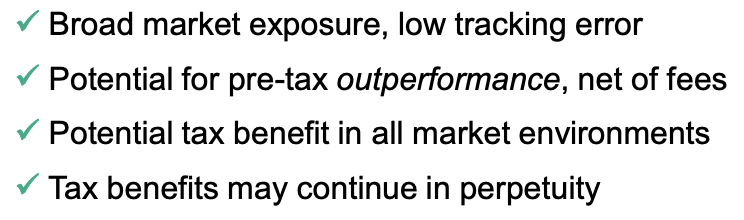

Tax-Loss Harvesting

If you have investments that have lost value, you might consider selling them to offset gains in other areas. This is known as tax-loss harvesting and can be an effective way to minimize your tax liability. You may want a professional to help you with this if you’re not familiar with all the rules. Be ware of the “wash sale rule” that could eat away the losses you’re trying to capture. If you don’t have any losses to capture this year but want to employ this strategy next year, start investing a little new money each month. This will create new tranches for you to potentially harvest from as the markets move over the course of the year.

Investment Portfolios

Rebalance Your Portfolio

The end of the year is an excellent time to review your investment portfolio. Market fluctuations may have thrown your asset allocation off balance, so it’s a good time to realign your investments with your financial goals and risk tolerance. Were you trying to keep your portfolio at 60% stock and 40% bonds but now you only have 30% bonds due to market movements? Time to buy those bonds on “sale” and bring your portfolio back to that 60/40 split you were aiming for.

Capital Gains and Losses

Don’t be hit with a surprise tax bill for gains! This is something you can certainly try to fix before December 31st. Review your capital gains and losses for the year. If you have gain, you may want to sell off underperforming assets to offset them, which can help reduce your overall tax liability.

Retirement Planning

Max Out Contributions

If you haven’t already maxed out your contributions to retirement accounts like 401(k)s or IRAs, now is the time to do so. These contributions are often tax-deductible, reducing your taxable income for the year. Make sure you know when the deadlines are. For any retirement plans via your employer, the deadline will be December 31st for any EMPLOYEE contributions. If you have your own business and have an Individual 401(k), SEP or SIMPLE IRA – you can still put the EMPLOYER contributions in after December 31st. You have until tax filing day in April of the following year. This is also true for Traditional IRAs and Roth IRAs. So if you expect to get a year end bonus sometime in the next few months, consider increasing your 401(k) contribution before 12/31 OR have a plan to invest this money before April next year in your IRA or Roth IRA.

Roth Conversions

Are you in a lower tax bracket this year? Expect tax brackets to go up in the future? Maybe you are very overweight in your pre-tax accounts (IRAs and 401(k)s) with no after-tax money. Consider converting some of your traditional IRA funds to a Roth IRA. While you’ll pay taxes on the conversion now, Roth IRAs offer tax-free withdrawals in retirement, which could be beneficial if you expect to be in a higher tax bracket later on. Know the deadlines! December 31st is the deadline to CONVERT any money to a Roth IRA. And another conversion benefit is there is NO limit on how much you can convert. This is different from the annual contribution limit (which is $6,500 for 2023 if you’re under age 50).

Wealth Transfer/Legacy Planning

Gifting Strategies

The end of the year is a good time to make any planned gifts to family members or charities. The IRS allows you to gift up to $17,000 per person per year without incurring a gift tax, so take advantage of this if it aligns with your wealth transfer goals. This may be in the form of a Roth IRA contribution to your child or grandchild. It could also be a contribution to a 529 plan for education expenses for a loved one. Any donations made to a qualified charity do not have the same $17,000 per person limit to avoid gift taxes. Have a lot of extra cash or income this year? Why not open a Donor Advised Fund (DAF) and do a lump sum donation this year. Then you can take time over the next several years/decades to determine who to give the funds to.

Estate Plan Review

Do you have a Legal Service through your employer benefits plan that you’ve paid for all year? And you don’t have a Will or Power of Attorney yet? This is a great time to get that done before the year ends! You might even be able to opt-out of that benefit next year during your open enrollment period right now. This will save you some extra cash each paycheck!

If you already have estate documents, ensure that your will, trusts, and other estate planning documents are up-to-date. This is also a good time to review your overall estate plan with your financial advisor and Estate Planning Attorney to ensure it aligns with your long-term objectives.

This chart provides greater detail into some of the areas that can be reviewed.

Year-end financial planning is a crucial exercise that can have a significant impact on your financial well-being. By focusing on these four key areas, you can optimize your financial situation and pave the way for a prosperous new year. As always, it’s advisable to consult with financial and tax professionals to tailor these strategies to your specific needs. It’s important to note that many institutions get swamped with year-end requests. You’ll want to get your to-do items checked off sooner than later. Asking for something the last two weeks of December is risky, as they are not likely to be completed in time by the institution.

So, as the year winds down, don’t miss this opportunity to get your financial house in order. Your future self will surely thank you.

Disclosure

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.