We’ve said before that the most dangerous four words in investing…

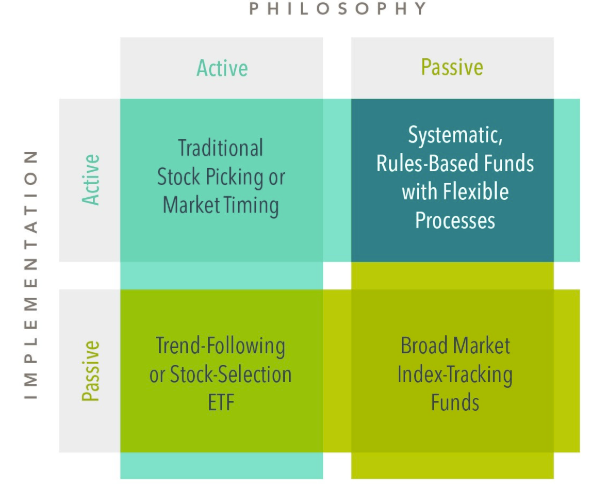

Are you a passive or active investor?

Have you ever been asked – “Are you a passive or active investor?”. What the person probably wants to know is do you pick your own stocks or do you just use some broadly diversified fund and don’t touch your investments that often. The answer to this question used to be straight forward, but it’s not anymore.

Over the past few decades, the traditional lines between “active” and “passive” investing have blurred. This has created a challenge for investors to rethink how they define and approach investment strategies.

Active investing:

The old thought of “active investing” was that someone was guessing which stocks would outperform by trying to find stocks that were underpriced. History has shown this is very hard to consistently do, successfully.

Passive investing:

And index funds were meant to just hold a “basket” of stocks that met some metric. Possibly they were the biggest 500 companies based on their market capitalization. The index would be updated once or twice a year and that’s the only time your investment changed.

While index funds were initially embraced as a way to leverage the efficiency of markets and avoid the pitfalls of speculative investing, today’s investment landscape tells a more complex story.

Active, passive or something else?

Index funds were originally created because active investors struggled to consistently pick undervalued stocks. By investing in index funds, investors demonstrated trust in the efficiency of markets—the idea that market prices reflect all available information. But why should investors care about market efficiency? Because it underpins the rationale for broad, diversified investing. If markets are efficient, trying to outsmart them through frequent trading or stock-picking is unlikely to yield better results. Instead, trusting market efficiency allows investors to focus on long-term growth while avoiding the costs and risks of speculative strategies.

Fast forward a few decades. The connection between index funds and a belief in market efficiency is no longer straightforward. The rise of thematic ETFs — focusing on trends like millennial habits or pet care — has turned some index funds into tools for market timing. For example, index funds that focus on tech companies often see frequent trading as investors adjust their expectations for the sector’s performance. This type of trading, based on predicting future outcomes, is far from a passive approach. In fact, it goes against the original spirit of trusting and embracing market prices.

At the same time, active investing has evolved. Instead of trying to outguess market prices, many active strategies now rely on rigorous academic research, using what market prices tell us rather than trying to outguess those prices.

In practice, any approach that doesn’t follow an index is considered active. But some active strategies rooted in market trust might actually reflect the original goals of “passive” investing better than the wide array of index funds available today.

How are you investing?

In today’s complex investment landscape, understanding what you’re truly investing in is more important than ever. With the blurred lines between “active” and “passive” investing, it’s not always clear if an index fund is really passive. Some strategies marketed as “passive” may actually involve active decisions, such as market timing, that can stray from your core investment philosophy. While some “active” strategies may be based on academic research and align more with your investment philosophy.

By ensuring your investment approach aligns with your views on market efficiency, you can make choices that support your financial goals. Working with a fee-only advisor can be instrumental in this process. Fee-only advisors provide objective guidance, free from conflicts of interest, and can help you navigate the nuances of modern investment options. They ensure your portfolio reflects your long-term objectives and your beliefs about how markets work, ultimately helping you stay on track to achieve your financial goals.

Source Disclosure

Dimensional Fund Advisors

CAM Disclosure

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.