We’ve said before that the most dangerous four words in investing…

CAM Launches New Tax Advantaged Investment Strategies

Tax advantaged investment strategies are becoming a priority for high-net-worth investors facing growing tax challenges. To meet this demand, CAM Investor Solutions is expanding its offerings to help clients manage risk, reduce taxes, and pursue stronger long-term investment returns.

July 31st, 2025, Austin, Texas — CAM Investor Solutions (“CAM”) is proud to announce the expansion of its tax advantaged investment strategies. These strategies are designed to help reduce taxes on ordinary income and/or capital gains. CAM now offers investors multiple advanced tax planning options that allow room for higher returns when appropriate.

Why Tax Advantaged Strategies Matter Now

For more than a decade, investors have benefited from a strong economy and rising markets, which have significantly enhanced their wealth. This growth has fueled substantial wealth across real estate, company stock, small businesses, and personal investments.

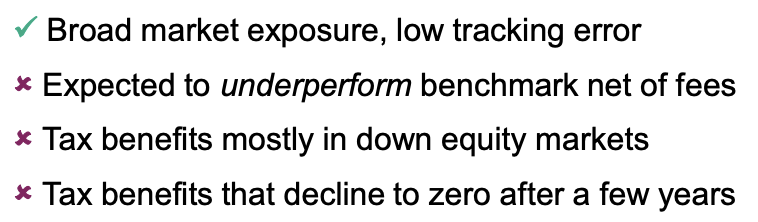

When investors want to unlock gains, they often look for the most tax-efficient way to access liquidity. However, this is where most of the financial services industry has struggled to keep up with the growing needs of investors. A good example where the industry has fallen short is via traditional vehicles such as Direct Indexing or older Separately Managed Account (SMA) structures, that are too often sold to investors. As a result, managing taxes only becomes harder—especially for those facing increased tax liability or approaching a liquidity event.

Liquidity and Risk Management Challenges

“We recognize the challenges and limitations that come with traditional tax managed investments in the current environment,” said Marc Jimenez, Managing Principal & Chief Investment Officer at CAM Investor Solutions.

CAM’s Approach to Smarter Tax Planning

In fact, Jimenez continues, “Since expanding our tax advantaged solutions earlier this year, these strategies continue to be well-received, especially as more and more investors are facing liquidity events and potentially greater tax liability. We believe investors deserve better tax managed investment strategies that don’t prohibit their ability to seek better investment performance. Through a blend of traditional and nontraditional institutional strategies, our goal has always been to help our clients better achieve their long-term investment objectives.”

Why Traditional Tax-Managed Solutions Like Direct Indexing Often Fall Short

How CAM’s Philosophy Creates a Structural Advantage for Investors

Who Should Consider these Tax Advantaged Solutions?

These solutions are especially useful for investors with the following types of assets:

- Real Estate: Investors with highly appreciated residential or investment properties who want to reduce capital gains taxes.

- Company Stock: Over the past 25 years, companies have increasingly awarded employees with equity compensation (stock options, RSUs, ESPP, etc.). For many investors, this has led to large amounts of concentrated stock with highly appreciated gains.

- Owners of a Small Business: There may be no other place where investors have seen as much significant growth of wealth as compared to starting and selling a small business. As business owners consider a future sale or are in the process, finding ways to reduce taxes can be one of the greatest wealth preservation strategies of all.

- Large Investment Portfolios: As we’ve experienced over twenty-years of a low interest rate environment coupled with a significant bull market, many investors have accumulated large taxable portfolios and/or retirement accounts. As a consequence, capital gains and ordinary income tax become a challenge during rebalancing or retirement withdrawals.

CAM’s tax advantaged investment strategies are designed for investors who want to:

- Preserve wealth

- Reduce taxes

- Manage risk in today’s volatile market

As a result, these strategies aim to balance liquidity, tax efficiency, and growth—without limiting investment performance.

“With our tax advantaged strategies, we are excited to offer solutions that directly address the needs of our clients, helping them to more effectively navigate taxes and the complexities of the capital markets.” added Jimenez.

These strategies are available to investors at Fidelity and Schwab who are looking for an innovative and diversified approach to reducing tax liability and complement their investment strategy and long-term objectives.

About CAM Investor Solutions

CAM Investor Solutions, a fee-only independent Registered Investment Advisor, has offices located in Colorado, Florida, and Texas. As a growing wealth management firm, we focus on the needs of our clients to improve their quality of life. Our firm’s commitment to innovation through rigorous academic research enhances how we serve a multi-generational audience.

CAM’s Specialties Include:

- Managing concentrated wealth

- Planning for stock and option compensation / company IPOs

- Advanced tax managed investment strategies

- Custom retirement income strategies

- Cash management

Contact:

CAM Investor Solutions

info@caminvestor.com

1-844-247-0787

https://caminvestor.com

CAM Disclosure

SOURCE: Bloomberg; AQR.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.