We’ve said before that the most dangerous four words in investing…

Can you pick market winners?

With each new presidency, investors speculate on which industries will be the “winners” under the new administration’s policies and which might struggle. Every year, people also look back at market performance, hoping to identify winning companies that will deliver BIG returns in the year ahead. But how often are these predictions actually correct?

Will winners in 2024 be winners in 2025?

When people talk about the “market”, they usually mean the U.S. stock market and specifically the S&P 500. The S&P 500 is the top 500 largest companies in the U.S.. Last year this group of 500 companies, collectively, had a return greater than 20% for a second year in a row. Do you know what the historical average is for the S&P 500? It’s 10.57% over the last 100 years and adjusted for inflation, it’s only 7.405%. This is much lower than what we’ve seen in the past two years. So are 20%+ returns the new normal? Or should we just try to pick out the “winners” within the S&P 500 and invest in those?

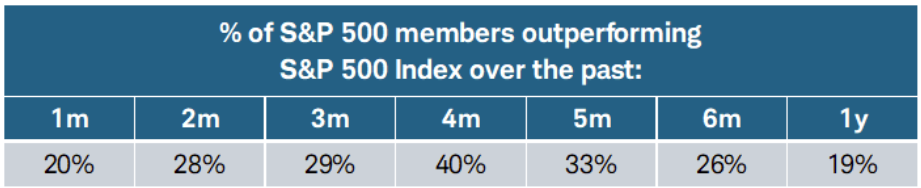

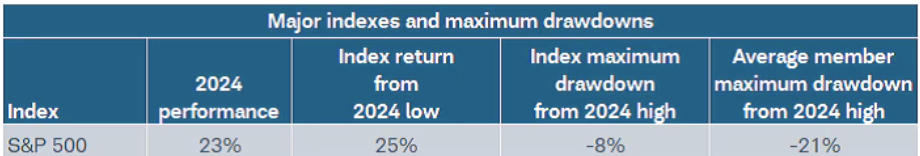

Let’s look at who the winners were in the S&P 500 last year. Out of all 500 companies, only 19% of them beat the index’s 2024 annual return at the end of the year. That’s 95 companies out of 500. And you’ll see in the far right column of the second chart below that the average “max drawdown” (or low) from the highest return in 2024 was -21%. Looking at these two charts doesn’t give me much confidence that many, or even a few, people could accurately predict this years “winners”.

Many of you may have heard of the “Mag 7” – aka “The Magnificent 7”. These are Alphabet (GOOGL; GOOG), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), NVIDIA (NVDA), and Tesla (TSLA) and have been big contributors to the S&P 500s overall outstanding performance for the past 2 years. But have they been THE top performers in the S&P 500?

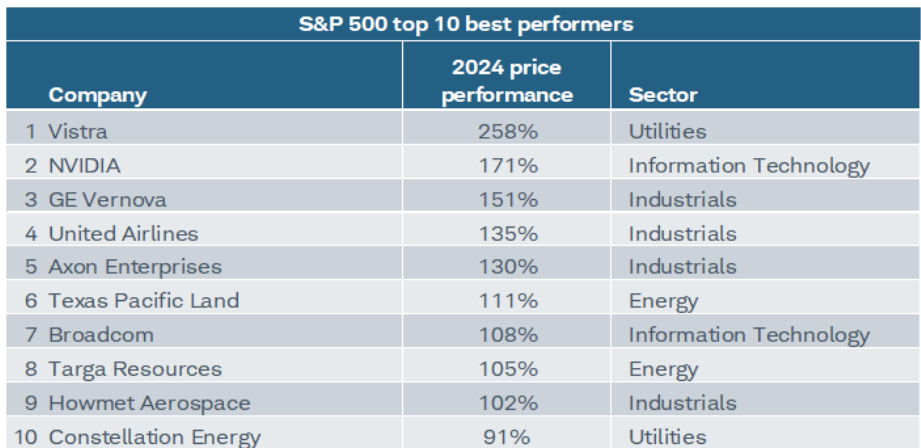

Groups of stocks like the Mag 7 and other mega-cap stocks do represent an outsized contribution to overall S&P 500 returns. However, they have not been the best price performers. Their higher contribution weight is courtesy of the multiplier of their cap size. Only one of the Mag 7 stocks—NVIDIA—was within the top-10 best S&P 500 performers in 2024, and it was second to Vistra (a Utilities stock). There were actually only two Technology stocks (NVIDIA and Broadcom) in the top 10, while there were also two Utilities stocks in the top 10, four Industrials stocks and two Energy stocks. Would you have guessed any of these names, besides NVIDIA, to have such a great 2024?! We weren’t even familiar with most of these companies.

All corporate names and market data shown above are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security.

Picking winners after a Presidential election

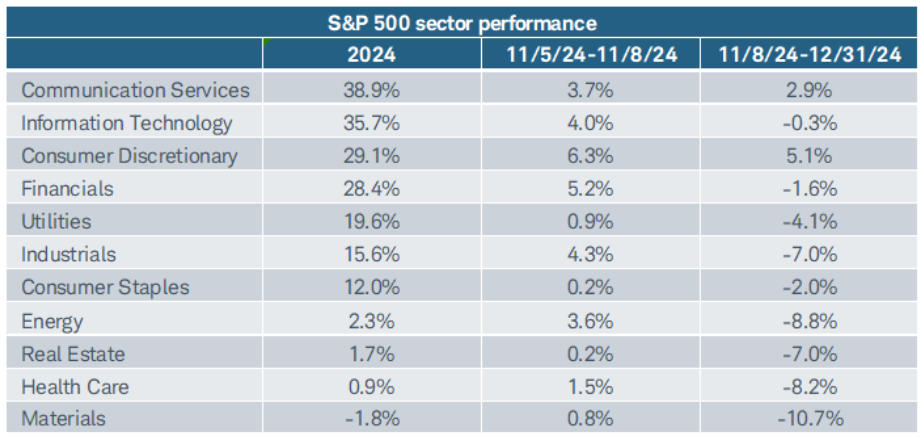

Do you remember the market surge after the November 2024 Presidential election? Which sectors benefited the most from President Donald Trump’s victory?

The chart below highlights the top-performing sectors immediately after the election (middle column). However, as shown in the far-right column, that initial momentum faded for some industries, with growth slowing significantly or even turning negative to finish 2024.

Markets swiftly adjust to new expectations following election results. Once votes are counted, stock prices immediately reflect investor outlooks on factors like regulatory and tax policy changes. As these expectations become embedded in prices, any election-driven market impact is unlikely to persist.

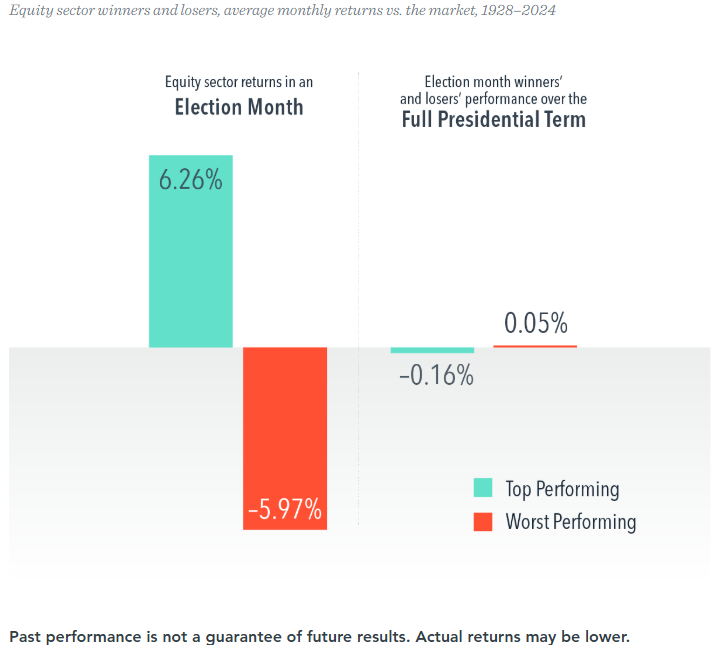

This is evident when analyzing the performance of top- and bottom-performing sectors after elections. For instance, sectors that outperformed during the election month exceeded the broader U.S. market by an average of six percentage points during that period but aligned with market performance over the elected president’s full term. Similarly, sectors that lagged during the election month didn’t necessarily continue underperforming.

Presidential Election Month Winners and Losers

If we can’t pick winners, what can we do?

We can’t predict the future or guarantee only winning investments, but one thing is clear—this year is shaping up to be volatile. That’s why maintaining a well-diversified portfolio is crucial. Overcommitting to a single sector or company can increase risk, especially in uncertain markets.

At CAM, we focus on a long-term, balanced approach to help clients navigate market ups and downs with confidence. If you’d like to discuss your portfolio strategy or market outlook, we’re here to help. Schedule a meeting with us for a complimentary second-opinion portfolio review—we’d love to connect.

Source Disclosure

Charles Schwab. * Sectors are based on the Global Industry Classification Standard (GICS®), an industry analysis framework developed by MSCI and S&P Dow Jones Indices to provide investors with consistent industry definitions. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

CAM Disclosure

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.