Tax saving strategies 2026 go far beyond higher 401(k) limits. For…

Capital Gains Distributions: The year-end tax impact you may not see coming

We know this is a busy time of year. Holiday parties, shopping, decorating, trying to complete work tasks before year-end, trying to complete your own life tasks before year-end; it’s a lot! We’re the last people that want to put anything else on your list…but if there was one thing we would want you to consider, it’s capital gains distributions in your taxable investment accounts.

“What are capital gains distributions?” you ask. Capital gains distributions are payments made by mutual funds, ETFs, and other investment funds to their shareholders. These distributions represent the fund’s realized capital gains from selling securities within the fund’s portfolio. These distributions typically occur annually. You, the investor, are usually subject to pay taxes on these distributions. Your tax bill depends on the your tax bracket and the nature of the gains.

You may be wondering why you would need to pay capital gains taxes when you, yourself, did not sell any investments and realize a gain. Let’s look further on how these capital gains distributions work.

How Capital Gains Distributions Work:

- Realized Gains:

When a fund manager sells securities (e.g., stocks or bonds) for a profit, the gain is considered a “realized” capital gain. These gains accumulate throughout the year. The fund manager may sell securities for multiple reasons. Some may be to rebalance the stocks within the fund. Or they may sell if investors pull money out of the fund and cash is needed. You as just one investor in the fund have no control over when the fund manager buys or sells stocks within the fund. - Distribution to Shareholders:

At the end of the year (usually in December, aka NOW), the fund distributes these gains to its shareholders in the form of cash or additional shares. - Types of Capital Gains:

Short-term capital gains: From securities held within the fund for one year or less. Taxed as ordinary income at your tax bracket.

Long-term capital gains: From securities held within the fund for more than one year. Taxed at lower capital gains rates (0%, 15%, or 20%, depending on income). - Impact on Investors:

Even if an investor doesn’t sell their fund shares, they may still owe taxes on the capital gains distribution. The distribution increases the investor’s taxable income but reduces the fund’s Net Asset Value (NAV) by the same amount, preventing double taxation when the investor eventually sells.

Why do funds distribute these gains? Funds are required by law (IRS regulations) to distribute almost all their realized gains and income to shareholders annually to avoid paying corporate income taxes themselves.

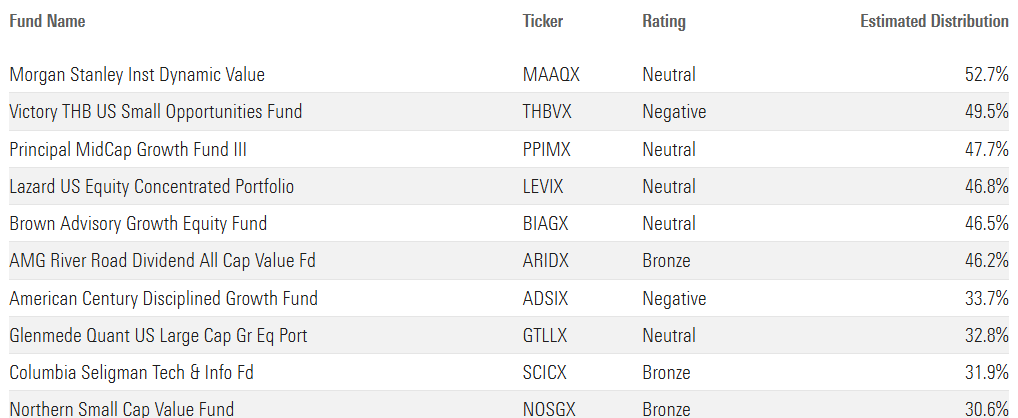

What are 2024 distributions expected to be?

Fund companies are required to give investors an idea of what their 2024 tax bills might look like by estimating how much their funds will distribute in income and capital gains later this year. Not all the data is out yet, but a preliminary look shows many strategies across the value-growth spectrum will make sizable distributions. Most will pay out their realized gains between late November and the end of the year.

Morningstar put out a list of the top 50 funds expected to pay out the most in capital gains distributions. Here is a link to the full list. We’ll provide the top 10 below:

To see a complete current list, search for your fund manager here or look on the fund managers website directly.

Can you avoid the tax impact?

If you hold all or most if your investments in retirement accounts (i.e. 401(k)s, IRAs, Roth IRAs or HSAs), then capital gains distributions are not a problem for you. These tax-advantaged account types do not experience tax impacts until the investor actually withdrawals cash, and sometimes never (for Roth accounts). So if you like any of these high paying distribution funds, place it in one of these account types instead of your taxable investment account.

Other ways to avoid or reduce the tax impact of these distributions are:

- Invest in tax efficient funds: Get out of the high distribution fund(s) and into funds with lower turnover. Examples are index funds, ETFs and tax-managed funds that focus on minimizing capital gains. BEFORE you sell anything to move to a more tax efficient fund – be aware of what your tax impact will be for selling your heavy distribution funds. Consult your tax or financial advisor if you’re unsure of what your tax impact would be.

- Harvest losses: By selling some of your underperforming investments at a loss, you may be able to offset some of the gains you’ll experience through your other investments.

- Donate: You can donate your high paying distribution funds to charity. This will help your tax bill if you itemize, you’ll avoid capital gains by not selling the investment, and you could avoid the capital gains distribution the fund may pay out.

Customized Solutions by CAM Investor Solutions

As part of CAM’s holistic service for our clients, we first try to avoid high paying distribution funds in taxable client accounts. If a client does hold one, we monitor this closely to determine what steps can be taken.

We can design personalized strategies that align with each client’s financial goals and tax situation. Key services include:

- Portfolio Tax Optimization:

Proactive management to minimize taxable distributions while maintaining growth and income objectives. - Tax-Efficient Asset Location:

Strategically placing investments in taxable vs. tax-advantaged accounts to reduce overall tax exposure. - Collaborative Tax Planning:

Working closely with clients’ tax advisors to ensure investment strategies align with their broader financial and estate plans. - Year-End Reviews:

Offering year-end tax-loss harvesting, income projection, and charitable giving strategies to reduce tax liabilities.

It’s one thing to pay capital gains taxes when you sell something at a profit – you sold it. But it’s quite another thing to pay capital gains taxes when you did nothing! So if you have capacity on your personal to-do list before the end of the year, please consider reviewing your taxable investment accounts. You’ll be thanking yourself in April! Need help? Please give us a call and we’d be happy to give you a second opinion.

CAM Disclosure

Source: Morningstar

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.