We’ve said before that the most dangerous four words in investing…

Confident explanation or accurate prediction?

We came across an insightful quote from James Clear, author of the mega-bestselling book “Atomic Habits,” recently:

“Do not mistake a confident explanation for an accurate prediction.”

It resonated with us because it perfectly describes so many of the talking heads in the financial media who bombard us with their hot takes on a daily basis.

Clearly (forgive us the pun) Mr. Clear has wisdom that extends beyond building good habits. He continues:

“An engineer can predict how much weight a steel bridge will hold, and you can be quite sure reality will match their calculation. That’s an accurate prediction.”

“Meanwhile, strongly held opinions about what will happen in markets or sports, or politics have little predictive power. A lot of what you hear can be summarized as: confident, but inaccurate.”

In other words, seldom right but never in doubt.

Media and the prediction business

We speak frequently about why it’s vital to ignore the litany of economic and market predictions in the financial media. The reason we address this so often is because these predictions are a.) impossible to miss, and b.) tempting to watch. This is especially true in times of market volatility such as we experienced in 2020 and again in 2022-23.

It’s human nature to strive to anticipate future problems and get ahead of them, if not avoid them entirely. It’s part of our survival DNA, and nothing triggers it quite like the fear of losing (or running out of) money.

That’s why the daily broadcast of market and economic predictions call to us like sirens on the rocks. We want to believe these well-credentialed gurus know what’s coming so we can either avoid the bad events or capitalize on the good ones.

These fortune-tellers are compelling because they are often subject-matter experts in their respective fields. Being such, they provide convincing explanations for why recent economic and market events have unfolded the way they have.

If that was where they left off, then there would be no harm done. But that’s not the name of the ratings game, is it? What drive ratings (and readership) are the bold, sensational predictions about where things are headed next. The more sensational the predictions are, the more eyeballs they draw and the longer they hold their attention.

To tie this back to James Clear one more time, this is why we have to build the daily habit of turning a blind eye to the financial media. We have to be disciplined every day in recognizing the market-hype machine for what it is: an advertising revenue generator and not a place to get sound financial advice.

Elections and markets

While we are on the subject of predictions and speculation…much of the current focus in that regard is on the upcoming presidential election and its potential impact on the economy and, by extension, the stock market.

Emotions run high for everyone in presidential election years, and it’s when emotions are high that we are tempted to let them influence our investment decisions.

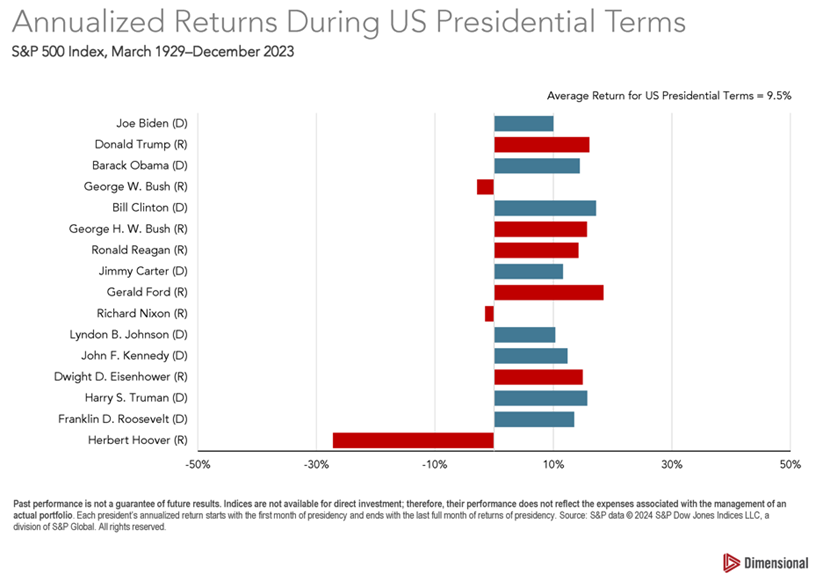

History shows, however, that there has been no definitive correlation between which party gains the presidency in an election year and how the stock market subsequently performs during their tenure in office:

There’s no doubt that, with any presidential administration, there will be policies and legislation that significantly impact various segments of the economy. In other words, there will be winners and losers. But, as we see in the chart above, that impact really doesn’t extend to the global capital markets.

Policy, of course, is important. However, the capital markets have historically shown themselves to be far too robust, complex and expansive for any particular set of political initiatives to derail their long-term upward climb. Add to that the fact that gridlock seems to be the default condition in Washington and the likelihood of any political party’s policy agenda dramatically moving the markets in the long run declines even further.

Staying focused

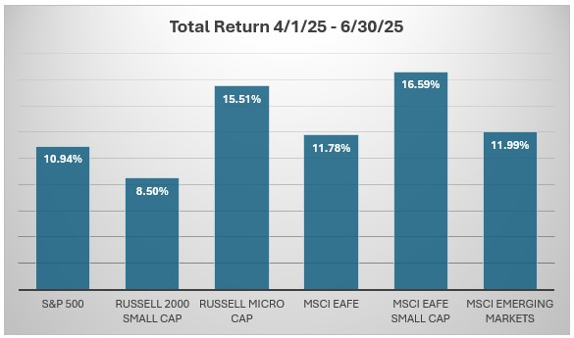

This, then, is another reason we believe an effective diversification strategy should include both domestic and international asset classes. The goal should always be to capture the long-term return of stocks as efficiently as possible while minimizing the risk that comes from being concentrated in any one asset class, sector or stock.

Let the market sort out the winners and losers in any particular political administration while you stay above the fray and stay the course.

Source Disclosure

Source: Dimensional Fund Advisors LP

CAM Disclosure

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.