Will stocks perform better or worse after the presidential election? We explain what affects a stocks price in our latest blog.

Do Midterm Elections Affect the Market?

Every four years we go through the same thing – two parties battling it out for control of Congress. And each time the media likes to speculate how the market will react if a certain party wins the House, the Senate or both. How can they know who will actually win and what impact that will have on the markets? They don’t! They just need to fill airtime and keep viewers tuned into their channel.

As financial advisors, we hear this question a lot around this time of year: Does control of the House or Senate by a certain party have any impact on market performance? The short answer – NO.

How do we know?

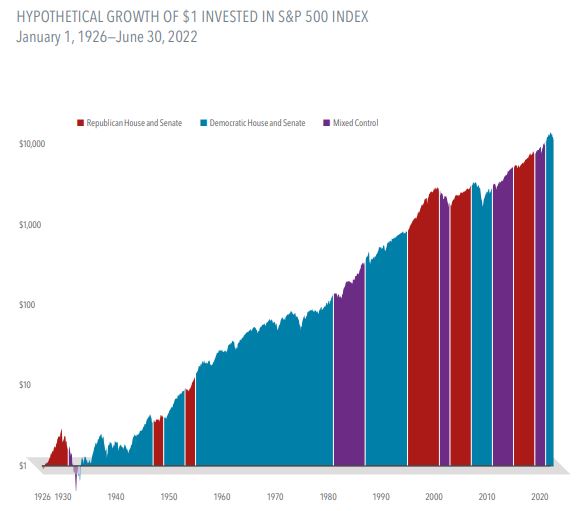

Financial researchers have studied data as far back as 1926 for evidence of an impact on market performance due to either political party controlling Congress. Nearly a century of US stock market returns suggests that making investment decisions based on control of the chambers of Congress is unlikely to lead to better investment outcomes.

- From 1926 to 2022, stocks trended higher regardless of whether Democrats or Republicans controlled the House and the Senate, or whether control was mixed.

- Actions by Congress and the other branches of the federal government may impact returns, but other factors like geopolitical events, interest rate changes, and technological advances do too. Decades of research suggest that current market prices incorporate all of this information

- Shareholders invest in companies, not a political party, and companies focus on serving their customers and growing their businesses, regardless of what happens in Washington.

Stocks tend to reward disciplined investors no matter who has the upper hand in the House and Senate—a useful lesson about the benefits of a long-term investment approach.

Still unsure if you should make an investment change right now, in the face of political uncertainty? Seek guidance from a professional financial advisor about your concerns. They will provide you with specific advice tailored to your personal situation infinitely better than the talking media entertainers ever could. They are are not licensed financial professionals with your best interest in mind. A true fiduciary seeks to know you, your goals, your concerns and fears – then creates a unique plan to help you succeed.

Source: Dimensional Fund Advisors LP. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. Past performance is not a guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. In US dollars. Growth of wealth shows the growth of a hypothetical investment of $1 in the securities in the S&P 500 Index. S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

Data presented in the growth of wealth chart is hypothetical and assumes reinvestment of income and no transaction costs or taxes. The chart is for illustrative purposes only and is not indicative of any investment.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Past performance is not a guarantee of future results.

Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.