We’ve said before that the most dangerous four words in investing…

Do you need a financial advisor if you already have a 401(k)?

Did you know that the concept of “retirement” in the U.S. is less than 100 years old? Their are still people alive today that had grandparents who never knew what life was like without having to work. Social Security was not passed until 1935 and when it was, it was never meant to completely supplement someone’s previous living wage. So while folks could possibly “retire” some day, it wasn’t until they were much older and had saved a lot to cover what social security didn’t.

It wasn’t until over 40 years later that the 401(k) plan was created in 1979, thanks to Ted Benna and there were no formal IRS rules around it until 1981. With the creation of the 401(k), employees were finally able to take their retirement into their own hands. They now how the power to choose when and how retirement would look for them.

But is it enough? Does having a 401(k) plan and diligently adding money to it annually ensure you’re prepared to retire when you want? What financial guidance or education is provided by employers to help guide their employees to make wise contribution decisions, tax considerations and investment choices?

Survey says…

In the recent 401(k) Literacy Survey completed by Pontera and The Harris Poll, they found a disconnect between perceived and actual financial knowledge of employer-sponsored retirement accounts, among retirement savers. This highlights a critical need for increased financial education and accessible resources to help savers make informed decisions about their retirement savings.

The study assessed the financial literacy of over 2,000 full-time workers with an employer-sponsored account. Researchers found that six in ten respondents considered themselves highly financially literate. But when asked fundamental questions about their retirement plan accounts, an alarming 85% struggled to answer correctly or at all.

Let’s test your knowledge:

- What is a “Catch-Up Contribution” and at what age is it possible?

- How do you change the investment allocation of your 401(k) and what investments are right for you?

- When looking at the performance of your investment options, what does that tell you about how those investments will perform in the future and their risk level?

If you’re able to answer these questions on your own without using Google or an AI tool, great job! Your 401(k) account might look in pretty good shape.

If you don’t know the answers, don’t worry. Retirement plans use a lot of jargon not common to most people. They also offer a lot of investment choices with little guidance or education, and the tax laws change annually. It’s hard to keep up! For these reasons, many people keep their 401(k) contributions in the default investment option. This isn’t a bad thing, but it may not be the right thing. By design, the default option is much more conservative than most people need or want. This protects the employer and 401(k) provider from putting anyone in something “too risky”, which helps avoid lawsuits. It also means your 401(k) account may grow much slower than you’d like. Instead of retiring at 60 like you’d hoped, you may not be able to retire until 65 or 70.

How to reach retirement confidently with your 401(k)

Addressing the knowledge gap for employees around retirement plans is essential for achieving retirement readiness. Financial advisors play a key role in helping and educating individuals as they work toward a more secure future. According to the Pontera study, individuals who work with a financial advisor are more actively involved with their retirement plan accounts. They are more likely to check their account balances weekly and contribute a higher percentage of their income to their 401(k) or 403(b) compared to those without an advisor. Moreover, advised participants are significantly more likely to maximize employer-matching contributions, an important strategy for increasing retirement savings.

In addition to promoting better saving habits that drive financial growth, professional financial advice provides intangible benefits such as increased confidence in retirement planning. Over 80% of respondents credited their advisor’s guidance with helping them feel secure about their ability to retire comfortably.

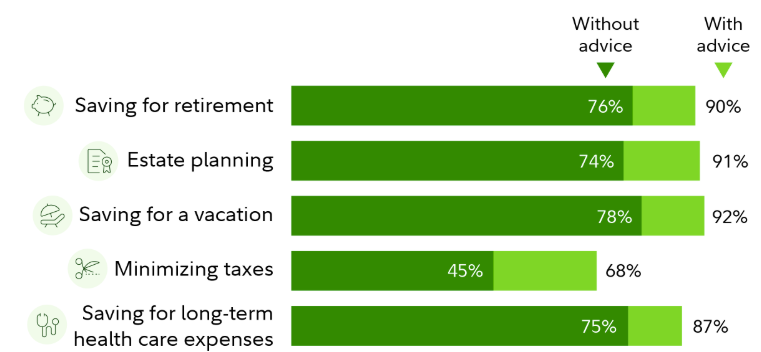

The investor confidence data revealed in the Pontera survey is also supported by the data found in a 2021 Fidelity Investor Insights Study. After surveying over 1,900 people, the Fidelity study provided the below results regarding how confident investors feel reaching their goals WITH and WITHOUT financial advice:

How to find the right financial professional for you

Everyone can benefit from working with a financial professional. And we mean everyone—no matter your situation. But not every financial professional is the right one for you. With so many different types of institutions offering financial advice, how do you find the one that best suits you?

Use the following step-by-step guide to help you make the best choice for you:

- Understand your needs – What are your financial goals? Do you need holistic planning or specific advice?

- Know the different types of advisors

- Fee-Only Advisors: Charge a flat fee, hourly rate, or a percentage of assets under management. They don’t earn commissions on products they sell.

- Commission-Based Advisors: Earn money from the financial products they sell.

- Fee-Based Advisors: Combine fee-only and commission-based compensation.

- Check credentials – These certifications indicate a high level of training and adherence to ethical standards.

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Personal Financial Specialist (PFS)

- Research potential advisors – Ask friends and family for recommendations. Look on the NAPFA or CFP Board website.

- Verify their background – Check for disciplinary actions or complaints on the FINRA BrokerCheck website.

- Assess their services and approach – Are they a fiduciary? What is their investment philosophy? Do they specialize in your financial needs?

- Review their fees – Understand how they get paid. Ask for a clear explanation of all costs, including hidden fees.

- Schedule a consultation – Meet with several advisors to see which one feels right. Ask questions like – “What is your experience working with clients like me?”. “How often will we meet?”. “What is your approach to financial planning?”

- Trust your instincts – Choose someone who listens to you, explains concepts clearly, and makes you feel comfortable.

We know this is a big decision and want our clients to feel 100% confident that they made the right choice when working with us. That’s why we offer everyone this free advisor checklist. Shop around and compare. You don’t buy a house without seeing it in person and looking at several. Choosing your financial advisor shouldn’t be any different. Want a second opinion when shopping around or in regards to your own advisor’s approach? We’d be happy to offer that for free. As fee-only fiduciaries at CAM, our goal is to help you rest easier knowing you financial health is in good order.

CAM Disclosure

Sources: Pontera; Fidelity

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.