How proactive tax planning can improve long term investment goals. Wondering…

Every Generation Learns its Lesson

Inflation fears are dominating the financial news headlines these days, and it’s not hard to understand why. The Covid-19 global shutdown in 2020 was an unprecedented economic event, resulting in disruptions to manufacturing and distribution chains around the world. As the global economy has slowly rebooted over the past 12 months, consumer demand rebounded much faster than many industries’ production capabilities. We’ve all seen this first-hand since last year, in the scarcity of everything from toilet paper to tires to taco sauce. When demand exceeds supply, prices typically rise, and dollars don’t buy as much. This is inflation, and it’s a legitimate concern for investors.The last major bout of high inflation in the U.S. was in the late 1970s and early 1980s, which means investors today haven’t had to contend with it for a half-century, if ever. While the doom-and-gloom headlines may be unnerving, the inflation issue for investors really boils down to two practical questions: Is a long-term spike in inflation inevitable, and, if so, what can we do about it?

In that regard, here are five points to consider:

- It’s important to keep in mind that just because we’ve seen short-term price spikes in certain areas of the economy doesn’t necessarily mean we’re in for a prolonged period of high inflation. In testimony to a Congressional oversight committee in late June, Federal Reserve Chair Jerome Powell said the Fed views the pandemic-related supply shortages as temporary, and that “as these transitory supply effects abate, inflation is expected to drop back toward our longer-run goal, and the median inflation projection falls from 3.4 percent this year to 2.1 percent next year and 2.2 percent in 2023.”

- Market forces play a major role in determining the ultimate inflation rate, and these forces are hard to quantify and predict. Manufacturers might be willing to absorb price increases in raw materials to protect their market share against competitors. New innovations might arise that allow companies to reduce spending in some areas even as their costs are rising in others. And consumers may ratchet down their discretionary spending when prices on certain goods rise, forcing suppliers to adjust their prices or perish. None of this is to say inflation won’t rise going forward – just that short-term price spikes and supply disruptions don’t make soaring inflation a foregone conclusion.

- Notwithstanding any of this, it still makes sense for long-term investors to protect themselves against the corrosive effects of rising prices. Economists consider some inflation to be “normal,” and even desirable. Historically that rate has been in the range of 2% annually. So, regardless of what happens in the near-term with the inflation rate, it makes sense for long-term investors to protect themselves from the inevitability of rising prices, even in a low-inflation environment.

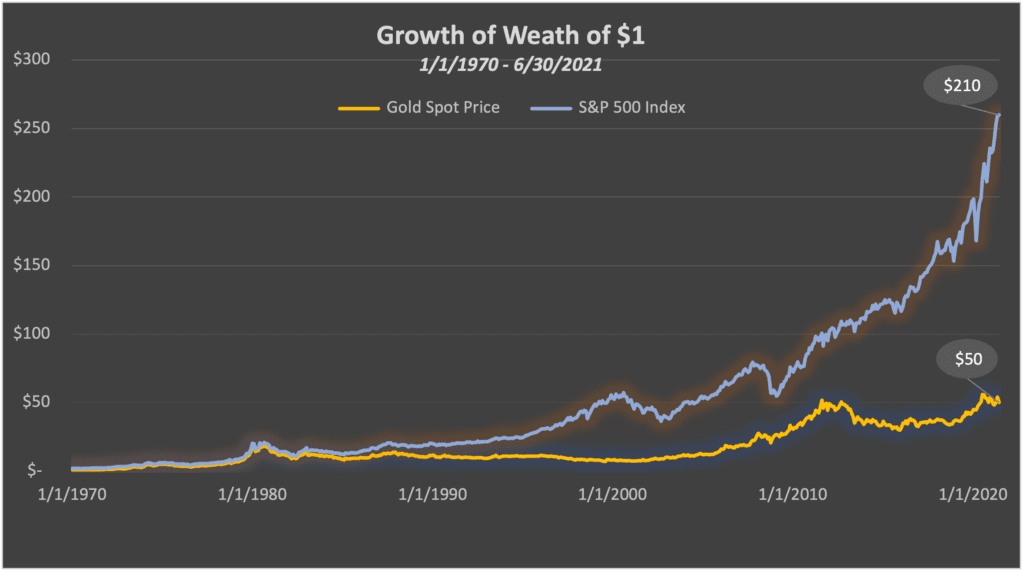

- Gold is often touted as a safe-haven during times of high inflation, but that correlation isn’t as high as conventional wisdom would have us believe. Moreover, gold is a more volatile and less liquid investment than stocks, and that introduces a higher degree of sector risk into a portfolio strategy. In contrast, stocks have historically proved to be a solid hedge against inflation, as corporate earnings typically outpace the inflation rate even in high-inflation environments. While that may not be true in every short-term scenario, it certainly has been true over the long run. Consider that $1 invested in the S&P 500 index in 1970 would have grown to more than $200 today on an inflation-adjusted basis. Taking into account all the economic shocks the world has experienced in that 50-year time period – wars, depressions, asset bubbles, etc. – there’s no greater proof that stocks are a sound way to protect against inflation without having to incur the added risks that come with gold.

- Investors who are more sensitive to the volatility that comes with stocks, such as those in or nearing retirement, can still take steps to hedge against inflation. Treasury Inflation Protected Securities (TIPS) are often used as a hedge against unexpected inflation, and corporate and municipal bond portfolios can also be structured to better withstand high-inflation environments. We incorporate some or all of these securities into many of our clients’ portfolios to help them protect against both the volatility of stocks and the dilutive effects of inflation on their purchasing power.

Not long ago we came across a recent survey by The Motley Fool that highlighted the investing tendencies and beliefs of Millennial and Generation Z investors. (Generally, Millennials are defined as being between ages 25 and 40, while Gen Z’s are between ages 6 and 25.) Combined, these two generational cohorts account for adult investors ages 18 to 40 — what we might call today’s younger investors.

The results of this survey were interesting, and we found a few to be concerning – particularly against the backdrop of the GameStop stock and cryptocurrency mania that has played out this year. Specifically:

- 77% of respondents said they get investment advice from social media

- 37% use the Robinhood trading app at least once a month

- 61% think Reddit is a trustworthy source of information about investing

Technology has had massive impacts on all aspects of our lives in the past two decades, and it’s naive to think young investors wouldn’t avail themselves of it today. And there’s nothing inherently wrong with getting investment information from social media, any more than it’s wrong to get it from “the internet.” It all depends on who you’re listening to on social media (or any other platform) and what their advice is.But these three bullet points, taken together, point to a reality of life in today’s wired world that will be a particular challenge for young investors. Internet forums like Reddit, and social media platforms like Facebook and Instagram, often act as a sort of echo chamber in which everyone confirms the group’s conventional wisdom and dissenters are shamed into silence. Groupthink can be a toxic potion for investors, leading to the kind of investment manias we saw in the dot-com stock bubble in the late 1990s, the real estate bubble in the mid-2000s, and similar asset bubbles going all the way back to Tulip Mania in the 1600s. Young investors today are more susceptible to this kind of groupthink than ever before, because the speed at which unfiltered information is disseminated, and the ease with which it can be acted upon via trading apps, is unprecedented.Every generation has to learn its own investment lessons. Many people in today’s generation of younger investors are learning the hard way that jumping into buying frenzies such as we’ve seen in GameStop and Bitcoin can wipe out their investment portfolios in the blink of an eye. But wisdom doesn’t have to be gained through experience. It can also be gained from those who’ve gone before them and seen the dangers of allowing the current conventional wisdom to influence their investment decisions. In that regard, please know that we are happy and willing to be a resource for any younger investors you care about who might be interested in hearing our perspectives on this subject.

We appreciate our relationship with you and as always we are here to help.

Source: Dimensional Fund Advisors; Bloomberg; Motley Fool; Capital Directions. M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees. This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Any stated performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Charts and graphs provided herein are for illustrative purposes only. There are many different interpretations of investment statistics and many different ideas about how to best use them. Nothing in this presentation should be interpreted to state or imply that past results are an indication of future performance. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.