We’ve said before that the most dangerous four words in investing…

In the Short Run, The Market is a Voting Machine

It’s been said that the stock market does not like surprises. The past few weeks have certainly reinforced that bit of conventional wisdom.

It now seems clear that the market believed the Trump Administration’s threatened tariffs had been mere posturing to drive countries to the trade negotiating table. The actual imposition of those tariffs the first week of April blindsided the market and sent stocks reeling in a way we haven’t seen since the Covid 19-related selloff of five years ago.

Major declines in the stock market are always unsettling; sometimes those declines last just a few weeks, and sometimes they last months. A few have dragged on for a year or two. But it’s important to remember that these downturns are not the default trend for stocks; the default trend for stocks in the long run has always been decidedly upwards.

However long the current selloff takes to run its course, there are a few things in which we feel confident about:

- Stocks will likely start their recovery well before the economic outlook begins to improve, or even stabilize. We saw this vividly in the spring of 2009, when the Dow hovered around the 6,500 level and the economic news was as bleak as it had been since the Great Depression.

- From that point on, stocks took off and never looked back, despite the overwhelmingly negative news cycle at that time. Today, 16 years later, the Dow is hovering around the 40,000 mark. We don’t recall anyone predicting “Dow 40k” back in those days.

- Panic runs both ways. In times of major market declines, many investors panic and sell their stock holdings, fleeing to cash investments. Then, once the market starts moving upwards again, they try to jump back in the market and panic buying ensues. This is why the biggest gains in a stock recovery have typically come early in the cycle.

While every market shock is unique in its own way, the behavior of stocks in such times has historically been consistent: A dramatic near-term selloff, followed by a period of protracted volatility, and then ultimately a dramatic recovery.

The stock market in the past 30 years has seen a series of major shocks, including the bursting of the dot-com bubble in 2000, the 2008 financial crisis, and the so-called “Covid Crash” of 2020. In every case, the market has worked through the fallout caused by the shock and ultimately continued along its upward climb. We have no reason to believe this time will be any different.

Investing vs. Speculating

“In the short run, the market is a voting machine. In the long run, it’s a weighing machine.” – Benjamin Graham, legendary value investor

Mr. Graham was perhaps the most famous investor of the mid-20th century and the mentor to Warren Buffett. So it’s worth unpacking his quote above in light of the current turmoil in the stock market.

Ben Graham urged investors to distinguish between investing and speculating, and this quote speaks to that. Investors often react emotionally to new information, especially when it has the potential to impact the global economy and, by extension, the stock market. Their short-term decisions to buy or sell based on that new information are essentially their speculative vote about how they think that information will impact a particular stock or sector.

But trading decisions based on new information (like the sudden imposition of tariffs) are purely conjecture, because there’s no way to know in the short term how impactful any new development will actually be in the long term. What is speculated about today may turn out to be a big nothing-burger a decade from now. Or not. Hence the conjecture.

Fifteen years ago, “peak oil theory” was all the rage. It claimed that global crude oil supplies had peaked around 2006 and would begin permanently declining from that point on, resulting in a second Great Depression in the years between 2010 and 2030. We still have five years to go on that prediction, but whatever triggers the next economic downturn, it seems unlikely that running out of oil will be the culprit.

Around this same time, however, predictions also began to appear about the dramatic impacts that Artificial Intelligence would have in the decades to come, both on the economy and on life in general. Clearly, those predictions have proven to be correct.

Only time will tell which new developments in the world today will be the major drivers of the global economy in the long run – and that’s what Mr. Graham was referencing in the “weighing” part of his quote. Over the long run (10 years or more), the market weighs the fundamentals of every stock trillions of times and values them accordingly.

This is why long-term stock charts are much smoother than short-term charts. In the long run, the market smooths the extremes and arrives at a fair price for publicly traded companies based on all known information along the way.

Does Timing the Market Work?

Successful investing, then, is all about avoiding the temptation to vote (buy or sell) on the near-term direction of stocks based on guesswork, and, instead, position our investment portfolios to reap the rewards of the market’s ability to fairly and accurately assess their true long-term value.

We believe history shows that the best way to accomplish this is through an effectively diversified portfolio that seeks to capture the long-term return of stocks as an asset class, while helping reduce the risk that comes from short-term guesswork and conjecture.

This is the difference between investing and speculating. It’s not an easy distinction to keep in mind in times of extreme volatility like we’re seeing in the stock market currently. But it’s a vital distinction to make if you want to be a successful investor.

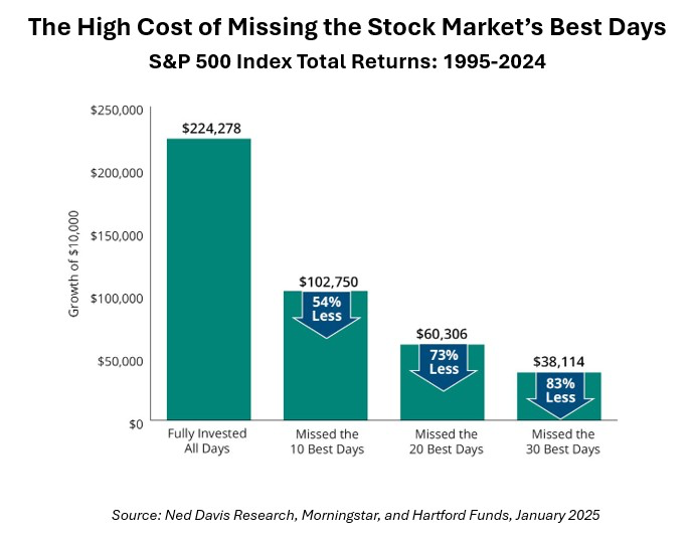

Finally, we thought this would be a good time to revisit the chart below. It shows the hypothetical growth of $10,000 invested in the S&P 500 index, and the impact of missing just a handful of the market’s best days over the course of 30 years:

Clearly, the margin for error is razor-thin when it comes to trying to time the market. Missing just a handful of the best days among many thousands of trading days can leave investors with the worst of all worlds: total returns closer to what bonds or cash historically deliver, but with all the volatility that comes with stock investing.

No doubt it would be nice to avoid the market’s worst days, but that requires a crystal ball, and we have yet to find anyone who has a good one. In contrast, we believe there’s an easy way to be sure you reap the full benefit of all the market’s best days:

Stay invested.

That’s it. No guess work required.

CAM Disclosure

SOURCE: Ned Davis Research, Morningstar, Hartford Funds January 2025; Dimensional Fund Advisors; Cboe.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.