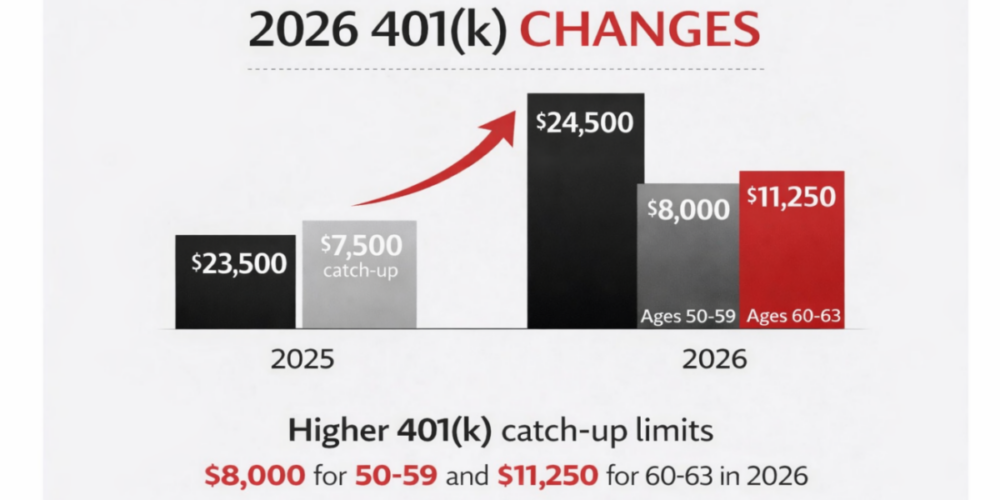

Tax saving strategies 2026 go far beyond higher 401(k) limits. For…

Invest it ALL now? Or a little at a time?

Are you thinking of investing your money but don’t know where to start? Maybe you’ve been building up your savings account during 2022 waiting for the market to start performing better. Perhaps you received a year-end bonus or you’re expecting a return on your taxes, and want to put your money “to work for you”. The question we want to help you answer is – do I invest it all at once (i.e. lump sum investing) or do I slowly invest my money a little at a time over time (i.e. dollar cost average, DCA)?

If markets have recently hit all-time highs, you may wonder whether you already missed the best returns and better wait for a market drop or decline before investing. Alternatively, if stocks have just fallen and news reports suggest more declines could be on the way, you might take that as a signal that you should wait to buy. One central fear is behind both reactions to these very different scenarios: what if I make an investment today and the price goes down tomorrow?

Dollar Cost Averaging

Dollar cost averaging (DCA) is when you invest a fixed amount of money on a regular basis for an extended period of time. This could be indefinite until your circumstances change, or it could be until you’ve invested the full amount you had saved up. The appeal of DCA is the perception that it helps “diversify” the cost of entering the market – buying shares at prices that fall somewhere between the highs and lows of a fluctuating market. We do not claim to know when the market will go up or down, so this approach avoids trying to “time the market”.

Let’s take the hypothetical example of an investor with $12,000 in cash they want to investment. Instead of investing $12,000 today, they go the DCA route and invest $1,000 each month for the next 12 months. If the market goes up each month during this period, the DCA investor will pay a higher price on average than if investing all up front. If the market drops steadily over the next 12 months, the opposite will be true.

In an environment where the market is volatile with many ups and downs, and no one has any clue which is here to stay, DCA investing can help calm your nerves. You’ll be adding money when the market is up and when it is down. This will even out your experience so you don’t have to feel like you “missed out” but can still feel good when the market goes up.

Another benefit of DCA relates to taxes. DCA allows you to start accruing tax losses when the market does go down. As we all know, the market can’t go up forever so why not make those down times work for you as well? By investing smaller chunks over time, you are able to sell any investments that have taken a loss. Those losses can be “saved” and accumulated to help you in the future. When you are ready to withdraw cash from your investments and need to sell, you hopefully will be doing so with a larger amount than you started. This investment growth will incur taxes when in a taxable account, but those taxes on your gains can be offset (reduced) by investment losses you’ve experienced when you sold your investments previously. This method of investing and trading is called tax-loss harvesting. To learn more about how investments are taxed, you can check out one of our previous blogs here.

Lump Sum Investing

A lump sum investment is exactly what it sounds like, it’s when you invest a singular amount at one time. It could all be in one investment or spread out across different ETFs, mutual funds, stocks, bonds, etc. The point is, all your cash enters the market at the same time. This strategy is beneficial in the sense that you have the potential to receive the benefits of compounding interest or earnings right away, in the right market environment.

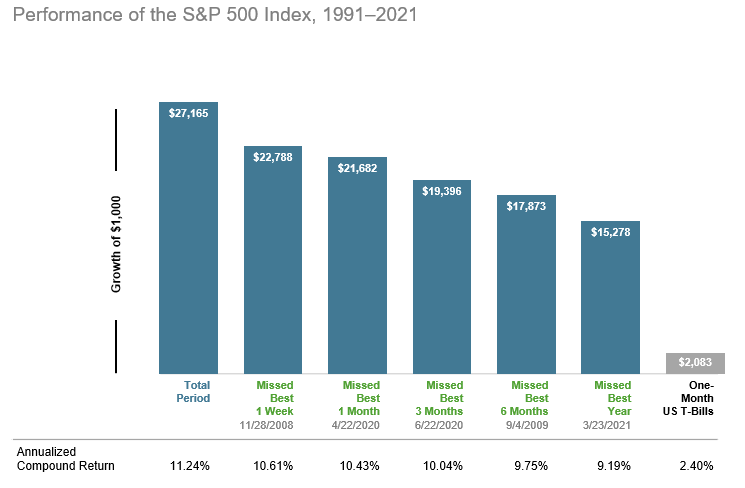

The data shows that we don’t know when the market will go up, and sometimes it can be brief and steep. Therefore, some would suggest that it’s better to invest all at once to be ready and invested when those sudden big jumps happen. The impact of being out of the market for a short time can be profound, as shown by this hypothetical investment in stocks that make up the S&P 500 Index, a broad US stock market benchmark. Staying invested and focused on the long term helps to ensure that you’re in position to capture what the market has to offer.

To be transparent, lump sum investing is not for the faint of heart. The market does go down and will likely go down after you invest your entire cash amount at some point, and that will not feel good. You may start to doubt yourself and your decisions. Thoughts of selling and going back to cash may even start to cross your mind. This is the “cost” of investing for the long-term and waiting for the market to reward you for your patience.

Different Strokes

Both theory and data suggest that lump sum investing is the more efficient approach to building wealth over time. But DCA may be a reasonable strategy if you might otherwise decide to stay out of the market altogether due to fears of a large downturn after investing a lump sum.

The stock market has offered a high average return historically, and it can be an important ally in helping you reach your goals. Investing your cash, whether gradually or all at once, puts you in position to reap the potential benefits. Working with a trusted financial advisor can help you decide which approach — lump sum investing or dollar cost averaging — is better for you. What’s clear is that markets have rewarded investors over time. Whichever method you pursue, the goal is the same: developing a plan and sticking with it.

Source: Dimensional, Inc.

Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results.

In US dollars. For illustrative purposes. Best performance dates represent end of period. The missed best consecutive days examples assume that the hypothetical portfolio fully divested its holdings at the end of the day before the missed best consecutive days, held cash for the missed best consecutive days, and reinvested the entire portfolio in the S&P 500 at the end of the missed best consecutive days. Annualized returns for the missed best consecutive days examples were calculated by substituting actual returns for the missed best consecutive days with zero.

S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. “One-Month US T- Bills” is the IA SBBI US 30 Day TBill TR USD, provided by Ibbotson Associates via Morningstar Direct. Data is calculated off rounded daily index values.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.