We’ve said before that the most dangerous four words in investing…

Invest Your Summer Earnings in a Roth IRA

Summer is here and the sun is hot! I love summer for so many reasons – the sun stays up longer, the initial warmth you feel when walking out of a cold building, the excuse to eat more ice cream or snow cones and of course the vacations or days off.

Summer is also a great time for teenagers to get their first job or seasonal workers to earn some cash. If you’re a teacher and you’ve wanted to start a side hustle, summer can be the perfect time to earn some extra income. What should you do with that extra income? Of course treat yourself, but also don’t forget you can save and invest it. Adding your summer earnings to a Roth IRA is a great way to pre-fund your future.

Why save now?

Sound boring? Most people think of retirement when they here the word IRA (Investment Retirement Account). So why would you want to start thinking about retiring when you just started working? Roth IRAs can be used for more than just retirement! Contributions made to a Roth IRA (but not the earnings) can be withdrawn penalty-free at any time. This, combined with the exceptions for major life events can make Roth IRAs flexible accounts.

Major life events that allow for early withdrawals penalty-free before the age of 59 1/2 include:

- Eligible educational expenses, like college tuition

- Up to $10,000 for a first-time home purchase

- Up to $5,000 during the first year following the birth or adoption of a child

To avoid penalties, an investors first contribution to a Roth account must have been at least 5 years before the withdrawal. Keep in mind that withdrawals of earnings may still be subject to any applicable taxes.

Are you eligible for a Roth IRA?

So who can open a Roth IRA? One of the best parts of a Roth IRA, other than the ability to shield you from higher tax rates later in life, is that there are no age limits to open an account. As long as the account holder has earned income for the year, they (or any family member/friend) can contribute to a Roth IRA. While a child may be able to earn income, they can’t sign up for a traditional Roth IRA on their own until age 18. Before then, an adult can open what is known as a Custodial or Minor Roth IRA for their child under the age of 18.

What earnings count for Roth IRA contributions?

While many teenagers hold W-2 part-time jobs during the summer or after school, this isn’t the only income that counts. Earned income doesn’t have to be from a traditional job with a W-2 or 1099. Income could be money earned from smaller gigs like babysitting, cutting grass or other entrepreneurial endeavors. If your family has a business, you may employ your child and pay them a fair market wage, which can then be invested. What doesn’t count, unfortunately, is allowance or money for chores.

The important thing to remember is you’ll need to track their wages to determine how much they can contribute each year. Contributions cannot exceed earned income, but can be contributed by anyone – the child themselves or a family member. For example, if Suzy earned $2,000 over the summer babysitting and wants to use that income towards her cheer camp then her parents (or any family member, like Grandma) can put $2,000 from their savings to Suzy’s Roth IRA. The contribution limit for anyone, regardless of age (up to age 49), for 2023 is $6,500. Once you reach age 50, you’re able to add an additional $1,000 for a total contribution of $7,500 for 2023.

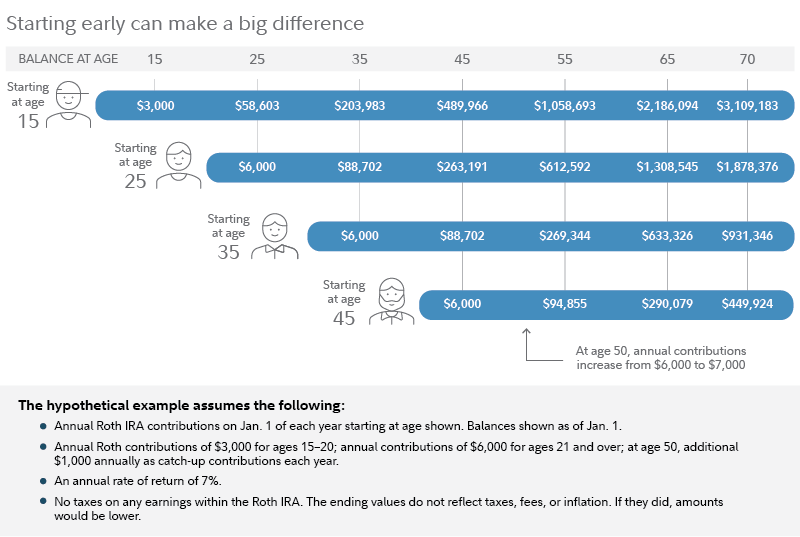

Another benefit to children contributing to their Roth IRA is that their earned income level is usually much lower than adults’. They likely won’t have to pay many, if any, taxes on money before it’s put into their Roth IRA. This means they may be able to lock in what is essentially a tax-free growth potential of never-taxed money in a Roth IRA. And don’t forget the benefit of compounding over several decades, as show in the example below.

Hypothetical pre-tax growth of annual IRA contributions

Makes me wish I could roll back the clock and start investing when I was 15 with my first job as a lifeguard!

The future looks bright!

This summer while you’re soaking in the sun, consuming as many snow cones as possible and staying up later than any other time in the year – consider your future. Your child’s future. How can you keep these magical summer days going long into your 80s or 90s? Plan ahead!

The appeal of a Roth IRA is its flexibility, starting with the lack of an age threshold. If your child is an eager entrepreneur, child artist, or just a hardworking teen, they can reap the benefits of this tax-advantaged plan. More than any other investor, children benefit from either tax-free contributions or those at the lowest possible tax bracket. Another bonus – introducing them early to the practice of saving, the concept of compounding and becoming comfortable with investing, can create lifelong habits that will serve them well.

So whether you are 15 years old or 40 years old, if you have some extra summer income, save some of it and make a plan!

Disclosure

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.