We’ve said before that the most dangerous four words in investing…

Is it Time for a Portfolio Checkup?

Despite a sense of cautious optimism coming out of the pandemic-induced lockdowns, the year 2022 has thus far been characterized by economic uncertainty. Investors of all kinds continue to wrestle with the effects of decades-high inflation, rising borrowing costs, and extreme volatility in the markets—and things may continue their downward trajectory before they get better.

While these periods of widespread decline among stocks, or “bear markets,” are a normal part of the economic cycle and should not be feared, they can reveal weaknesses in one’s portfolio. As we approach another quarter of economic uncertainty,

investors may want to consider revisiting their investment portfolios to ensure their allocations still align with their financial goals and risk tolerance.

What is a Bear Market?

Prices on the stock market generally move as a result of shifts in investor sentiment. More specifically, these movements are a function of investors’ faith in the future prospects of the companies whose equity the stocks represent. When it seems that a

company’s future is bright, demand for its stock increases along with its price. Conversely, when investors take a more pessimistic view of a company, demand for its stock decreases along with its price.

When macroeconomic factors like rising interest rates and global supply chain disruptions threaten the growth and profitability of so many companies, the market demonstrates its lack of faith by conducting widespread selloffs. This rush by investors

to protect themselves from unfavorable price movements can throw stocks into a prolonged tailspin known as a “bear market.”

In other words, a bear market is a phase of the economic cycle during which stock prices decrease—usually by 20% of more—over an extended period of time. The decline must be pervasive for it to be a bear market, so investors use benchmark

indexes like the S&P 500, which tracks the performances of the largest American companies, and the tech-focused Nasdaq to assess the broader market.

This is often accompanied and perpetuated by negative investor sentiment and diminished prospects for growth. While these conditions often last for several weeks to a few months, longer-term bear markets can last for years at a time.

Are We in a Bear Market?

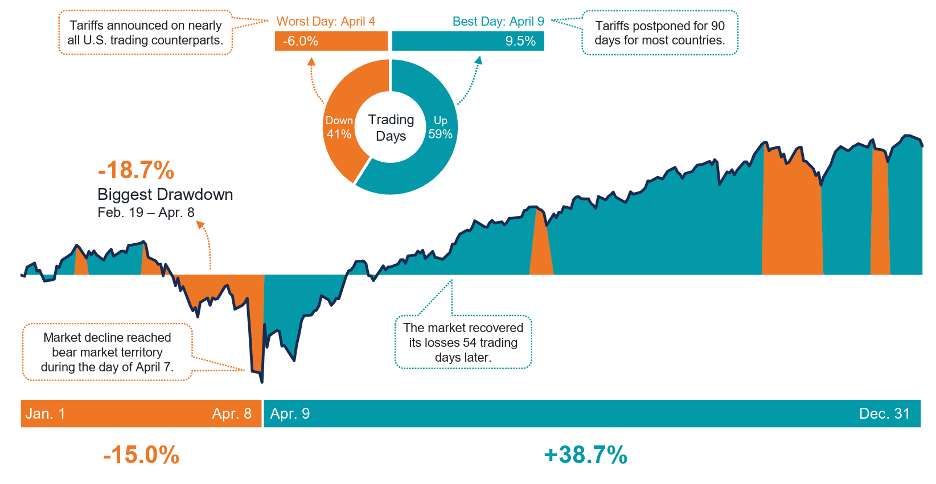

The first half of 2022 was certainly in bear market territory as the Nasdaq and S&P 500 indexes fell by 30% and 20%, respectively. Then, Q3 saw the market mount a comeback on hopes that inflation had peaked and interest rates would stop climbing.

The summertime rally came to an abrupt halt in late August and late September, with stocks finishing negative for the quarter.

It’s unclear what the future holds for the stock market and the larger US economy, but economists and financial institutions believe there may be another shoe to drop before we can expect to see normalcy return to the markets.

Check Up on Your Portfolio

While economic downturns can be scary, it’s important not to make any rash decisions out of fear. Instead, take the time to do a deep dive into your financial portfolio and ask yourself the following questions. Are your investments diversified enough, both within and across asset classes? Are you invested in the best retirement funds? Are you on track to reach your goals? These are questions that can help guide you in your asset allocation.

Instead of potentially compromising your long-term goals by trying to avoid losses in the short-term, use declining stock prices to your benefit. You can take advantage of the cyclical nature of the market by ramping up retirement and investment contributions when prices are down and then scaling them back when prices are high, thus enabling you to capture more value in the long run.

But how do you perform a portfolio checkup? Let’s break down some of the steps it entails.

1. Evaluate Progress Towards Goals

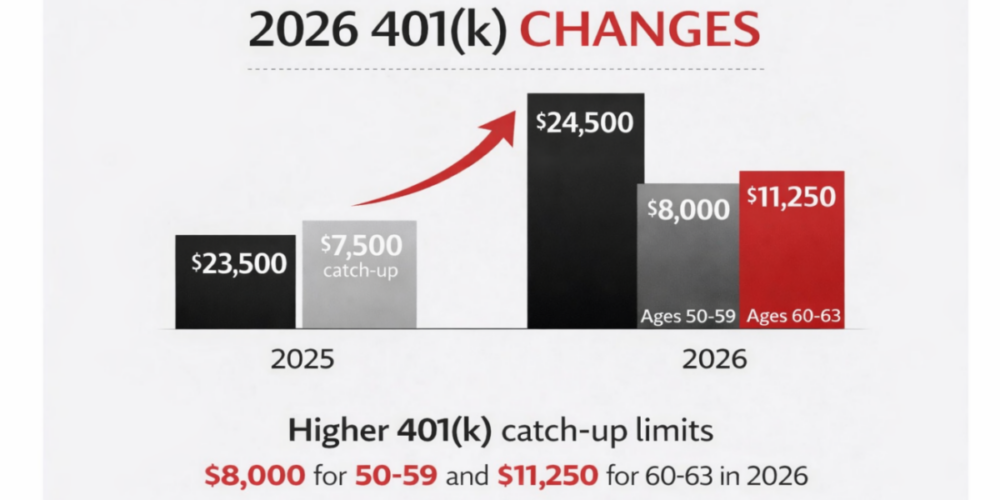

The first step of the process is assessing where you currently stand in regard to your larger financial plan. Think about reviewing the balance of your retirement accounts and your savings rate to determine how much progress you’ve made toward your retirement target.

Now consider whether you need to make any changes to your investment strategy. If you’ve experienced any major life changes recently, such as a new job, a marriage, or the birth of a child, it’s important to evaluate how these changes might affect your

long-term plans so that you can act accordingly. Your goals are bound to change either by want or by circumstance and it’s important that your financial plan evolves along with them.

2. Assess Asset Allocation and Diversity

Once you’ve gotten a comprehensive look at the health of your overall plan, it’s time to dig into the details of your portfolio to see if you can identifying inefficiencies or areas for improvement. There’s a good chance that recent market movements have impacted your assets, so keep this in mind and always view the performance of your investments within the context of your long-term goals.

Is your current portfolio allocation delivering the return that’s required to hit the milestones you’ve set for yourself? Are you satisfied with the diversification of your portfolio? If not, you could benefit from exchanging a portion of a more concentrated

position for assets of a different market sector or asset class.

Regularly assessing your portfolio allocation and reweighting as necessary can help you stay on track to meet your financial goals and ensure that you aren’t taking on more risk than you choose to.

3. Examine Risks

Next, take sufficient care to analyze the different risks that might threaten your investment portfolio and the goal you’ve set for it. These threats could be practical or existential; microeconomic or macroeconomic. Your career, family, and physical and mental health are factors that could impact your ability to reach your financial goals. High inflation and rising interest rates could also play a pivotal role. Anticipating some of these risks ahead of time can help you adapt your plan as needed.

Based on how much volatility your investments are demonstrating, you may be able to smooth out some of the peaks and troughs by rebalancing or making adjustments to your portfolio’s risk profile. Remember that having too many eggs in one basket can burden you with undue risk and add a “feast or famine” element to your investments. Instead, it’s often beneficial to strike some kind of balance between more volatile, higher-growth assets like stocks and more steady income-generating assets like bonds.

Checkup Results?

Your decision to buy, sell, or hold a specific investment within your portfolio will likely be a function of a variety of factors, but this rule of thumb may help you navigate market cycles more efficiently:

- When prices are low, consider boosting your investment and retirement contributions to acquire assets at a discount.

- When prices remain high, consider scaling back your investment and retirement contributions to avoid paying a premium for assets during peaks in the market.

Could you use the guidance of a specialist in portfolio checkups? Schedule a call with us to get a free second opinion or sanity check.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees. This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.