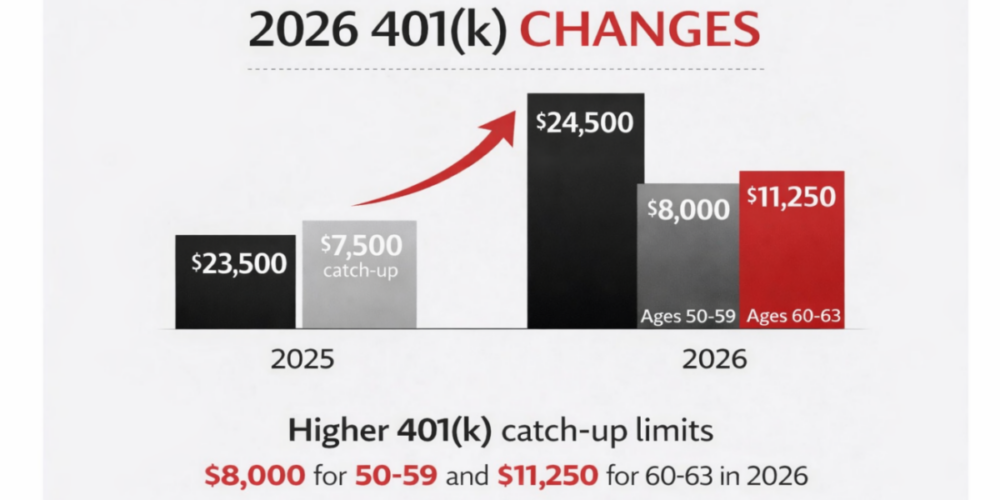

Tax saving strategies 2026 go far beyond higher 401(k) limits. For…

Is It Time to Leave Traditional Methods for a Fee-Only Approach?

When it comes to managing your wealth, working with the right financial advisor can make all the difference in reaching your goals. Many have experienced the traditional model where advisors earn commissions by selling specific financial products. It often feels like there’s a conflict of interest in these relationships. But more and more people are moving toward fee-only advisors because they offer something refreshing. Fee-only advisors are always being a fiduciary, transparency, unbiased advice, and a focus on long-term value. So, is it time to rethink the traditional approach and switch to a fee-only advisor? Let’s explore why this shift could be the smarter choice for managing your wealth.

What is a Fee-Only Financial Advisor?

A fee-only financial advisor is compensated solely by the fees their clients pay for services such as financial planning, portfolio management, and advisory services. These fees are typically charged as a percentage of assets under management (AUM), a flat fee, or hourly rates. Unlike commission-based advisors, fee-only advisors do not earn money from selling financial products, which helps eliminate potential conflicts of interest. They are also able to ALWAYS act in your best interest, a fiduciary.

The Benefits of Fee-Only Advice

1. Transparency and Trust

One of the most significant advantages of working with a fee-only advisor is the transparency of costs. Since the advisor’s fees are straightforward and agreed upon in advance, clients can trust that recommendations are made in their best interest, without the influence of commission-based incentives.

In contrast, commission-based advisors may be tempted to recommend products that generate higher commissions, which can cloud their judgment. The fee-only model fosters a stronger client-advisor relationship, built on trust and clear communication.

2. Unbiased Advice

Fee-only advisors are required to always act in your best interest, putting your needs first, no matter what. This is known as a fiduciary duty, meaning their advice is objective and focused solely on your financial goals. What many people don’t realize is that some advisors only act as fiduciaries part of the time—meaning there could be moments when they’re not required to put your interests first. Fee-only advisors, on the other hand, don’t have the pressure to sell specific products. Instead, they focus entirely on creating personalized financial plans that work for you, whether it’s retirement planning, managing an estate, or handling complex tax strategies. In contrast, commission-based advisors might recommend products that earn them commissions, which could create a conflict between what benefits you and what benefits them.

3. Long-Term Focus on Client Value

The fee-only model fosters a true long-term partnership between you and your advisor. Because they’re compensated through a flat fee or a percentage of the assets they manage, their success is directly tied to your financial success. This alignment motivates them to focus on sustainable, long-term strategies designed to grow your wealth steadily, rather than chasing quick sales. At the heart of this approach is comprehensive Financial Planning—far more crucial to your financial well-being than simply picking investments.

In contrast, commission-based advisors may be more focused on generating sales to meet quotas or earning one-time commissions. Their personal goals may not always align with your financial goals over the long haul. It is not uncommon for clients to only hear from commission based advisors when they are ready to pitch a new product, not to do planning or projections.

Is the Fee-Only Model Right for You?

Switching to a fee-only advisor could be the right choice if:

- You value unbiased, transparent advice without the pressure of sales tactics.

- You prefer to pay directly for the advisor’s services, knowing their compensation isn’t tied to product sales.

- You want a long-term financial partner focused on your success, not one-time transactions.

How to Make the Transition

If you’re considering transitioning from a traditional, commission-based advisor to a fee-only model, here are some steps to take:

- Evaluate Your Current Advisor Relationship: Are you confident your advisor is acting in your best interest? Are the fees and costs transparent? Do they offer financial planning or only investment advice?

- Research Fee-Only Advisors: Look for advisors who are certified as fee-only through organizations like the National Association of Personal Financial Advisors (NAPFA) or the Fee Only Network, which specialize in fee-only financial planning.

- Ask the Right Questions: When interviewing potential fee-only advisors, ask how they are compensated, whether they act as fiduciaries, and what services are included in their fees. See our checklist on how to compare financial advisors.

Choosing the right financial advisor is about finding someone whose interests align with yours, and for many high-net-worth individuals, the fee-only model offers the transparency, trust, and long-term commitment needed for successful wealth management. While traditional commission-based models may still work for some, fee-only advisors provide a clearer path to building wealth without the conflicts of interest often found in product-driven financial planning.

If you’re ready to prioritize unbiased financial advice and develop a wealth strategy that puts your goals first, it might be time to leave the traditional methods behind and embrace the fee-only approach.

CAM Disclosure

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.