We’ve said before that the most dangerous four words in investing…

Is the market too high? Focus on history, not headlines!

Like many of you, I’ve come to enjoy the fall in the Colorado Rockies. The weather is great, there is so much to do, and more seasonal fun is just around the corner. There is also something about seeing the early snow-capped mountains and knowing a lot more is on the way. But we just can’t predict how much or when all the snow will arrive!

We continue to receive questions on many popular topics and how they might impact one’s investment portfolio for the future. For example, the latest question relates to Warren Buffett selling large amounts of stock. Many take this as a sign – but no one can agree on what the “sign” is. Instead of being induced with fear of the unknown, let’s focus on things we do know.

We are not in the business of making predictions, but here are a few current themes I thought I would touch on:

- Stock Market Euphoria

- Impact of Election Results

- The “Crisis of the Day”

Summary:

- We can’t control the stock market or know when we’ve hit max euphoria.

- We are not experts in predicting what exactly will happen following an election (nor is most anyone as we’ve witnessed yet again).

- But when it comes to investing, I feel very confident that we have and continue to help our clients manage what we call “The Crisis of the Day”.

Like in any economic environment, investors often experience many crises and we all will face many more in our lifetime. This isn’t a prediction, but one of the few guarantees I will offer. How investors react to these crises will be a major factor in their financial success. For most, they should stay the course and focus on History, not Headlines. Why? Because as we have always discussed with our clients, this will help avoid irreparable harm to their portfolio from reacting to market crisises.

“So, Marc, how do we do that?“

If you invest with CAM, you have a dynamic financial plan that has been established and is updated on a regular basis or as needed. Investments shouldn’t dictate how you plan for your future. Instead your plan should drive most of your investment decisions such as how much risk and return one should accept or pursue. Whether a crisis occurs, or you are concerned one is around the corner, it’s almost always important to stay the course with your investment strategy. You should only revisit the plan if the crisis has changed your goals or circumstances.

We do understand that at times, emotions can run high. Volatility in markets can do this and make us feel like we lose our sense of control; especially when someone is running a business, planning for retirement, owns a lot of their net worth in company stock, or planning for their next phase of life. As our clients know, we can’t plan for what the future will hold, but we can and do plan for uncertainty. “Hope” is not an investment philosophy, but instead using reliable information that helps stack the odds in one’s favor can help investors have a successful investment experience.

Planning drives investment strategy

- Ask yourself, “Have recent events or the crisis of the day changed my goals or any of the assumptions my financial plan was built on?” If yes, then revisit the plan. If no, we’ve planned for this so stay the course.

- For clients near retirement, we’ve planned for a market response to a crisis by ensuring that several years of living needs are allocated to safer, less volatile investments like bonds and cash. If a client has three years or more of living needs in the bond portion of their portfolio it allows them to move their time horizon beyond the crisis and gain confidence that stocks will recover by then.

Focus on history, not headlines

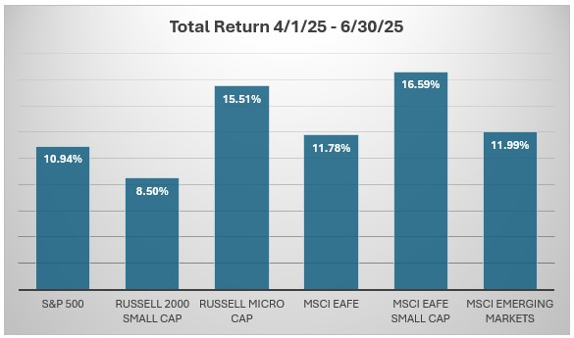

- Market corrections – often caused by a new crisis – happen frequently. There have been 37 (38 counting COVID-19) over the past 70 years and the markets have recovered 37 of 37 times. Investing offers no guarantees, but 37 for 37 is about as close as we will get to one.

- We often share many resources to reinforce how markets have recovered from crises in the past. The greater the volatility or correction most often leads to a more pervasive and sharper recovery to the upside. Investors need to stay in their seat to avoid missing out.

Avoid the temptation to “go more conservative” or “to cash” as a reaction to the Crisis of the Day

We’ve found no reliable way to predict when negative days will occur (we have a great example with COVID-19). But we do know how to capture positive days, stay invested.

When investors move in or out of the market in response to an event, they are predicting when the market will have a positive or negative return. We believe markets are a powerful, information processing machine and incorporate all available information. Thus, once information related to the event is known by investors, prices have already adjusted.

In addition, if you flee the market after a major crisis, you must then decide when to return to stocks. You must be right twice to be a successful market timer. In many cases, the decision to reinvest comes after a rebound has begun, resulting in missed opportunity. Moving in and out of the market can also incur additional costs and have potential tax implications for investors.

Avoid the pain

I used to travel quite a bit in my former life and speak to investor audiences about investing, how to think about capital markets, and consider what should matter most. I would often suggest that investors should view investing like a house.

You don’t check the value of your house every day or week. You plan to own it for the next 10 to 20 years so you only care about the value then. Same way with the stock market. I think about it in relation to a house price. People don’t look up the price of the house every day. First, your house may or may not be priced every single day but second, you’re not checking the price of your house every day because you know you’re not going to sell, you know you’re not going to sell for the next 10, 15 maybe even 20 years. Overtime house prices will fluctuate many times based on different events but people don’t look because they don’t have to sell it. I think this is a very important point in relation to a stock portfolio.

People are putting themselves through this unnecessary pain by checking every single day when in reality, they don’t intend to take any action.

CAM Disclosure

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.