It’s been said that the stock market does not like surprises…

Making Your Decision: Recommendation Meeting

You’ve done the data gathering, you’ve met a few times and you’ve shared your goals. You may have done this with a few financial planners as you “test” them out to see which you like best, feel you can trust and your gut says “this is the right planner for you”. What’s the final deciding factor? That’s the role of the Recommendation Meeting.

When it comes to choosing a financial planner, this step is often the most crucial. We believe in offering advice that’s tailored to life’s complexities, setting you up for success. That’s why our Recommendation Meetings are designed to give you a clear picture of the planning activities we believe will best help you. We will also outline what the next few months will look like as we tackle your most pressing needs together. The Recommendation Meeting helps set expectations for both you and us, and sets the stage for a successful partnership. In this blog, we’ll walk you through our process for Recommendation Meetings, ensuring that you’ll feel confident and ready to make your decision – which financial planner do I work with?

Your Unique Plan

As you can see from the above life path, the road is not smooth. We all look forward to the ups and are often unprepared for the downs. Part of our job as financial planners is to help you plan for ALL these different stages. We are your guide and rock to keep you on the path and not become disheartened. This is why we gather so much data, ask what your values are and learn about your dreams and hopes.

After the Discovery Meeting, which we discussed in this previous blog, we look at everything you shared. We look at the quantitative facts, but more importantly we look at the qualitative. By active engaged listening we are able to create a financial plan that looks beyond the numbers. The plan is to help you achieve that future you want for yourself and your family.

Outlining Next Steps

Once we’ve shared our recommendations on the financial planning areas we see a clear need for action, we will go over next steps. This may be a list of “to-do” items for you, some items for us to research and some things we work on together. This is where the planning turns into implementing.

It may seem overwhelming at first with how many things need to get done, but don’t worry. We’ll help you prioritize what needs immediate attention and what can wait a bit. We will also help keep you accountable as we work through the plan together.

The Importance of Questions

The Recommendation Meeting is not just us talking or presenting. It’s an open dialogue, where we want to get your feedback and answer any lingering questions you may have. We ask questions that help confirm we’re providing the advice and guidance you actually need help with, and spurred you to call in the first place. Whether you’ve spoken with other advisors or not, ask us how we’re different. If you’ve gotten recommendations from anyone, could be another advisor or just a friend, feel free to ask our opinion. Ask us how that might fit into your plan or why we didn’t include it in our plan. This two-way communication ensures that we’re all on the same page and that our strategies align with your expectations and comfort level.

Are You Ready?

At this point you’ve had three meetings with us. And by the end of the Recommendation Meeting, you’ll have a solid understanding of:

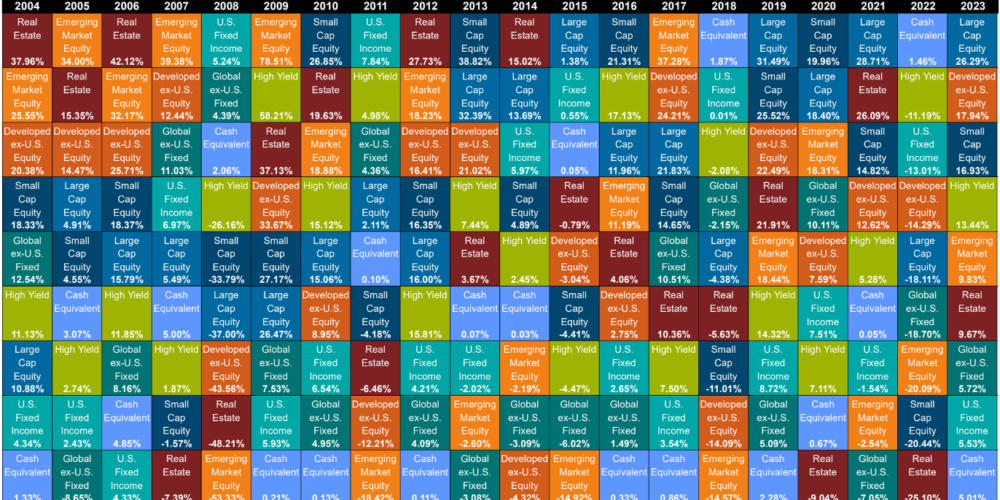

- Who you’re working with: Our investment strategy and philosophy

- Financial health: Your complete picture

- Your unique plan: Know next steps to move forward

You’ll leave the meeting with more than just information; you’ll have clarity and a plan of action to solve your financial issues. What does the before and after life of working with us look like? Below we outline the various areas where we can take concerns and disarray and turn them into organization and peace of mind.

We would be delighted if you took the first step towards your financial peace by setting up a meeting with us. It’s easy to do with our online calendar tool, just click below. We look forward to the opportunity to guide you on your financial journey.

Disclosure

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.