Tax saving strategies 2026 go far beyond higher 401(k) limits. For…

Market Timing Mistakes: Why “This Time It’s Different” Fails

We’ve said before that the most dangerous four words in investing are: “This time it’s different.” Those words often signal the beginning of market timing decisions, when emotion starts to override discipline.

We’ve heard that statement frequently in recent decades, from the bursting of the dot-com bubble to the Great Recession to the Covid crash of 2020. We heard it again this past spring, when the Trump administration announced the imposition of sweeping, severe tariffs that blindsided investors and sent the stock market reeling.

Peel back the onion on that statement and you find an underlying justification for market timing. In other words, “this time it’s different, so we must do something.”

Blink Moments and the Cost of Market Timing

These are what we call the “blink moments”, the pivotal times when otherwise rational, level-headed investors may feel tempted to throw in the towel and decide they are going to bail out of the market “just this once. Because this time…it’s different.”

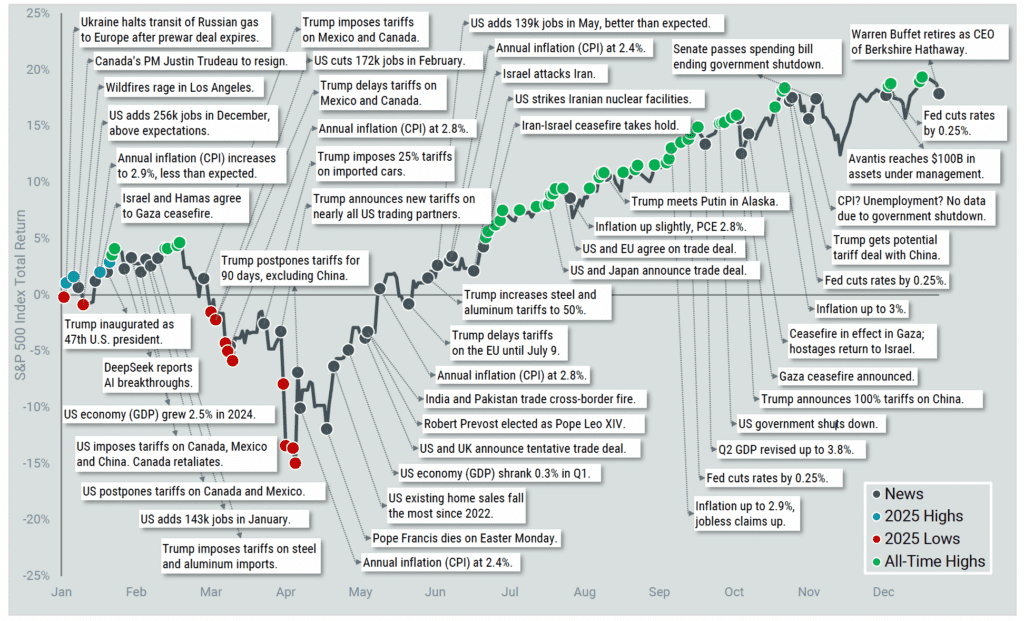

As Much of 2025 That Fits on One Page

The thing is, it’s always different. Every crisis is unique in its own way; after all, it wouldn’t be a crisis if we already had the blueprint for how to fix the problem!

The real question is whether investors can avoid the fallout from these market shocks by jumping out of stocks and into the perceived safety of bonds and cash. History suggests that even a single poorly timed “blink moment” can potentially have major adverse effects on your portfolio.

For example, this goes back to the oft-cited chart we included in this space recently showing the impact of missing even just a few of the stock market’s best days over the long run. Missing out on even a handful of the market’s best days over the course of two decades can mean the difference between earning equity rates of return and the lower returns associated with bonds and cash.

S&P 500 Index by the numbers in 2025

results.

At its core, market timing is an emotional decision masquerading a logical decision. It’s about letting fear take the reins of our decision making – and fear is no basis for an investment strategy.

Market Timing and the Importance of Global Diversification

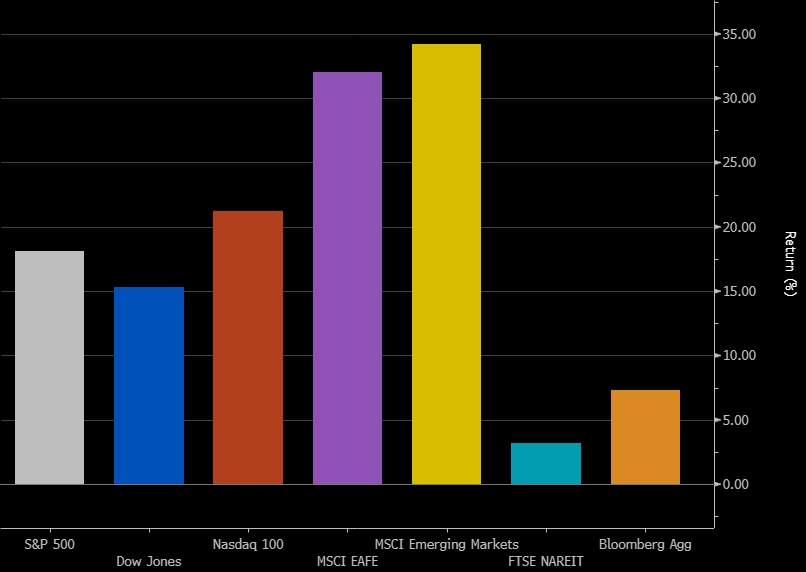

Stocks in recent years have been led by U.S. stocks, but 2025 saw a notable rotation in the capital markets. While U.S. large cap stocks (as reflected in the Dow Jones Industrial Average and S& P 500 indices) still enjoyed robust gains in 2025, international equity asset classes surged well past their U.S. counterparts.

The dispersion of returns across asset classes in 2025 highlights why staying diversified, rather than attempting to time the market, remains critical.

2025 Index Returns by Asset Class

Market Cycles and Leadership Rotations

Over time, like the pistons on an out-of-tune engine, market sectors rise and fall in unpredictable ways, often for extended periods of time. We saw that in the decade of the 2000s, when the S&P 500 posted a negative total return while many other equity asset classes enjoyed triple-digit gains. While it can sometimes be frustrating to see international stocks trail domestic stocks for extended periods, we believe maintaining a healthy allocation to international stocks can help support a broad representation of asset classes around the globe and not just those in our backyard.

Staying Disciplined During Periods of Uncertainty

At its core, market timing is an emotional decision that appears logical at the time. It is about letting fear take the reins of our decision making, and fear has never been a reliable investment strategy. History repeatedly shows that investors who react to short term market stress often lock in losses and miss the recoveries that follow.

In fact, periods of uncertainty are not a signal to abandon a well constructed plan, but rather a reminder of why that plan exists in the first place. Diversification, discipline, and patience are practical tools.. They are the tools that help investors navigate exactly these kinds of moments.

While markets will continue to test investors with new headlines, new risks, and new reasons to believe that this time it is different, our role is to help you stay focused on what matters most: your long term goals, your personal timeline, and a strategy built to endure uncertainty.

If recent market volatility has raised questions or concerns, we encourage you to reach out. A conversation, not a reaction, is often the most valuable step during periods like these.

* * * * *

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or categories. Need to add more disclosures.

About CAM Investor Solutions

CAM Investor Solutions, a fee-only independent Registered Investment Advisor, has offices located in Colorado, Florida, and Texas. As a growing wealth management firm, we focus on the needs of our clients to improve their quality of life. Our firm’s commitment to innovation through rigorous academic research enhances how we serve a multi-generational audience.

CAM’s Specialties Include:

- Managing concentrated wealth

- Planning for stock and option compensation / company IPOs

- Advanced tax managed investment strategies

- Custom retirement income strategies

- Cash management

Contact:

CAM Investor Solutions

info@caminvestor.com

1-844-247-0787

https://caminvestor.com

CAM Disclosure

SOURCE: Bloomberg; RBC GAM; Dimensional Fund Advisors.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.