Tax saving strategies 2026 go far beyond higher 401(k) limits. For…

“Math is Math” – Reviewing Q2 2022

Rising inflation and growing recession fears delivered a one-two punch to the global capital markets in Second Quarter 2022.

The Dow Jones Industrial Average fell 10.78%, while the broader S&P 500 index declined 16.10%. Small stocks, as measured by the Russell 2000 index, dropped 17.20%. Traditional bonds provided little cushion to the stock declines, as fears of interest-rate hikes sent the Barclays’s U.S. Aggregate bond index down 4.69%.

As many of you know, we’ve been discussing the potential negative impact of rising interest rates on bond prices (as well as other asset classes) for the past few years. It was impossible to predict when rates would begin to rise as well as by how much. We also felt the risk/return trade off was certainly in question for investors in traditional bonds, given how low interest rates had declined over the past 20+ years which pushed bond yields close to zero. Yet, it seemed odd that many didn’t believe interest rates could rise again or perhaps didn’t fully understand how the bond math really worked since we have not had a true rising rate environment for many years. This has been an expensive tuition bill for some.

At CAM, we often find ourselves using the phrase, “Math is math” for many things when it comes to investing given our philosophy. For those of you who have younger children like we do, you might appreciate this phrase from the popular Incredibles 2 scene: Mr. Incredible: “I don’t know that way—why would they change math? Math is math. Math is math!“ We believe this also holds true for determining bond prices as interest rates move up and down as it hasn’t changed. While the rates market is impossible to time, it is simple to calculate the impact on many strategies (both good and bad) should interest rates continue to rise as expected.

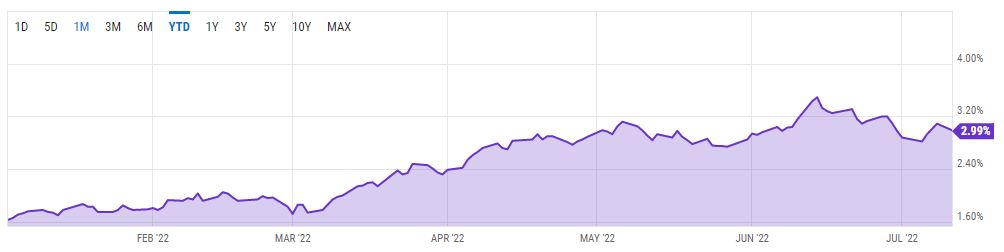

10 Year Treasury Rate

Year to Date as of July 11, 2022

As a result of the market’s recent performance, many Wall Street analysts and pundits are making all kinds of dire economic predictions in the financial media. Yet, while a recession may well be in the making (if we’re not already in one), there are still positive economic indicators out there, with unemployment low and the housing market remaining strong. The balance sheets of U.S. consumers are strong as well, with household debt as a percentage of GDP still well below 2008 levels.

Much of the recent volatility is likely attributable to markets attempting to sort out the good from the bad and discern the near-term direction of the economy. But even if a recession does come to pass, there are really only two options for long-term investors:

1. Do nothing;

OR

2. Do something

In this case, “do something” means pulling some or all of your portfolio out of stocks and into the so-called safe haven of cash. Many investors did exactly that in the early stages of the pandemic in 2020, when the global economy shut down and the S&P 500 plummeted nearly 40% in just four weeks. Millions of investors ran to the sidelines, locking in steep losses and waiting for things to “calm down” before they got back into stocks.

Unfortunately for them, they spent the next 20 months watching stocks climb higher and higher while they missed out on the party. From April 1, 2020 through December 31, 2021, the S&P 500 gained nearly 90% without experiencing a decline of even 10%.

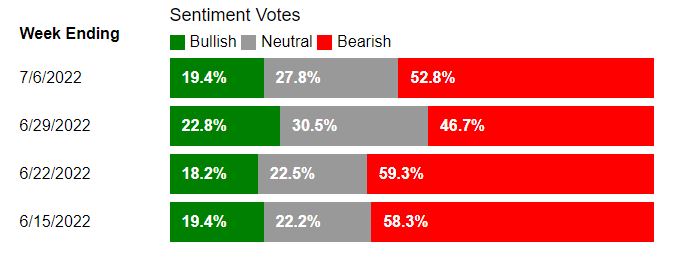

Now that stocks have fallen well below their highs, the opportunity to get back in the stock market has finally arrived for these investors. Yet a look at the American Association of Individual Investors’ “Survey of Investor Sentiment” the week of June 22 – when the S&P 500 hit its recent low – showed that only 18.2% of individual investors viewed themselves as bullish, while 59.3% considered themselves bearish (22.5% were neutral).

Disciplined investors are in the “do nothing” camp and view a bear market as a great opportunity to invest available cash into stocks trading at deep discounts. But those who fled the market in early 2020 struggled with staying disciplined. Their fears, emotions, and worries about a very uncertain world got the best of them. These same investors are likely not viewing the current stock sell-off as a buying opportunity. As we like to say, “Math is math” and perhaps it really is an opportunity for many of us given these lower prices.

Whether you’re feeling disciplined and sure about your financial future, or you have concerns and are thinking of “doing something”, we would love to have a conversation with you.

Sources: YCharts; American Association of Individual Investors; Bloomberg. M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees. This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Any stated performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Charts and graphs provided herein are for illustrative purposes only. There are many different interpretations of investment statistics and many different ideas about how to best use them. Nothing in this presentation should be interpreted to state or imply that past results are an indication of future performance. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.