We’ve said before that the most dangerous four words in investing…

No more excuses, start your financial plan!

People who make bad money choices often find ways to justify them. In fact, we are surprisingly good at tricking ourselves when it comes to our finances. In both work and personal life, we often make excuses for our fears and lack of financial planning.

Instead of simply acknowledging how we feel and thinking about those feelings, we skip that step and create a convincing reason to cover up our unclear emotions. These internal debates are usually complicated, short-term excuses that we use to defend actions that aren’t in our best long-term interest.

What if you had simple counter points to help you get past your excuses to achieve financial success and freedom? It’s hard to move beyond our own self-talk but if you have someone to talk to or something to read that provides another perspective, you may be able to break free of the excuses.

Counter points to common financial planning excuses

1) “I just want to wait till things become clearer.”

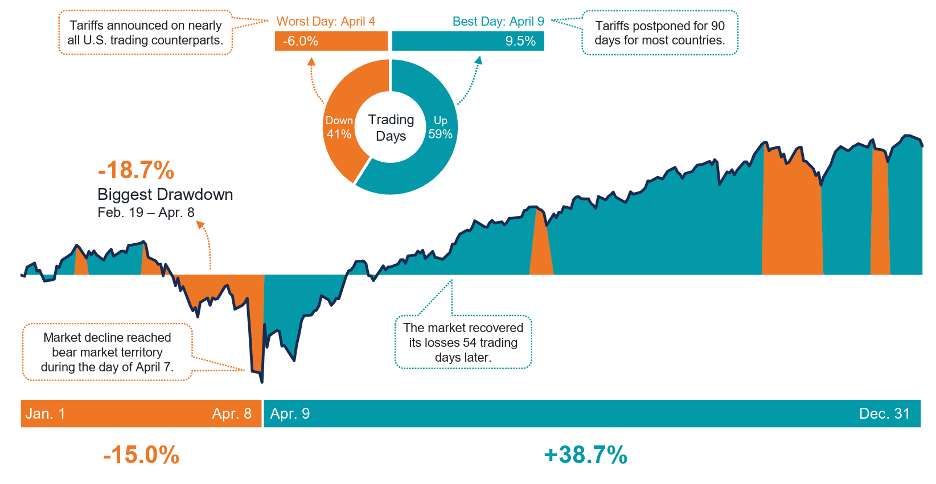

It’s understandable to feel unnerved by volatile markets. But waiting for volatility to “clear” before investing often results in missing the return that can accompany the risk. Some are still waiting since the recovery began in March 2009.

2) “I just can’t take the risk anymore.”

By focusing exclusively on the risk of losing money and paying a premium for safety, we can end up with insufficient funds for retirement. Avoiding risk can also mean missing an upside. In addition, not employing proper risk management techniques can also jeopardize your nest egg.

3) “I want to live today. Tomorrow can look after itself.”

Often used to justify a reckless purchase, it’s not either-or. You can live today and mind your savings. You just need to keep to your budget. If you don’t have one or understand how to establish some basic financial fundamentals, you may want to consider seeking a qualified financial advisor for help.

4) “I don’t care about capital gain. I just need the income.”

Income is fine. But making income your sole focus can lead you down a dangerous road. Just ask anyone who invested in collateralized debt obligations in 2008 as well as leveraged preferred stocks in 2016 right before interest rates began to rise.

5) “I want to get some of those losses back.”

It’s human nature to be emotionally attached to past bets, even losing ones. But, if this is putting your financial plan or even worse, your ability to receive the proper amount of retirement income, its probably time. As the song says, you have to know when to fold ’em.

6) “But this stock/fund/strategy has been good to me.”

We all have a tendency to hold on to winners too long. But without disciplined rebalancing, your portfolio can end up carrying much more risk than you bargained for. This discipline applies not only to when markets are down (similar to 2008), but also in 2017 as markets continue to reach new highs.

7) “But the newspaper said…”

Investing by the headlines is like dressing based on yesterday’s weather report. The news might be accurate, but the market usually has reacted already and moved on to worrying about something else. This helps explain why we’ve seen a big market rally since the Presidential election, as it seems the market is already pricing in events to come.

8) “The guy at the bar/my uncle/my boss told me…”

The world is full of experts, many who recycle stuff they’ve heard elsewhere. But even if their tips are right, this kind of advice rarely takes your circumstances into account. Remember the dot.com bubble?

9) “I just want certainty.”

Wanting confidence in your investments is fine. But certainty? You can spend a lot of money trying to insure yourself against every possible outcome. While it cannot guard against every risk or possible outcome, it’s cheaper to diversify your investments. Its also very likely you have a long list of financial planning issues that need to be addressed and will better define your success beyond just your mutual fund portfolio.

10) “I’m too busy to think about this.”

Greg McKeown (author of Essentialism) often lectures to those who are too busy because they are doing too much – “It is a systematic discipline for discerning what is absolutely essential, then eliminating everything that is not, so we can make the highest possible contribution toward the things that really matter….The life of an Essentialist is a life of meaning. It is a life that really matters.”

No more excuses

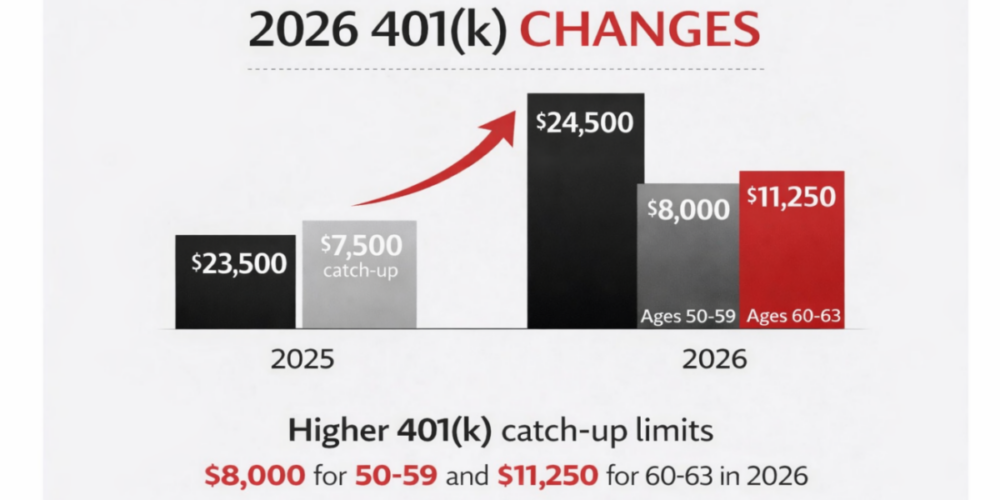

We frequently attempt to manage aspects beyond our control — such as market fluctuations and media distractions — while overlooking areas where our efforts can truly impact, like developing a retirement savings strategy or controlling investment costs. Focusing on these aspects is certainly worthwhile.

Since it’s all too simple to deceive ourselves, seeking unbiased advice from someone who understands your unique needs and situation can be beneficial. A fee-only fiduciary financial advisor can help you stay focused to your true goals and avoid the shiny objects and distractions. Implement your “no more excuses” strategy today.

CAM Disclosure

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.