Concerned about interest rates lowering and not earning above inflation on your cash and cash-like investments? Read about our new offering!

Recession – Markets Don’t Wait for Headlines

As we head into the new year, it has been almost three years since the last US recession. Negative stock returns and aggressive US Federal Reserve interest rate hikes have many investors concerned we are headed for another big “R”—if we’re not already there. However, recessions are always identified with a lag and by the time one is called, the worst of its impact on markets has usually passed.

The National Bureau of Economic Research (NBER) identifies phases of the business cycle using a bevy of indicators, such as consumption and income data, employment rates, and gross domestic product growth. None of these measures has been consistently dominant in the determination of economic conditions, and certainly past US recessions have come in all shapes and sizes. Recessions are therefore named retroactively, with the benefit of hindsight (and additional economic data that may be available with a lag).

Some investors may worry about the stock market sinking after a recession is officially announced. But history shows that markets incorporate expectations ahead of economic reports.

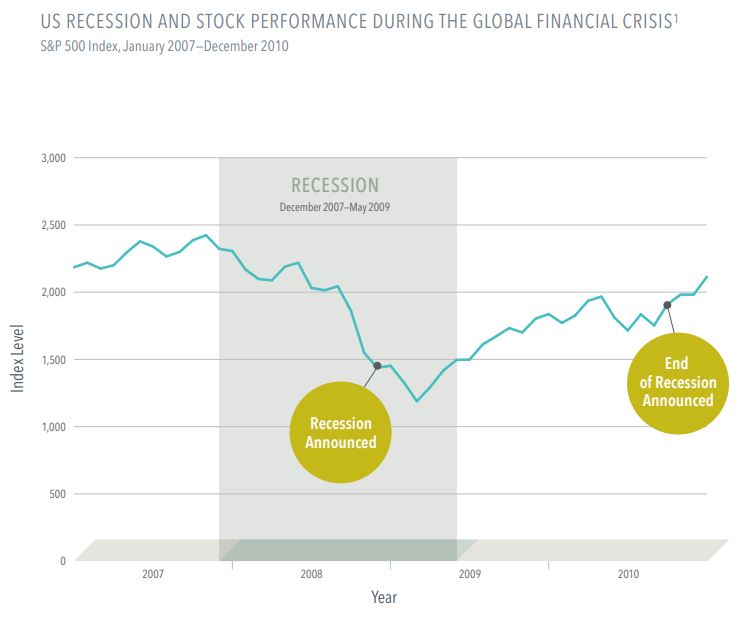

What does the graph above tell us about how markets perform during and after recessions, regardless of what’s in the headlines and talking heads are saying? Below are a few key takeaways.

- The global financial crisis offers a lesson in the forward-looking nature of the stock market. The US recession spanned from December 2007 to May 2009, as indicated by the shaded area in the chart above.

- But the official “in recession” announcement came in December 2008—a year after the recession had started. By then, stock prices had already dropped more than 40%2, reflecting expectations of how the slowing economy would affect company profits.

- Although the recession ended in May 2009, the “end of recession” announcement came 16 months later (September 2010). US stocks had started rebounding before the recession was over and climbed through the official announcement.

The market is constantly processing new information, pricing in expectations for companies and the economy. Investors may be better positioned for long-term success if they can look beyond after-the-fact headlines and stick to a plan. Work with a trusted advisor that is “tuning out the noise” of the media and focusing on the data.

Source: Dimensional Fund Advisors

- Start and end dates of US recessions, along with announcement dates, are from the National Bureau of Economic Research (NBER).

nber.org/research/data/us-business-cycle-expansions-and-contractions and

nber.org/research/business-cycle-dating/business-cycle-dating-committee-announcements - Decline based on the S&P 500 Index’s price difference between the actual start of the recession in December 2007 and the official

“in recession” announcement 12 months later.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.