Tax saving strategies 2026 go far beyond higher 401(k) limits. For…

Retirement Accounts for Business Owners

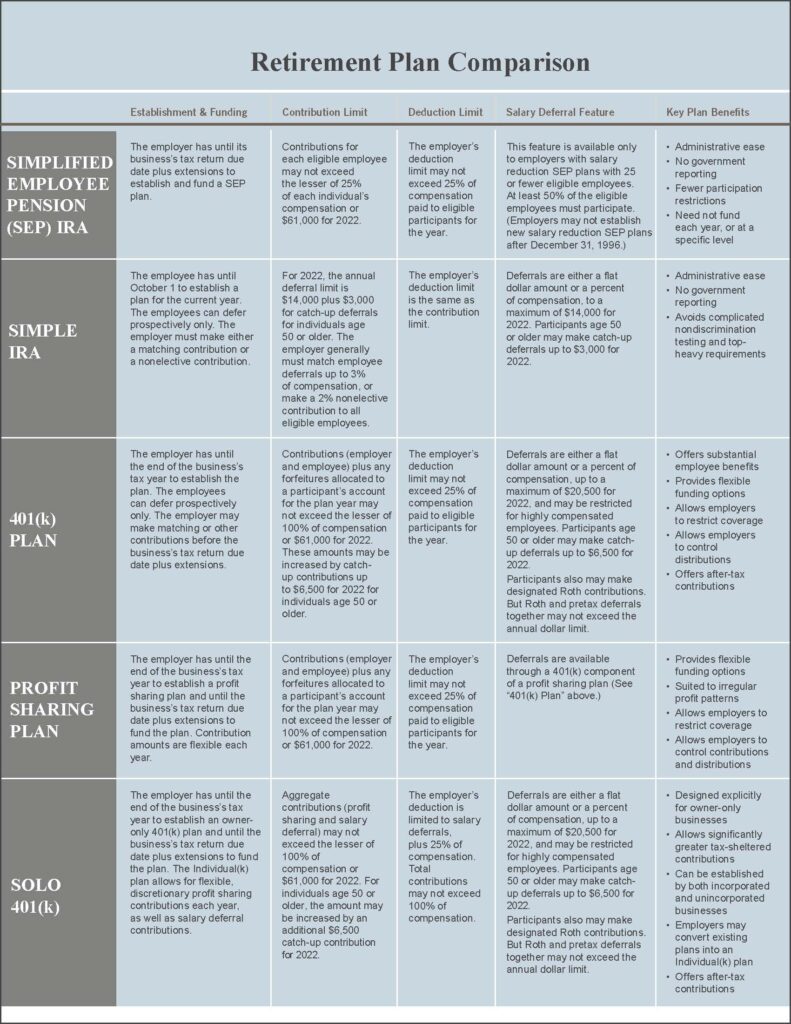

For most business owners, establishing a retirement plan is often the last thing they are thinking about when running their own company. When they come to us, these conversations usually start with “my accountant said I need to start a plan to gain tax benefits’ or ‘I want to attract top talent to my business’. But they don’t know where to begin or why one plan might be better for them than another.

When choosing a retirement plan for yourself and/or your business, you should ask yourself the following questions:

- Why am I establishing a retirement plan?

- How much time and money do I want to invest in a retirement plan?

- Is my revenue stream stable, or does it fluctuate?

- Do I have employees now, or will I in the future?

Establishing the right retirement plan now can help ensure that you have money to spend in retirement. But with so many retirement plans to choose from, it’s important to choose one that best fits your business needs.

Below you will find brief descriptions of the most widely used plans. You need to take into consideration what you want out of your plan, how taxes might be affected and what is feasible for your business. Consulting with your advisor or a CPA may help to determine which of these will be best for you but here are some details to get you started.

IRA

This was mentioned in last week’s retirement series and you don’t need to have a business to fund an individual retirement account (IRA) or Roth IRA, just earned income. If you don’t see yourself contributing more than $6,000 ($7,000 if you are age 50 and over) and don’t require added tax benefits or employee benefits this might be a good option and relatively simple.

SEP IRA

Traditionally this IRA was thought to be used for self employed business owners with no employees but it could be a useful plan even if you do have employees. If it is just you, you can defer 20% of your total compensation, or if you have employees, you can do up to 25% of compensation with a maximum into the plan per year of $61,000 for each employee. This plan differs from a Simple IRA primarily because it is funded by the business, not employees. So while it offers larger contributions for you as a business owner, keep in mind you also need to make these contributions for employees. This plan does not offer employees a way to contribute to their own retirement plan, therefore they may want to open their own IRA in addition to their employers SEP IRA and add their own funds to their personal IRA. Contributions to a SEP IRA are also optional each year which makes this one of the more flexible plans.

Simple IRA

A simple IRA is a plan for a company that has less than 100 employees. Employees can contribute up to $14,000 a year ($17,000 if you are age 50+). As a company you have to contribute up to 3% of employees compensation. This is a great option if you, as a business owner, want to establish a retirement plan that is mostly funded by employee’s contributions. Also, if you don’t want the added expense and complexity of a 401k and employees aren’t looking to defer more than $14,000 a year this may make more sense.

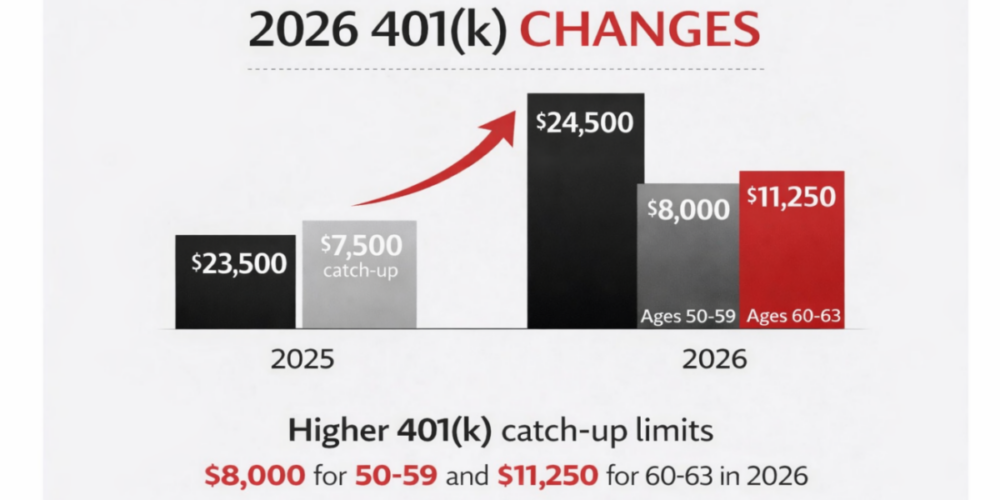

401(k)

This is the most widely known retirement plan. Any business size can have this plan and it is a combination of employee and business owner contributions. Most businesses love this plan because employees can contribute up to $20,500 per year ($27,000 for age 50+). When you add employer contributions to this it can add a significant amount to an employee’s retirement each year. You might like this plan if you are looking to attract talented employees, offer additional features on your plan like loans, Roth 401(k)s and vesting schedules. For additional funding beyond the 401(k), a profit sharing plan could be added as well. The downside to this plan is if you and employees aren’t looking to maximize contributions and the business isn’t looking to fund a lot toward retirement, it may not be worth the added expenses and compliance required.

Solo 401(k)

If you haven’t heard of this plan, it’s ok, not many are aware of it. If your business consists of just you (or you and your spouse) this may be a good choice if you like the larger contributions similar to the SEP but want more options like a 401(k). Again, this plan makes sense if you are looking to fund as much as possible but are also willing to pay for the added cost and compliance to gain additional investment options.

Choosing to start a retirement plan can be good for your business if you need tax deferred and deduction features, want to attract top talent, or just want to start contributing to your own retirement. There is a right plan for you and your business, and now may be the best time to start. October 1st is the deadline for some 401(k)’s to be established. Schedule a meeting with us to help you determine what’s right for you and your business.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees. This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.