It’s been said that the stock market does not like surprises…

Separate or Joint Accounts – What’s Best for Marriage?

Personal habits, communication style, household chores, finances, big decisions, quality time together, sex, parenting styles and in-laws. That’s the list of topics about which married couples most frequently argue. (It’s also a great set of things to bring up at your next dinner party if you’d like your guests to leave early).1

Although your partner’s most annoying habits can be the source of frequent conflict, those aren’t the things that cause a hit to relationship quality. (I still don’t understand how I could possibly brush my teeth too loudly.) Finances, parenting and sex, as you might have guessed, are the leading causes of lowered relationship quality in married couples.

I don’t have the space or academic expertise to talk about parenting and sex, so let’s stick to discussing finances among couples. First things first, even though there’s been an explosion of research about financial decision-making, the lion’s share of this research has looked at people making decisions on their own. The irony, of course, is that we often make big decisions with someone else—our partners, spouses, families and so on. Yet, only recently have researchers started to take a serious look at and offer potential remedies to the specific decision-making pitfalls that arise in couples.

Jenny Olson, a marketing professor at the Kelley School of Business at Indiana University, and Scott Rick, a marketing professor at the University of Michigan’s Ross School of Business, are two leaders in this growing space. They recently summarized the freshest findings, which I’d like to reprise here.2

If there’s a punchline, I think it’s this: When it comes to joint financial decisions, transparency wins the day.

What Gives Rise to Financial Disagreements in Married Couples?

One partner claiming the other spends money foolishly is a major source of conflict. This sort of argument often arises, in part, because opposites attract when it comes to money.

Early in his career, Professor Rick developed the Spendthrift-Tightwad scale to measure the extent to which someone feels pain at the prospect of spending money (a tightwad) versus someone who doesn’t feel enough pain at the prospect of spending money (a spendthrift). Spendthrifts and tightwads, as it turns out, tend to attract.3 The bigger this difference, though, the more people are likely to engage in conflict around money issues.

What’s the solution? You could tell your partner to loosen up and stop worrying so much about money. Or you could both try to meet more in the middle. Existing research suggests joint decisions tend to prioritize the wishes of the partner with less self-control. But we don’t know whether that’s just what people end up doing or if that’s what’s best for relationship satisfaction over time.

What’s clear, though, is that competing ways of spending—where one partner spends freely and the other doesn’t spend freely enough—can lead to serious conflict. One workaround I don’t necessarily recommend is engaging in what researchers have newly labeled “financial infidelity”— one or both partners lie about how much money they have spent or saved.4

People often do this in a misguided effort to avoid confrontation. It’s possible that some degree of this behavior could be beneficial. (For example, I’m not sure my wife needs to know how often I run to the store to get ice cream, which I love so much. But if she’s reading this, we are certainly going to have a conversation later.) Sustained financial infidelity over time, not unlike sexual infidelity, may cause deep rifts in relationships.

Better Ways for Married Couples to Make Spending Decisions

A better solution may be making spending decisions as transparent as possible through establishing joint accounts. Research on this topic is decisive: When couples use joint accounts, they tend to have higher levels of relationship satisfaction. With joint accounts, couples tend to make more utilitarian purchases (things they need) rather than hedonic purchases (things they want purely for pleasure) because the former are easier to justify.5

Of course, it could be the case that couples who decide to have joint accounts are naturally more satisfied in their relationships to begin with. In one compelling unpublished study, Professor Olson and her collaborators took a sample of newlyweds and randomly assigned them either to use joint accounts or keep separate accounts. Not only did the joint account holders end up seeing more eye to eye on financial matters, but they also had higher relationship satisfaction two years later.

So, observing what each other is spending can be good for relationships. Outside joint accounts, though, this type of observation and transparency may not necessarily be the way most couples engage in joint decision- making.

Many household-level financial tasks—paying the bills, rent/mortgage, setting up insurance—early on often fall to the partner with more time to engage in these tasks, even if they’re not necessarily the one better skilled at them. Over time, this household “CFO” naturally develops a higher degree of financial literacy because they are engaged in more financial decision-making.

Clear and Open Communication Is Key to Effective Joint Decision-Making

The problem with this arrangement is obvious: If the spousal CFO stops doing their job due to death, illness or divorce, it may leave the remaining spouse ill-equipped to handle everyday financial decisions. Transparency, once again, is likely helpful: Both partners may be better prepared to handled tough decisions if both know how the other makes these choices.

One additional solution I’d like to offer is taking a page from what we know about successful negotiations. Rather than compromising on decisions, first try to determine each party’s underlying interests and come up with solutions that consider these interests.

But that’s an exercise that can only happen with open and clear communication. It’s a conversation that’s much easier to have after you stop chewing so loudly and start brushing your teeth a little more quietly.

Want another opinion on financial decisions you are marking or need to make, give us a call or schedule a quick meeting with us. We’re here to listen and help.

Start saving together! Give us a call.

Endnotes

1 Dixie Meyer and Renata Sledge, “The Relationship Between Conflict Topics and Romantic Relationship Dynamics,” Journal of Family Issues, (first published March 1, 2021).

2 Jenny G. Olson and Scott I. Rick, “‘You spent how much?’ Toward an understanding of how romantic partners respond to each other’s financial decisions,” Current Opinion in Psychology 43 (February 2022): 70-74

3 Scott I. Rick, Deborah A. Small, and Eli J. Finkel, “Fatal (fiscal) attraction: Spendthrifts and tightwads in marriage,” Journal of Marketing Research 48, no. 2 (April 2011): 228-237.

4 Emily N. Garbinsky, Joe J. Gladstone, Hristina Nikolova, and Jenny G. Olson, “Love, Lies, and Money: Financial Infidelity in Romantic Relationships,” Journal of Consumer Research 47, no. 1 (June 2020): 1-24.

5 Ibid.6 Adrian F. Ward and John G. Lynch Jr., “On a Need-to-Know Basis: How the Distribution of Responsibility Between Couples Shapes Financial Literacy and Financial Outcomes,” Journal of Consumer Research 45, no. 5 (February 2019): 1013-1036.

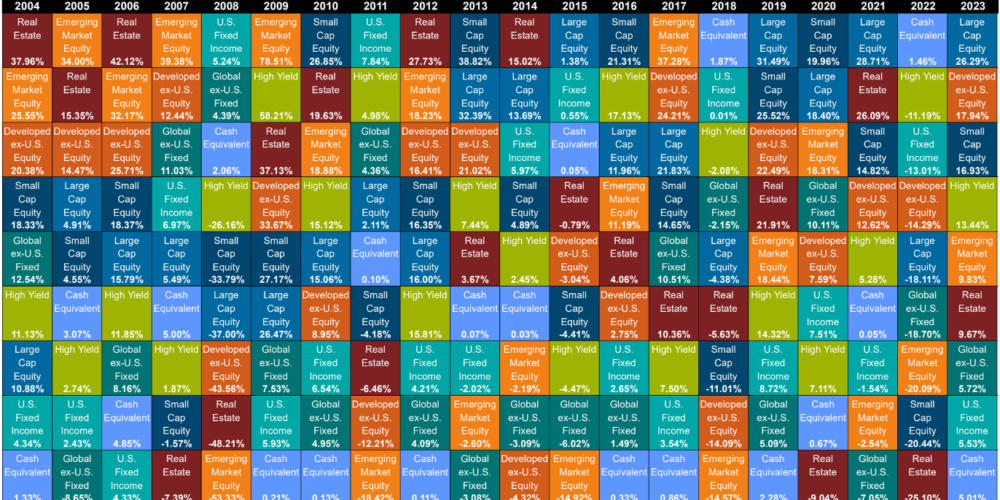

Source: Avantis Investors. M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees. This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Any stated performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Charts and graphs provided herein are for illustrative purposes only. There are many different interpretations of investment statistics and many different ideas about how to best use them. Nothing in this presentation should be interpreted to state or imply that past results are an indication of future performance. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.