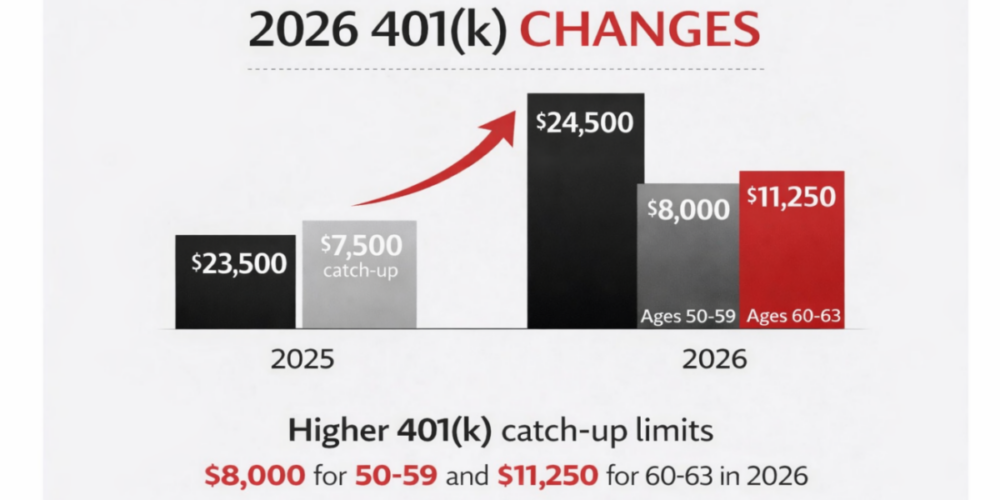

Tax saving strategies 2026 go far beyond higher 401(k) limits. For…

Should you pay off your child’s student loan?

Does this question “should I pay off my child’s student loan or not?” make you feel bad? Or like you’re being selfish or letting your child down? Well it shouldn’t! The fact that you’re even thinking of helping your child with their loans, in any way, is very generous and caring of you. You’re a great parent who wants to see their child succussed in life, without the burden and financial weight slowing them down from the get-go.

There is no shortage of statistics telling us how expensive college is now; or how high student loan debt is; or how recent college graduates are struggling much longer than previous generations to be able to buy cars or their first home. The news is overwhelming and disheartening. If you have the means to help your child with their student debt, by all means do so. But if it will be a burden, we have a few reasons why you should reconsider.

Don’t compromise your finances

- Have faith: Your child just graduated! They’re brilliant and can find a paying job that will kickstart their career and life-long pursuit of higher earnings. Give them a reason and drive to keep up their job search.

- Their expenses vs yours: While it may seem like you’re more qualified and able to pay their monthly loan payment with your higher income, that may not be the case. Your expenses are likely much higher than theirs. If you have a mortgage, drive a car and various insurances that go along with both. As well as maintenance on both. After it’s all added up, you may have less disposable income then your child, even if their salary is much lower.

- Retirement is knocking: You’ve been in the rat-race a long time, and it may be hard to see the finish line is approaching. But it is! And before you know it, these last 10 – 15 years will be over and you’ll be celebrating with a big cake and a retirement party. Are you ready? Have you put off savings over the last 18 – 24+ years to help support your child? If so, that’s great you were able to help them. Now it’s time to sure up your own plan so you won’t need to rely on your child in your later years.

Helping without paying

What’s the alternative to paying off loans for your child? Consider these 3 ways you can help them, help themselves.

Loan forgiveness

Some federal agencies are allowed to provide student loan repayment plans. An eligible employee can receive up to $10,000 per year for a total of $60,000 from the agency to pay down student debt. There are also some loan forgiveness plans available that will pay off your child’s debt after a certain number of employment years and/or consecutive payments.

Keep in mind that any repayment or forgiveness is considered income and your child will need to pay tax on it for the year it is received. For example, if your child is a doctor and has $300,000 in student loans forgiven through the Public Service Loan Forgiveness Program, in the year that the loan(s) are forgiven they will need to add $300,000 as income on their tax form, on TOP of what they earned as real income that year. This can create a pretty hefty tax bill. It will likely be smaller than the amount of the loan itself, but cash will still be needed to pay the IRS.

Income-based repayment plans

Student loan repayment options can be very confusing, as their are many. The one that can help your recent graduate in their early (possibly struggling years) is called the Income-Based Repayment (IBR) Plan. Monthly payments will be either 10 or 15% of discretionary income (depending on when loans were first received), but never more than what would have been paid under the 10-year Standard Repayment Plan. Payments are recalculated each year based on income and family size. This is a great option to help your child stay on track while not eating into every penny earned.

The best news about the IBR? Any outstanding balance on loans after 20 or 25 years, depending on when loans were first received, will be forgiven. As mentioned earlier, it’s important to remember that any loan forgiveness will likely be counted as income and incur a tax bill.

Consistent payments, small wins

Don’t let them ignore their debt. The total number may be huge, or feel that way at least, don’t let them become overwhelmed. The last course of action your child should take is loan deferment. While it sounds great – payments stop during a hardship – it can be very costly. The payments aren’t required, but the interest keeps building.

If you child has several loans, have them focus on the smaller loans. The loans with the lowest balance can be paid off the quickest. These small wins will help them see progress. Typically debt advice suggests paying of the loans with the highest interest rate first. And while that is accurate, it may not be what’s best psychologically for your child. Slow and steady wins the race versus sitting down and stopping.

Preparing for your next chapter

As parents of a college graduate, you can take comfort in the fact that your child has a long career ahead of them. With up to 40 years to work, their earnings growth potential is significant. This is great news for the lenders who are expecting loans to be repaid. Not great news is that you do not have as much time to work and save for retirement. In the next 10 to 15 years, your healthy steady income stream will cease once you retire. Which means you’ll be in decumulation mode – i.e. withdrawing cash instead of saving it. You will need to rely on your life’s savings as your new source of income.

Now is your time. It is important to re-focus on your own financial goals and savings, now more than ever. With adequate preparation, you can ensure that you have the resources necessary to enjoy a comfortable independent retirement. Knowing you can support yourself, without aid from your child, throughout retirement will truly be a gift to yourself (and to them). Don’t compromise your own finances!

Disclosure

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.