Tax saving strategies 2026 go far beyond higher 401(k) limits. For…

TAX SHELTERING AND COMPOUNDING

The American Families Plan that President Joe Biden introduced in late April contains several tax proposals which could have broad-ranging impacts for investors. However, much uncertainty remains about the details and probability of each piece of the proposed legislation becoming law.

Figure 1 outlines several key proposals in the plan. They include an increase in the top marginal tax rate—back to 39.6% for taxpayers earning $1 million or more per year in taxable income, an increase in long-term capital gains tax rates and the forced realization of capital gains taxes at death without elimination of the estate tax.

More specifically, a $6 million estate comprised of all gains that today is completely transferable to heirs would be able to transfer only about $3.8 million to heirs under the new tax regime (not considering any state-level taxation).

Again, it’s still unclear exactly which individuals and what types of assets will be impacted by the new tax policy. Exceptions have already been outlined for family-owned businesses and farms whose heirs continue to run the business.

Additional Details Continue to Emerge

Just recently, for example, further guidance indicated taxpayers should assume any increase in capital gains tax would be retroactively applied to “late last month” (referring to late April when the Biden administration first outlined the plan)—meaning investors hoping to avoid higher capital gains by selling assets now in advance of legislation passing would have no such luck.

So, what are investors, savers and retirees left to do as this debate unfolds in Washington?

That likely depends on several variables, and there is no substitute for speaking with a financial planning or tax professional for help. But certain aspects of the plan are more likely to come to fruition than others, namely some increase in the capital gains rate.

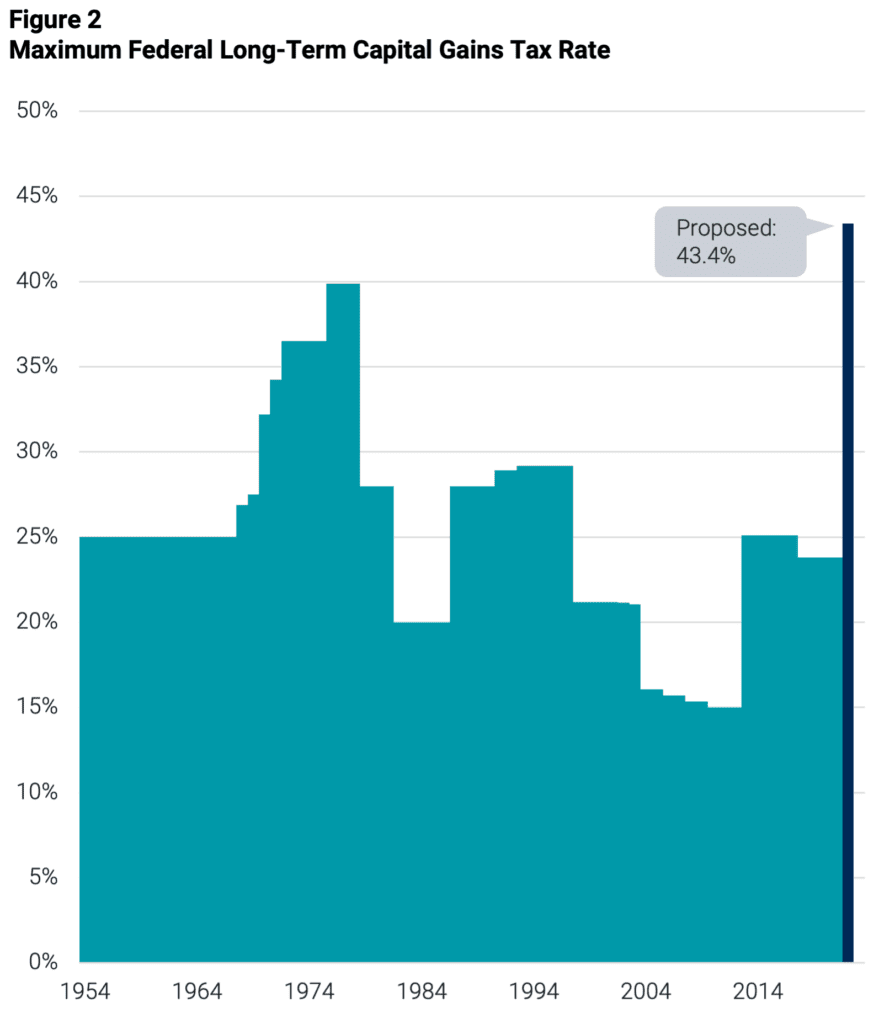

Figure 2 outlines the maximum federal long-term capital gains tax rate in the U.S. back to the 1950s. The current proposal increases it to 43.4% after inclusion of the 3.8% in net investment income tax—a level not seen for several decades. All else equal, higher capital gains realized under such a proposal would mean fewer assets to fund future consumption, retirement or other bequest motives.

In this article, we’ll review some of the tools available to investors to help ensure they are maximizing the potential benefit of tax deferrals in their portfolios and leveraging underlying investment strategies that tend to be more tax efficient.

Tax Sheltering and Compounding

The benefits of compounding are well-known, and this certainly applies inside a tax shelter. The ability to reinvest gains and let them grow produces an accelerated increase in final wealth. For example, the growth of $1 million invested at a 10% annual return and taxed at a 40% rate after 15 years produced 20% higher final wealth than the same $1 million taxed on an annual basis at the same 40% rate, $2.9 vs. $2.4 million.

The fact is, both income and capital gains taxes can detract from a portfolio’s ability to benefit from compounding. Sheltering the portfolio from taxes is a huge benefit and therefore saving inside retirement accounts is beneficial for investors.

The limited annual contribution of 401k/IRA accounts forces most affluent investors to complement their tax deferred retirement accounts with savings for retirement inside taxable accounts and face potential annual taxation on income and capital gains realizations.

https://www.taxpolicycenter.org/statistics/historical-capital-gains-and-taxes

Investors can employ a variety of tools to increase the benefit of compounded growth in a taxable account. These range from clever asset allocations (e.g., locating more tax-efficient assets in the taxable accounts) to tax-loss harvesting activity in an effort to achieve longer deferrals despite realized gains, to using tax-efficient investment vehicles.

Mutual funds and ETFs are the primary commingled vehicles leveraged in taxable accounts.

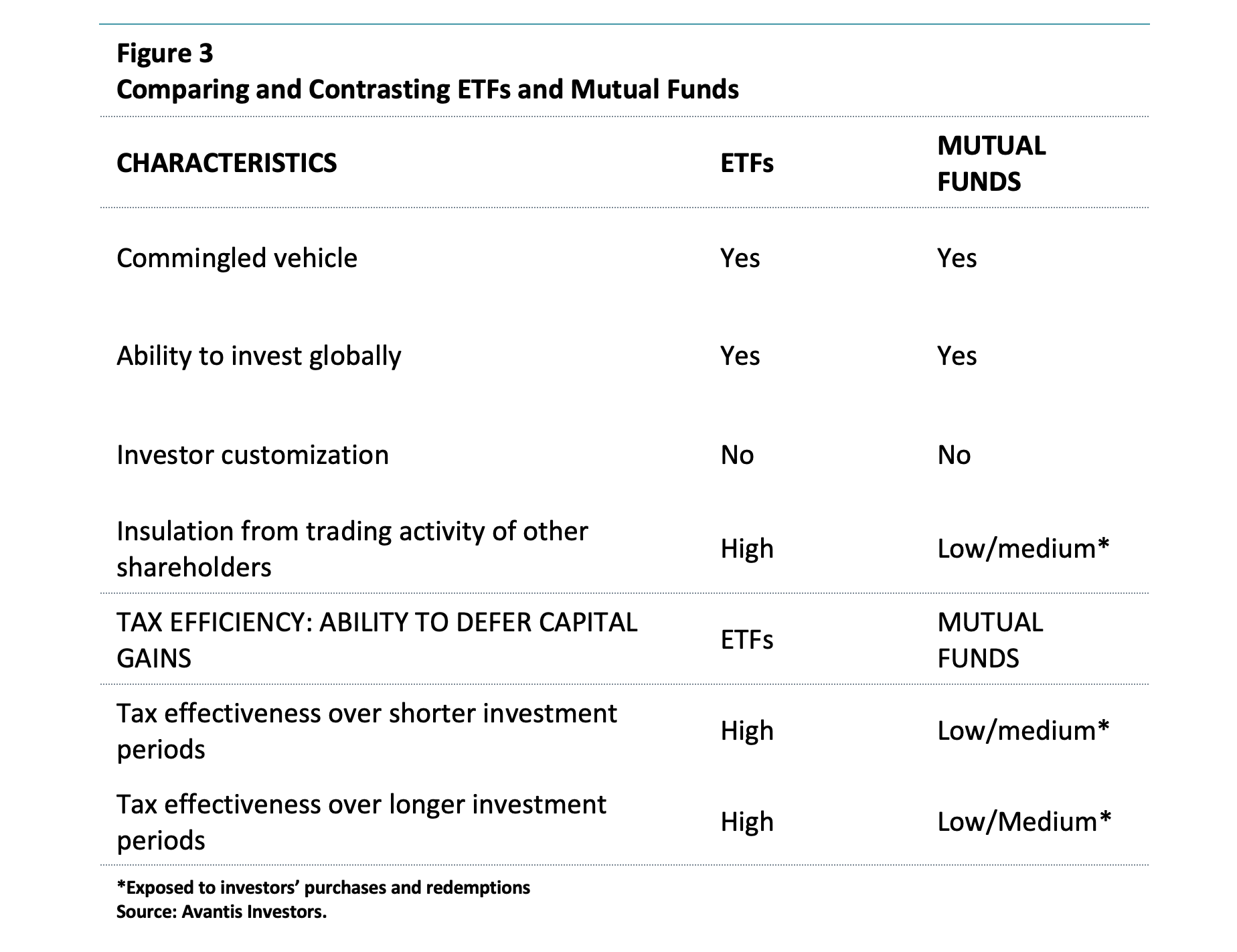

Since capital gains and tax deferrals are the focus of this article, we will focus on the most important differences between mutual funds and ETFs with respect to capital gains. Figure 3 illustrates the similarities and differences at a high level.

Mutual funds and ETFs have an obligation to distribute realized income and capital gains to underlying shareholders, triggering a taxable event. Most mutual fund investors use cash to buy and sell fund shares. For mutual fund portfolio managers, meeting investor redemptions often requires raising cash within the fund. To do this, the managers sell securities, which could cause the fund to realize gains. And these gains are passed along to the fund’s shareholders.

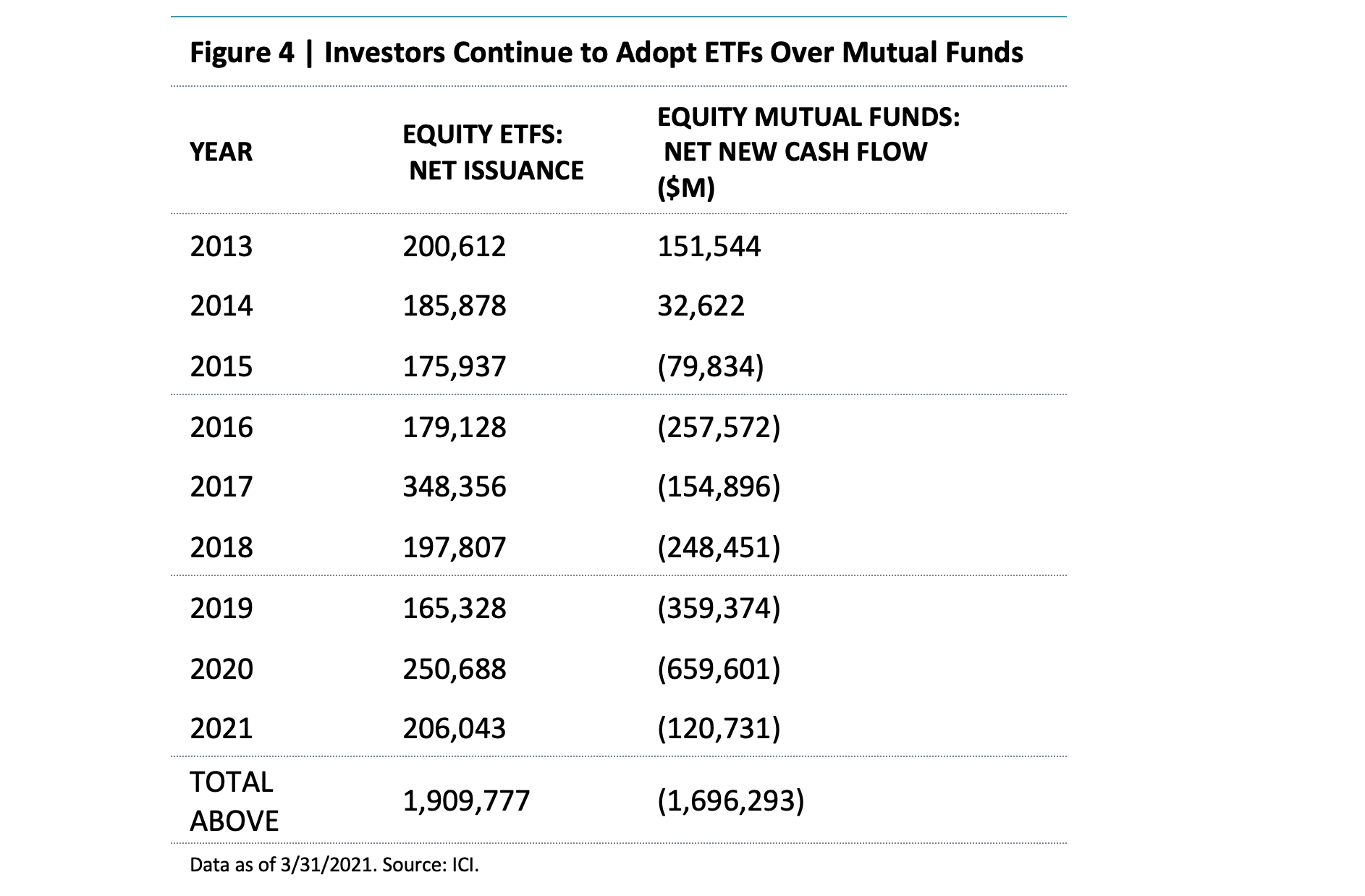

However, in ETFs the exchange of shares by investors often involves market makers, who can create or redeem shares with the investment advisor by exchanging the underlying securities directly, or “in kind.” This create/redeem mechanism means portfolio managers don’t necessarily have to sell underlying securities if an investor wants to sell shares.The ETF structure has continued to gain recognition by investors, as evidenced in Figure 4. Since 2013, equity ETFs have seen more than $1.9 trillion in net inflows while equity mutual funds have faced close to $1.7 trillion in net outflows.This is a block of text. Double-click this text to edit it.

A Plan for Many Paths

Changes to the tax code aren’t new. We can look back in history at the prevailing top federal marginal tax rates and federal capital gains rates as clear examples of this fact. We have seen tax rates increase and subsequently decrease more than once. The old saying about the only two certainties in life being death and taxes carries a fair bit of truth. And when it comes to paying capital gains taxes, it generally means there was a positive return on investment. (There is one exception where, if you buy into an old mutual fund with significant unrealized capital gains, you are taking on a potential future tax liability for gains embedded in the fund you did not enjoy.Regardless of the prevailing capital gains rate, investors and advisors can leverage various vehicles and tools to maximize deferral benefits, benefit from compounded returns and increase the chances of achieving their financial goals.Source: ICI; U.S. Department of the Treasury, Office of Tax Analysis; Richard Rubin, “Biden Budget Said to Assume Capital-Gains Tax Rate Increase Started in Late April,” Wall Street Journal, May 27, 2021.; Avantis Investors. M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees. This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Any stated performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Charts and graphs provided herein are for illustrative purposes only. There are many different interpretations of investment statistics and many different ideas about how to best use them. Nothing in this presentation should be interpreted to state or imply that past results are an indication of future performance. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.