We’ve said before that the most dangerous four words in investing…

The Strong-Dollar Era: Will it Persist?

It’s no secret that over the last 10 years, non-U.S. stock returns have trailed U.S. stocks. However, you might not know that, from the perspective of U.S. investors, non-U.S. market returns over this period have been meaningfully affected by something other than the stocks themselves — the currency effect. The U.S. dollar has been strong and has had a large impact on the returns U.S. investors see in non-U.S. investments. Is the strong-dollar era over?

What is the currency effect?

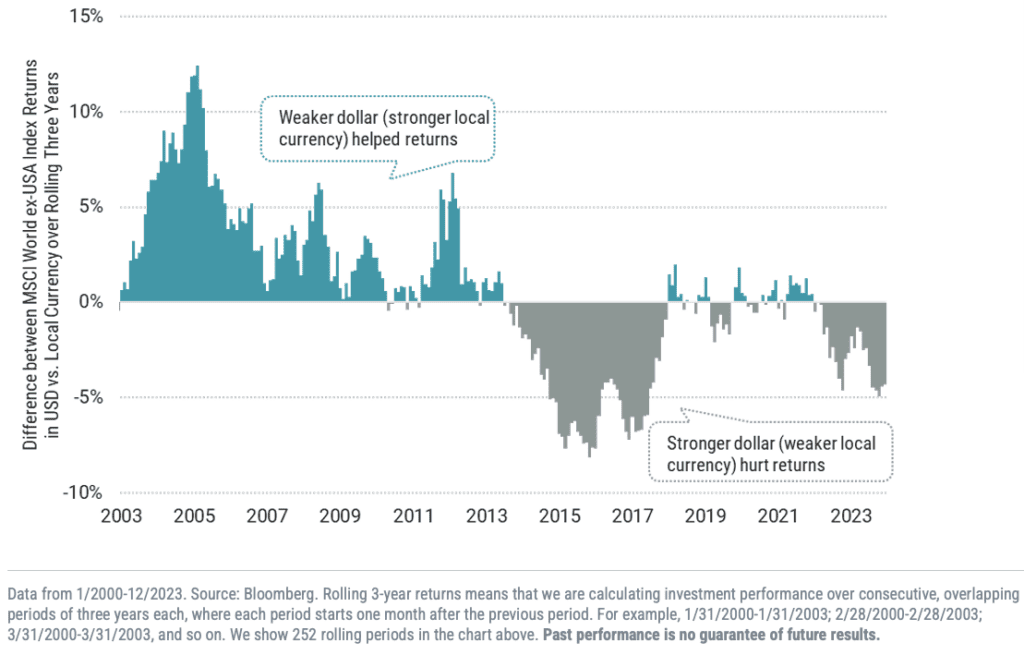

The currency effect refers to the impact that changes in currency exchange rates can have on the total returns of investments. If the local currency appreciates against an investor’s home currency (USD for us), the returns from their investments in that currency will increase when converted back to the U.S. dollar. Conversely, if the local currency depreciates, the returns will decrease when converted back to the U.S. dollar. You can see an example of how the currency effect can both help and hurt U.S. investors in the chart below.

Currency Effects on Non-U.S. Stock Returns

The relative strength and direction of the U.S. dollar affects all investors. As the value of the U.S. dollar fluctuates, global trade can fluctuate, global corporations can see foreign sales rise or fall and U.S. dollar-denominated investors in international markets can see returns increase or decline. Understanding how the dollar might move is therefore important. After years of appreciation, the dollar has swiftly declined, off about 5% from its peak earlier this year. As a result, many investors might wonder: is the strong-dollar era over? And if so, should they change their investment portfolios?

Is the strong-dollar era over?

Differences in interest rates between central banks around the world are important for understanding currency movements. When one country’s interest rates are higher than others, its currency can become more attractive to investors, driving its value up.

In this context, dollar strength makes sense: central bank hiking cycles post-pandemic were, after all, not of the same magnitude. The Federal Reserve took the overnight rate to 5.25 – 5.50% while other central banks hiked with varying intensity. The Bank of Canada (BoC) and Bank of England (BoE) nearly matched the Fed with peak policy rates of 5.0% and 5.25%, respectively. The European Central Bank (ECB) lagged modestly at 4.0%; and the Bank of Japan (BoJ) trailed far behind at 0.25%.

All these countries central banks are adjusting their interest rates at different times and levels. For example, Canada, Europe, and the UK started lowering rates earlier this year, while Japan continues to raise them. The U.S. might continue to cut rates based on future economic conditions. These differences in rate changes, at different times and magnitudes, affect the value of the euro, pound, and yen. While the U.S. dollar might weaken a little, it will happen unevenly across different currencies, which could benefit U.S. companies that sell overseas and investors in foreign markets.

So is the strong dollar-era over? It’s too soon to tell if that’s true compared to all other currencies, since no one has a crystal ball and knows what the different central banks will do. What can investors do to reduce their investment risk if the strong dollar-era is over? Keep reading!

A case for global diversification

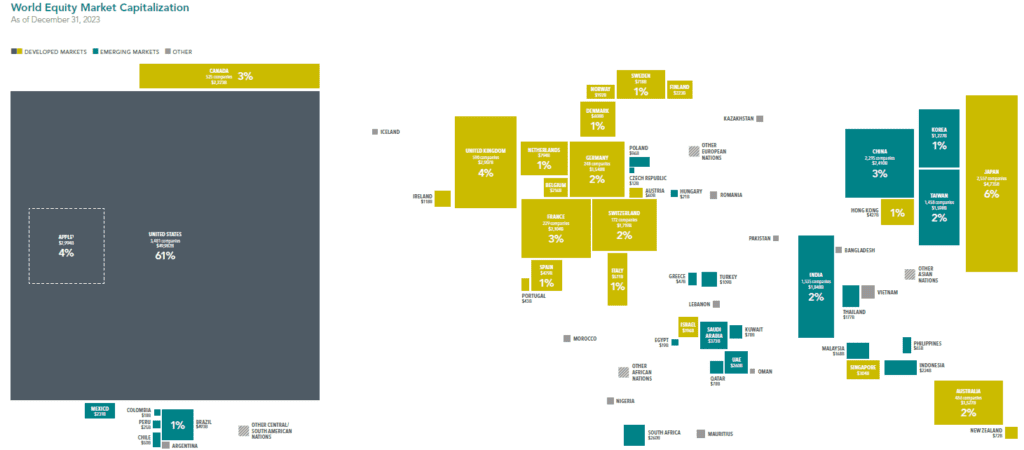

Investing beyond the U.S. markets can offer several benefits, enhancing the diversity and resilience of an investment portfolio. The US stock market is the biggest in the world, but stocks of the roughly 17,500 companies trading outside the US represent almost 40% of the world’s $82 trillion equity market

By investing in non-U.S. markets, an investor may find value from:

- Global growth opportunities

- Emerging markets growth: Emerging markets, like China, India, and Brazil, often experience faster economic growth compared to developed countries.

- Sector leadership: Some countries are leaders in specific industries. For example, European markets have strong pharmaceutical, automotive, and luxury goods sectors, while Japan excels in technology and robotics. Exposure to these sectors can complement U.S. investments.

- Reduced market correlation

- U.S. markets may not always move in the same direction as international markets. For instance, while U.S. stocks might be underperforming, European or Asian markets could be thriving.

- Access to different valuations

- At times, U.S. stocks, particularly in sectors like technology, may be more expensive than their international counterparts. International markets may offer attractive valuations, enabling investors to buy into companies at lower price-to-earnings ratios and potentially achieve better long-term returns.

- Interest rate and inflation differences

- Different countries have varying levels of inflation and interest rates, impacting investment returns differently – as we’ve clearly seen these last few years.

- Exposure to new technologies and trends

- Some international markets, particularly in Asia and Europe, are leading in emerging sectors like renewable energy, electric vehicles, or digital payment systems. Investing internationally provides access to these high-growth opportunities that may not yet be as developed in the U.S.

- Currency diversification

- If the U.S. dollar weakens, international investments denominated in other currencies can increase in value when converted back to dollars, providing a natural hedge against currency risk.

As you can see, there are several reasons why investing outside the U.S. can be good for ones portfolio, even if the strong-dollar era lives on.

Expand your horizons

Whether or not the U.S. dollar experiences a period of reduced strength, the global investment landscape remains diverse and full of opportunities. Currency fluctuations, like the strong-dollar effect, can impact both international and domestic investments. By diversifying globally, investors can take advantage of growth in other regions and reduce risks tied to any single market. The wealth advisors at CAM can help guide you through these changes. We work with clients to ensure their portfolio remains balanced and aligned with long-term financial goals, no matter where currency trends go.

Source Disclosure

- Avantis Investors: Currency Effects on Non-U.S. Stock Returns

- Dimensional Fund Advisors LP: World Equity Market Capitalization. In USD. Market cap data is free float-adjusted and meets minimum liquidity and listing requirements. Dimensional makes case-by-case determinations about the suitability of investing in each emerging market, making considerations that include local market accessibility, government stability, and property rights before making investments. China A-shares that are available for foreign investors through the Hong Kong Stock Connect program are included in China. 30% foreign ownership limit and 25% inclusion factor are applied to China A-shares. Many nations not displayed. Totals may not equal 100% due to rounding. For educational purposes; should not be used as investment advice. Data provided by Bloomberg.

CAM Disclosure

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.