We’ve said before that the most dangerous four words in investing…

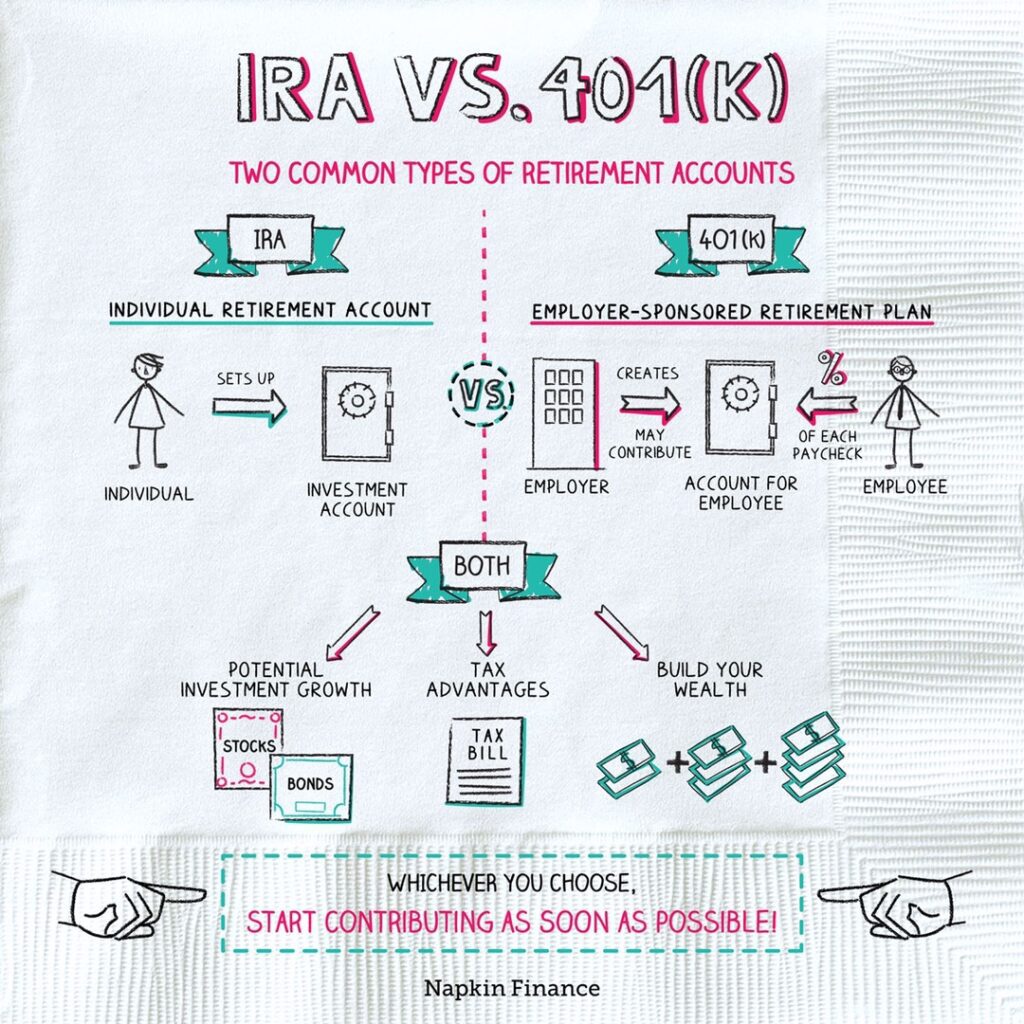

Where to Save Money for Retirement

By the time you graduated high school you probably had already opened your first bank account, or at least knew of the two main types – checking and savings. These accounts are good and necessary for your day-to-day, but not ideal to grow your cash long-term. By the time you started your first job, did you know all the different types of investment accounts that are available to you, especially ones that will help you save for retirement? What are their differences and why should you use one over the other? Let’s dive into the most common options and which one may be the right for you.

Most Common: Employee Offered 401(k) or 403(b)

Many employers offer retirement savings plans, such as 401(k)s and 403(b)s, to employees. If you choose to participate, a portion of each paycheck will be automatically sent to your retirement plan, pre-tax. This can help reduce your tax bill now by lowering your taxable income on your W-2. You will, however, have to pay taxes when you pull the money out in retirement. If you have a workplace retirement plan that offers to match any contributions you make up to a certain percent, you should highly consider contributing at least that much to get your employers match. We like to call this “free money” and it can help grow your retirement funds even if you can’t contribute the full allowable IRS limit. In 2022 the maximum an individual can contribute is $20,500 per year ($27,000 per year if you’re over 50). What many people don’t realize is that your employer contributions can go well beyond these limits, up to a total contribution (employer + employee) of $61,000 for 2022 ($67,500 if you’re over 50). There are some age restrictions that should be evaluated before using your 401(k) or 403(b) as your sole retirement plan. You cannot touch the money without a penalty before age 59 ½ and you HAVE to start taking money out by age 72, annually. These limitations can be a burden if you retire early or force you to take unnecessary cash out over age 72, that will then be taxed.

There are Others: The Traditional IRA & Roth IRA

You don’t have to pick just one account – a 401k or an IRA. You can contribute to both a workplace retirement plan and an individual retirement account (IRA) at the same time. If you’ve maxed out your 401(k) or you don’t have a retirement plan at work, consider a Roth or Traditional IRA. Everyone with earned income is eligible to have their own IRA, even a stay-at-home spouse is eligible if the couple files taxes jointly. The primary difference between the Roth and Traditional are when you pay taxes. A Roth has no tax benefit now, but is tax free on the way out at retirement. A traditional IRA may be more beneficial if you need the tax deduction today and are willing to pay taxes on the distributions later. The contribution limits to these accounts are much lower – $6,000 annually ($7,000 over age 50) and the Roth IRAs are limited based on your income. You can only contribute to a Roth IRA if your income is less than $144,000 if you’re single and $214,000 if married filing jointly in 2022. It is great to start contributing to Roth IRAs when you’re younger, before you earn too much. This also gives your money the longest to grow tax free! Both Roth and Traditional IRAs have the same age restrictions as the 401(k)s and 403(b)s. It is always important to review your eligibility and tax benefits of IRAs with a CPA or your financial advisor to determine what the best options are for your financial situation.

Taxed but Flexible: Brokerage Accounts

What type of investment account has the most flexibility with no age restrictions on when you can take money out, or requires you to withdraw money by a certain age? Taxable brokerage accounts! The most common brokerage accounts are for an individual, a couple as a joint account or a Trust. While you do have to pay taxes on income, dividends, and capital gains in these accounts each year they are opened, they allow you to control when and how much to withdraw. This flexibility allows you to control your cash flow during retirement. When you are forced to take income from social security, a pension, a 401(k) or 403(b), and/or an IRA, your annual income can quickly rise above the tax bracket you would like to be in, and you may not even need all that “forced” income. By diversifying where you’re saving cash for retirement, a brokerage account should be part of your portfolio of accounts.

So What’s the Right Retirement Account?

If your employer offers a retirement account, you should start there. If you have maxed out your contributions to that account, or just want to have more control of your investment options, an IRA and/or Roth IRA are the next accounts you should open and fund. Last but not least, a brokerage account should be considered to add some diversification for future cash flow and can provide you with income if needed before age 59 ½, penalty free.

If you’re self-employed or a business owner, don’t worry – there are a number of different retirement accounts that will help you and your employees save in a tax efficient manner for retirement. You can find out more about these accounts – SEP IRA, Solo 401(k), SIMPLE IRA and Profit Sharing – in our next blog post.

No matter which account you choose, the key is to choose one now and start investing today. How much should you contribute? Aim for a total savings of at least 10% of your gross income. Have questions about what you should be investing your retirement cash in? Feel free to schedule a free consultation with us to discuss your retirement goals and investments.

Source: Napkin Finance. M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees. This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.