Weight Watchers, the iconic American health and wellness giant, filed for…

Which Country Will Outperform? Here’s Why It Shouldn’t Matter.

Investment opportunities exist all around the globe, but the randomness of global stock returns makes it exceedingly difficult to figure out which markets are likely to be outperformers. How should investors deal with this kind of uncertainty?

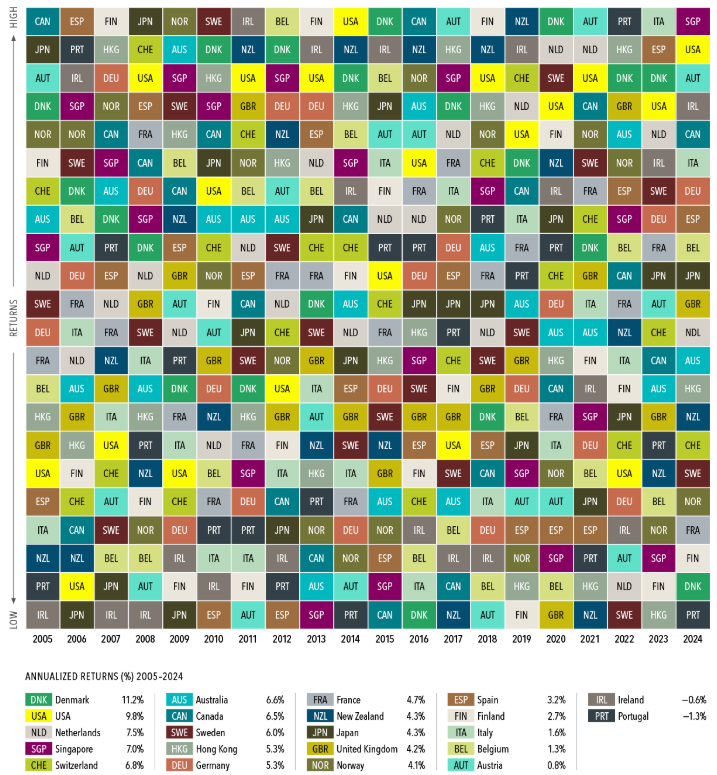

First, they should remember that it’s challenging, at best, to predict a country’s returns by looking at the past, as shown by the performance of global markets since 2005 (see Exhibit 1). In the past 20 years, annual returns in 22 developed markets varied widely from year to year. (Each color represents a different country, and each column is sorted top down, from the highest-performing country to the lowest.)

Most Favored Nations

In USD. MSCI country indices (net dividends) for each country listed. Does not include Israel, which MSCI classified as an emerging market prior to May 2010. MSCI data © MSCI 2025, all rights reserved.

Past performance is not a guarantee of future results.

Two examples help make the point well:

• New Zealand posted the highest developed markets return in 2019—but the lowest in 2021.

• The US ranked in the top two for annualized returns over the entire 20 years but finished first in the country rankings just once over that period. In eight calendar years, it was in the lower half of performers.

Investors can benefit from understanding that they don’t need to predict which countries will deliver the best returns during the next quarter, next year, or next five years. Why? Holding equities from markets around the world—as opposed to those of a few countries or just one—positions investors to potentially capture higher returns where they appear, and outperformance in one market can help offset lower returns elsewhere. Put another way, a globally diversified portfolio can help provide more reliable outcomes over time.

Have questions about your own investments and what you hold? We’d be happy to discuss your investments and ways to help prepare for various market environments.

CAM Disclosure

SOURCE: Dimensional Fund Advisors, LLC

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.