Looking back at the market or stock "winners" makes it seem easy to predict the future winners. But how easy is it really?

Will the presidential election impact the stock market?

With news headlines constantly covering every aspect of the presidential race, you may be wondering how the 2024 election may impact you and your finances. After all, every four years, uncertainty about the next president and their economic policies can lead to more uncertainty in the minds of investors.

The long and short of it is you may care passionately about who wins, but your investment portfolio probably doesn’t.

What the data shows

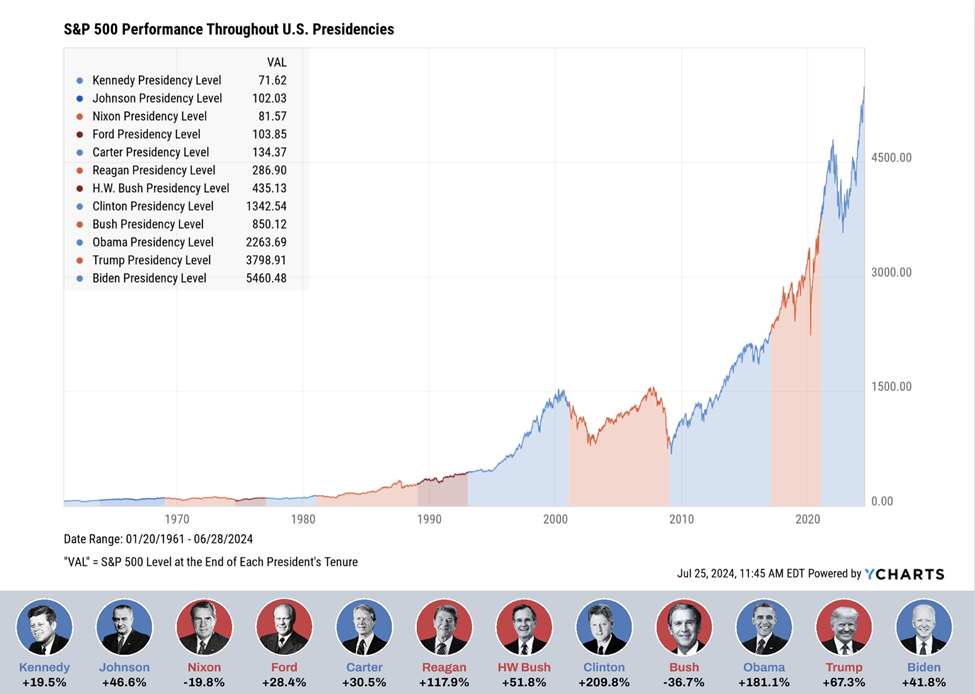

As this chart shows, while the stock market has fluctuated under the leadership of both parties, the S&P 500 Index1 has trended higher over the long term, no matter who’s in office. The trend suggests that the stock market’s performance may have more to do with the overall strength and resiliency of the U.S. economy rather than the person who sits in the Oval Office.2

What actually impacts the stock market?

- Long-Term Trend: Historical data shows that the stock market has generally trended higher over time, regardless of which party holds the presidency.

- Company Growth: Many successful companies were founded and flourished under various administrations, contributing to overall economic strength.

- Market Priorities: Factors like earnings growth, economic trends, and technological innovations typically influence the market more than political shifts.

- Investor Focus: Remember, when you invest in the stock market, you’re investing based on your time horizon, risk tolerance, and specific goals—not specific political outcomes.

Stay focused

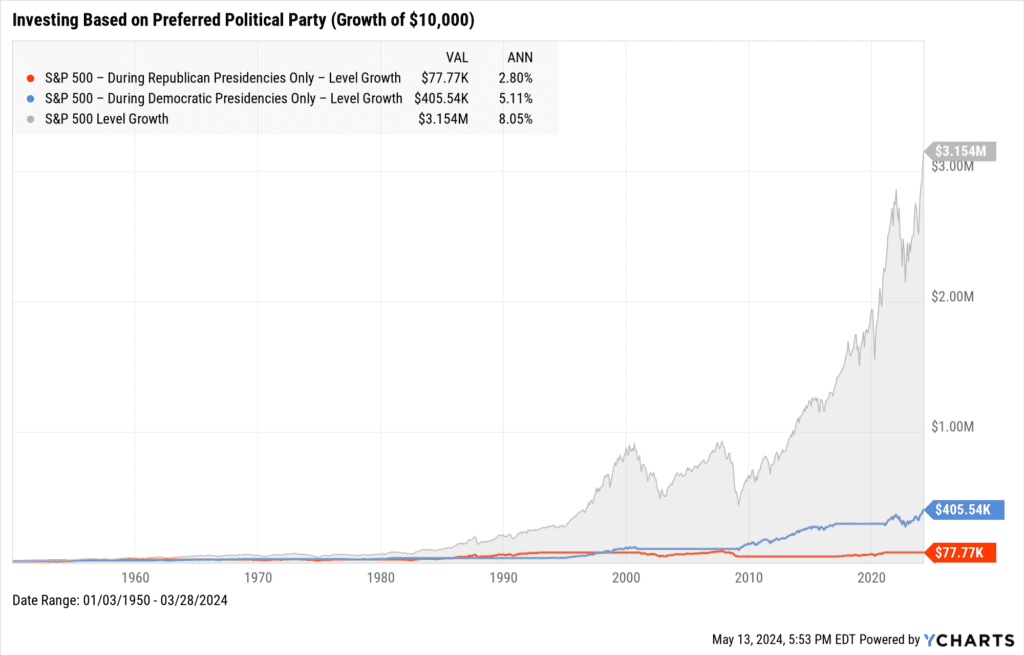

A presidents impact on the economy is more like a slow moving glacier than a 200m sprint. It can take many years for a presidents policies to have an impact on the economy, which then may have an impact on the stock market. So moving your investments in and out of the market into cash based on which party holds the presidency, has not proven a winning strategy – as shown the in chart below.

The parties occupying the presidency and Congress are just one of many variables that can impact investments. For example, the 2008 Great Financial Crisis created market risk for Presidents Bush and Obama, while the global pandemic in 2020 impacted the market beyond the control of Presidents Trump and Biden.

The most important takeaway: Elections often create some short-term uncertainty, so it’s best to prepare for some volatility over the next few months. But don’t allow unexpected price swings influence your overall approach. Need help staying on track with your investments or to tune out the media? We’re here to help our clients with every day questions and concerns. Give us a call or schedule time to meet.

CAM Disclosure

1 Stocks are measured by the Standard & Poor’s 500 Composite Index, an unmanaged index, an unmanaged index considered representative of the overall U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. Stock price returns and principal values will fluctuate as market conditions change. Shares, when sold, may be worth more or less than their original cost.

2 Charts – Ycharts

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.