Tax saving strategies 2026 go far beyond higher 401(k) limits. For…

Year-End Deadlines to Know

December seems so far away, and then all of a sudden it’s here – and it’s a whirlwind. Before we close in on the final days of 2022 and put our Out of Office notices on, there are a few deadlines you won’t want to miss. Consider making these 6 money moves so you can enjoy your holidays and set your finances up well for the new year.

1. “Use it or lose it” FSA money

Who doesn’t love to see a full healthy bank account? FSA accounts are meant to be spent so by December 31st, they should be empty and ready for the new year. Don’t forget to use this account because you may lose your hard earned and saved money if it’s not spent by the end of the year.

There are 3 different types of FSAs: health care FSA, limited purpose FSA that is compatible with a health savings account (HSA), and the dependent care FSA.

Sometimes a portion of the amount saved may be rolled over for the next year, usually to be used by the end of the first quarter. But in general, you must spend your FSA funds before December 31st or else the money is lost. Get those receipts submitted or pull out cash to reimburse yourself.

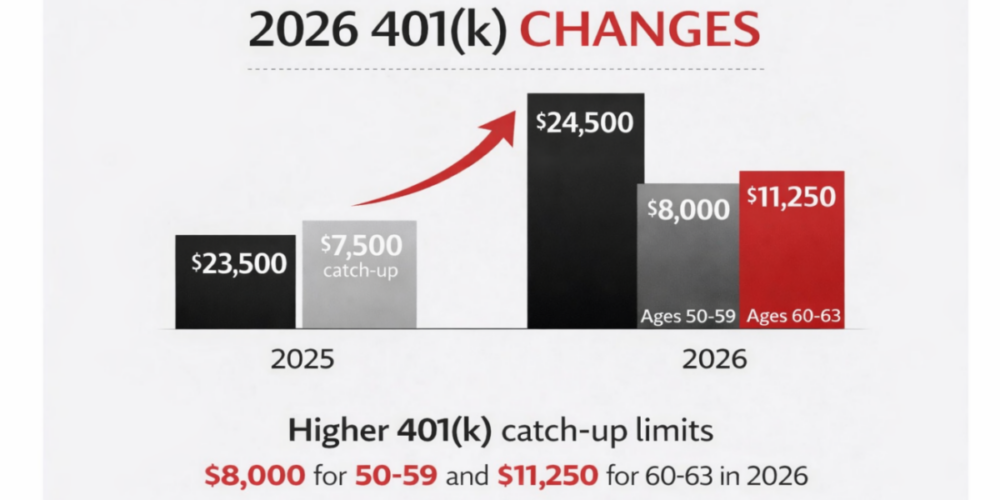

2. Contribute to your 401(k)

Some account types like IRAs and HSAs allow contributions for the past year until the tax-filing deadline in April. However, for HSAs, waiting until April may mean making a contribution outside of payroll deductions, potentially incurring FICA taxes that could have otherwise been avoided if the contribution had been made by December 31 of the previous year. Other types of retirement accounts like 401(k)s have clear deadlines at the end of the year.

In 2022, you can contribute up to $20,500, or $27,000 if you’re over age 50, to a 401(k).

If you get a year-end bonus, you may be able to direct some of it into your workplace retirement plan.

3. Consider harvesting investment losses

Tax-loss harvesting allows you to sell investments that are down, replace them with reasonably similar investments, and then offset other realized capital gains with those losses. The end result is that less of your money goes to taxes and more may stay invested and working for you.

An investment loss can be used for 2 different things:

- The losses can be used to offset investment gains

- The losses can offset up to $3,000 of ordinary income annually on a joint tax return

Unused losses can be carried forward to future tax years.

In order to put investment losses to good use, you’ll need to harvest your losses before December 31st.

4. Planning a Roth conversion?

The end of the year is the deadline for completing a Roth conversion for the 2022 tax year. While the last business day is December 30th, many banks are pretty swamped with these request. We advise you submit your paperwork as soon as possible to ensure your conversion is completed in 2022.

The silver lining of the market being down in 2022 is that now may be the right time for a roth conversion. That’s because the tax bill created by converting to a Roth is based on the amount converted. With stock prices down, the same number of shares may be converted for less money than it would have cost last year.

5. Charitable contributions may lower your tax bill

If you itemize your taxes, you can deduct charitable donations to qualified organizations from your taxes. In general, you can deduct up to 60% of your adjusted gross income (AGI) for cash donations, per IRS rules. For donations of appreciated securities, you may be able to deduct 30% of your AGI.

To make sure you’re able to get the deduction for your 2022 taxes, contributions must be made in 2022. Further rules may apply based on the charity you are donating to, any elections you make, and your personal tax situation.

If you don’t itemize your taxes you may be able to get a deduction with a strategy called bunching. That means concentrating deductions in a single year, then skipping one or even several years of future donations. This strategy can work well when your total itemized deductions for a single year fall below the standard deduction: Charitable contributions for several years made at once may allow the total of itemized deductions to exceed the standard deduction, making it possible to obtain a tax deduction for at least part of the charitable contributions. The catch is that this strategy requires having the financial capacity to pack more than a year’s worth of your donations into a single year.

6. Remember RMDs if you are 72 or older

A required minimum distribution (RMD) is the mandatory withdrawal from qualified retirement plans like traditional IRAs that start once you reach age 72. Your first RMD deadline is April 1st in the year after you turn 72. All subsequent RMDs must be taken by December 31st. Missing those deadlines can be costly with a 50% penalty on withdrawals not taken.

Note that if you delay your first RMD until April, you’ll have to take 2 RMDs your first year—and pay taxes on them. The first will still have to be taken by April 1st; the second, by December 31st.

Any time is a good time to start planning

We get it, there is a lot to do this month and these steps may not rank as high on your to-do list. And that’s okay! If you don’t make this year’s deadline for some of these tasks, you may have a chance to do it next year. Need help getting started? We’re here to help determine if any of these moves or other planning steps could benefit your bottom line.

Source: Fidelity

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.