When last we left “As the Stock Market Turns” in early…

The Psychology of Investing

When the time doesn’t seem right…..

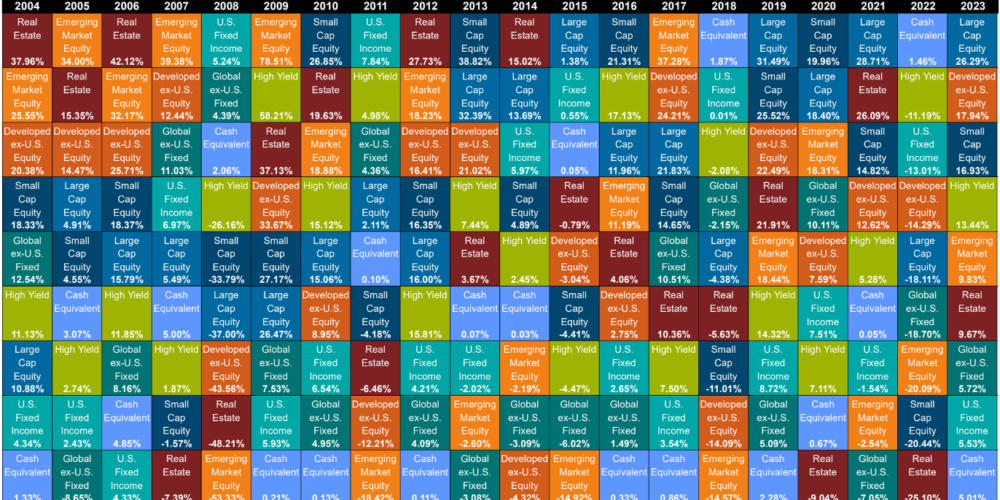

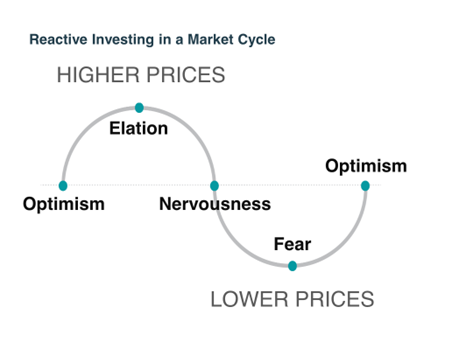

We see the cycle repeat itself over and over again: When the market has been up for several months or years, investors are trying to figure out how they can make even more money and capitalize on the big returns. In the psychology of investing, this is known as the elation reaction. Diversification for many investors tends to become the enemy and the ubiquitous ‘Greed is Good’ will show itself. Some investors often pile into high risk investments, with the intent of making fast money or at least accelerating their returns.

Markets will cycle though, and at some point we will see the trend shift. Call it what you will, a bear market, downward cycle, risk off,or correction, this market cycle never feels good. At this point we see investors starting to feel stressed, wondering if this is temporary or here to stay. Sometimes those bear markets move into a recession. This is when we see investors start to panic and fear set in.

Once we hit fear, many investors may begin to look at how they can protect themselves. They might be searching for more conservative investments and a way to move out of the investments that provided those higher returns for them in the past.

What investors effectively do during this process is buy high and sell low. This is not an efficient way to invest or to reach your goals, but we continue to see it again and again when investment decisions are based on emotions. The mindset is that investors are losing everything they gained and by sticking with their current strategy, it can feel like they are accepting losses. However, the reality is if they have a diversified portfolio and the proper investments in their portfolio, these cycles are just the normal path of progress. Doing nothing can actually be doing something. Soon the market will adjust again, everyone will forget about the drop in value because we will be reaching new market highs and the cycle will continue.

From a micro perspective, it can be hard to see shorter term losses as anything but a sure way to lose money. If investors can recognize the path to success is sometimes two steps forward and one step back, they will see they are still ahead even if they aren’t capturing as much of a gain as they initially thought. Markets aren’t meant to keep up that rapid pace. And the more risk you are taking, the more your investment balance will swing through these extreme returns both positive and negative.

As you must prune a tree or bush so that it may flourish and grow, so must the markets be pruned so that they may grow.

At its high, the S&P 500 was trading around 1500 in 2007. When the great recession hit, it dropped to a low of around 750. At the time things felt bleak and people worried they bought at the wrong time or that their investments would never return. Making an emotional decision then would look like selling and moving to cash until ‘things settled down’. But now, even with the market decline we have seen year to date, the S&P is trading around 3600. This is definitely a long game.

The way to navigate markets like these can be done in the following steps:

- Make a financial plan. It is a lot easier to create an investment strategy when you know what you are investing for.

- Decide how much risk or volatility you are willing to handle. If you aren’t comfortable with some of the downside that can come with the investments, you may not be suited for high growth or speculative investments.

- Be sure your investments fit into your portfolio style and reflect what you need. This should not be a cookie cutter approach.

- Once you establish a diversified portfolio, stick with that strategy. Just like the tortoise and the hare – what seems to be slow may actually be the key to winning the race.

Whether you decide to do this on your own or hire a fee-only financial advisor to help you, keeping our emotions in check and sticking to a plan allows you a higher likelihood of success and less rides on that emotional roller coaster.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees. This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.