Tax advantaged investment strategies are becoming a priority for high-net-worth investors…

Lessons Learned from Silicon Valley Bank

For some, the bank troubles of the past few weeks have brought back memories of 2008-2009. And while recent events are concerning, there are some key differences between the housing issues that caused the downfall of Lehman Brothers and what seems, at least for now, a more manageable problem at two regional banks beset by what appear to be questionable internal decision-making and risk controls.

For example, Silicon Valley Bank (SVB) didn’t follow a basic tenet of finance–matching assets to liabilities. SVB was invested in longer-duration treasury securities and could not manage short-term demands when customers started pulling their funds from the bank.1

SVB catered to venture capital technology companies in Silicon Valley. The Fed’s series of interest rate hikes in 2022 but the bank’s long-term bond holdings. SVB disclosed a $1.8 billion loss after completing a $21 billion sale of its fixed-income portfolio, and regulators closed the bank while they sorted out the entire deposit situation. This was the second-largest U.S. banking failure ever.2

So what lessons can we glean from these recent events? How can we ensure this doesn’t happen again to other banks? There are several take-aways we’ve learned from this SVB event that can also be applied to your own businesses or investment portfolios.

Lessons Learned

- Diversification: this may truly be the only “free lunch” out there. Silicon Valley Bank was a niche bank that only catered to the needs of the technology industry. The bank’s over-reliance on this industry proved to be its downfall. By diversifying, banks can avoid losing their entire customer base if one industry fails. It is essential for EVERYONE to diversify their portfolio to minimize risks.

- Risk Management: Silicon Valley Bank was known for taking big risks on untested ideas and startups. Although this strategy led to significant growth for the bank, it also led to a huge loss when the startups failed. Having a risk manager in place to monitor and safe guard is crucial for long-term success.

- The Latest Technology: Silicon Valley Bank was slow to adapt to the changing technological landscape, and this proved to be one of the reasons for its downfall. We all need to ensure we’re using the latest and greatest for tech security, investing and processes. Being open to and accepting change must be an integral part of ones plan.

The CAM Approach

Our investment philosophy is to not be complacent and instead seek to always capture opportunities for our clients as they present themselves. This does not mean we are trying to make aggressive portfolio changes when volatility is at its highest. Instead we chose to temporarily step back from rebalancing or any heavy trading. This is not market timing or forecasting, but it is a critical part of our process as well as what we’ve learned over the years from experience (similar to March 2020, 2009, or even 2001).

What this means is that while some asset managers and advisors may look to debate what will happen next or even turn overly defensive, we look to a more proactive approach that can best compensate our clients for the risks they take.

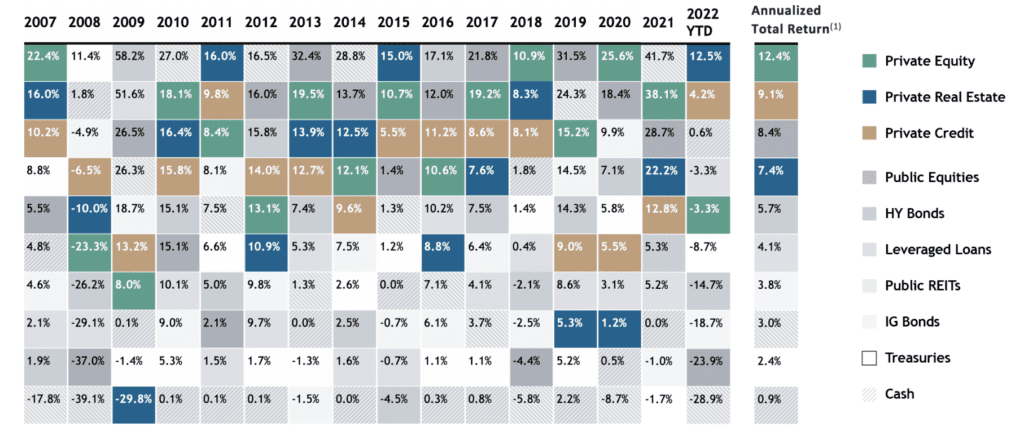

We look for investment opportunities that are not experiencing the volatility that the market may be enduring. Investments that are uncorrelated that can add stability, while rewarding investors at the same time. Data, like below, shows that opportunities in the private markets should not be overlooked or ruled out.

Annual Returns of Key Indices, Ranked in Order of Performance

(2007-Q3’2022)

There has been a surge in demand for private credit lending, which surpassed traditional bank lending for the first time in 2022. This demand is expected to continue, especially in light of the recent regional banking issues. Should interest rates remain high, or go higher, private credit strategies are expected to benefit given many have a floating rate structure and are already returning equity-like performance.

Providing diversified portfolios, across asset classes and globally, that incorporate risk management plans is fundamental to what we do for our clients. And utilizing the most current technology helps us ensure we’re able to implement these investments for our clients efficiently.

Market volatility and banking system uncertainty can test the mettle of the most seasoned investor. So if you hear or read anything that causes you some concern, please do not hesitate to reach out to us. We look forward to hearing from you.

Sources: 1 BusinessInsider.com, March 10, 2023; 2 Forbes.com, March 13, 2023;

3 Bloomberg and Preqin, as of 9/30/2022. Represents total returns for the respective calendar year, ranked in order of performance. Annualized total return is calculated over the period 1/1/2007 to 9/30/2022. Asset classes presented are based on the following indices: Preqin Private Equity Quarterly Index for “Private Equity”, S&P 500 Index for “Public Equities”, NCREIF ODCE Index for “Private Real Estate”, Cliffwater Direct Lending Index for “Private Credit”, Bloomberg U.S. Corporate High Yield for “HY Bonds”, Morningstar LSTA US Leveraged Loan Index for “Leveraged Loans”, Bloomberg U.S. Corporate Bond Index for “IG Bonds”, MSCI US REIT Index for “Public REITs”, Bloomberg U.S. Treasury Bill 1-3 Month Index for “Cash”, Bloomberg U.S. Intermediate Treasury Index for “Treasuries”.

Past performance is not necessarily indicative of future results. There can be no assurance any alternative asset classes will achieve their objectives or avoid significant losses. The volatility and risk profile of the indices is likely materially different from that of a fund. The indices employ different investment guidelines / criteria than a fund and do not employ leverage; a fund’s holdings and the liquidity of such holdings may differ significantly from securities comprising the indices. They aren’t subject to fees / expenses, and it may not be possible to invest in the indices. The indices’ performance has not been selected to represent an appropriate benchmark to compare to a fund’s performance, but rather is disclosed to allow for comparison to that of well-known and widely recognized indices.

A summary of the investment guidelines for the indices are available upon request. In the case of equity indices, performance of the indices reflects the reinvestment of dividends. The indices are not necessarily the top performing indices in the given asset class and recipients should consider this when comparing the performance of any fund or investment to that of the indices.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.