For years U.S. investments have outperformed non-U.S. investments. This is due in large part to the "strong-dollar era". Is the era over?

The US Dollar – Where does it stand?

The US dollar has long been the world’s most widely used currency. It plays a critical role in global trade and as a store of value for central bank reserves. But we occasionally hear claims that the dollar’s dominance may be in jeopardy. Recent headlines have lead some to question: “Should I be concerned about the value of the US dollar and investing more in BRICS countries?”

The headlines

Brazilian President Luiz Inácio Lula da Silva is creating headlines by supporting a proposed partnership with other emerging markets like India and China to form a unified trading currency. This would help the so-called “BRICS” countries (Brazil, Russia, India, China, South Africa) depend less on the US dollar. At the same time, domestic concerns about the US dollar’s outlook have mounted in anticipation of Fed policy aftermath. Some may be wondering whether it would be a good time to tilt their exposure towards the “BRICs” and away from the US.

This is a good opportunity to remind investors that there is no historical evidence of predictability for short-term currency movements. In turn, currency movements are not reliable predictors of future domestic or international equity returns. Currency hedging can help reduce volatility in fixed income but does not in equity markets.

Regressions show no relation between annual returns on the S&P 500 (gross dividends) and change in the dollar in the previous year. And it’s not just the S&P. It’s the same story for the MSCI World ex USA Index. Additionally, from the time period 1970–2014, the dollar depreciated against developed markets currencies by only 0.88% per year on average, with an annual standard deviation of 8.6%. For more information, please see Fogdall and O’Reilly, “Currency Returns and Hedging Decisions”.

Investors can benefit from understanding that they don’t need to predict which countries will deliver the best returns during the next quarter, next year, or next five years. Why? Sticking to a globally diversified portfolio over time positions investors to potentially capture higher returns where they appear. Additionally, outperformance in one market can help offset lower returns elsewhere.

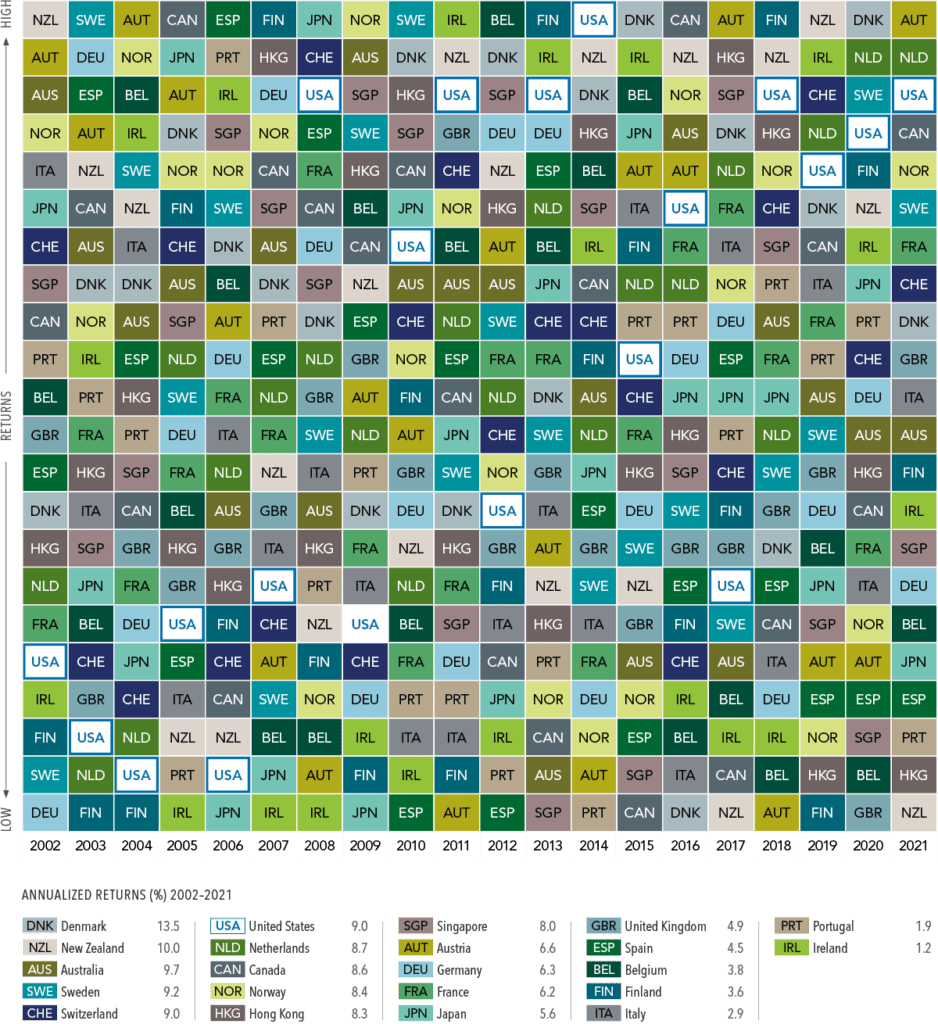

Put another way, the randomness of currency movements and global stock returns are hard to predict. Just look at the performance by country each year (Exhibit 1). See any patterns? We don’t.

Past performance is not a guarantee of future results

Global currency usage

Now that we’ve seen we cannot predict the performance of any given countries currency from year to year, let’s look at another way to address the question. What currencies are being used globally and how has that trend changed over time?

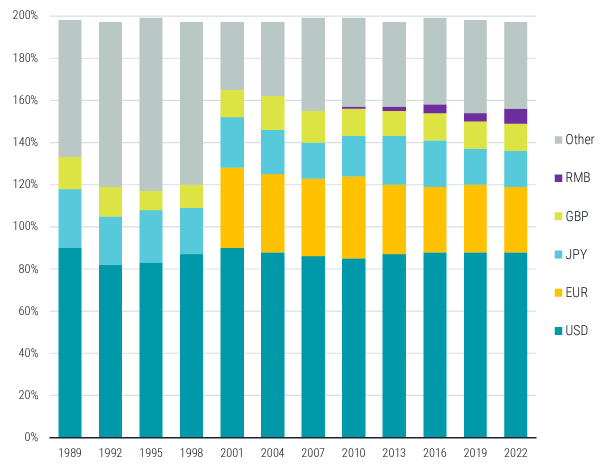

In Exhibit 2 we examine the usage of the US dollar by looking at the makeup of foreign exchange transactions by currency.

Because there are two sides to a foreign exchange transaction (i.e., the currency bought and the currency sold), totals for each period sum up to 200%. What stands out is that the dollar’s participation in foreign exchange transactions remained remarkably stable from 1989 to 2022. Neither the euro’s introduction in 1999 nor the growth in usage of China’s renminbi (RMB) had a noticeable effect on the dollar’s share over time. The stability of the US dollar in foreign exchange transactions comes from the outsized role it plays as a medium of exchange in global trade and payments.

In conclusion

So should you be worried about the value of the US dollar? From the data we can see that first off, we cannot predict currency performance for any given country from year to year. And second, the US dollar usage remains strong and constant. Therefore, the answer is – we don’t see the US dollar being replaced by another global currency any time soon.

What the future holds remains to be seen, but today the dollar’s role in the global economy remains unrivaled. Creating a well-diversified strategy and sticking to it can produce more reliable outcomes over time with less stress whenever global leaders or the Fed are in the headlines.

Disclosure

Exhibit 1 source: In USD. MSCI country indices (net dividends) for each country listed. Does not include Israel, which MSCI classified as an emerging market prior to May 2010. MSCI data © MSCI 2021, all rights reserved.

Exhibit 2 source: Data from 1989 to 2022. Source: Triennial survey of turnover of OTC foreign exchange instruments by currency. Survey is conducted for the month of April of each year. Results may be less than 200% due to rounding.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.