Tax advantaged investment strategies are becoming a priority for high-net-worth investors…

Graduates – Let the Compounding Commence!

Every year, families and friends celebrate students who are graduating from colleges and universities. Parents beam with pride at their children’s accomplishments and exhale in relief now that the tuition bills have finally stopped. It’s a time when adults give a lot of advice, which is why we have one simple idea we want to pass along to this year’s graduating class that I hope you never forget. Parents, take note too, because with college out of the way, you can get back to focusing on retirement.

Let the compounding commence!

In case you didn’t come across this idea in an economics class, here are the basics of compounding. It’s the process by which the value of an investment increases over time as earnings or interest are reinvested. It’s the snowball effect but with money. Here’s an example.

If you’re a US investor and lucky enough to have up to $35,000 left over in your 529 college savings plan, you can roll it over into a Roth IRA starting in 2024, provided the account has been open at least 15 years.1 If you don’t touch that $35,000 for 50 years, and the market averages a 10% annualized return (which is close to its long-term historical average) – guess how much you’ll have?2

A. $1,584,074

B. $2,551,167

C. $4,108,680

The answer is C. Over $4.1 million!

If you were to start this in your mid-20s and invest that same initial amount for only 45 years, you’d end up with B, or $2.6 million. That’s great, but not as great as C.

If you do it for 40 years, you’ll end up with A, or $1.6 million. Also good, but not even close to C.

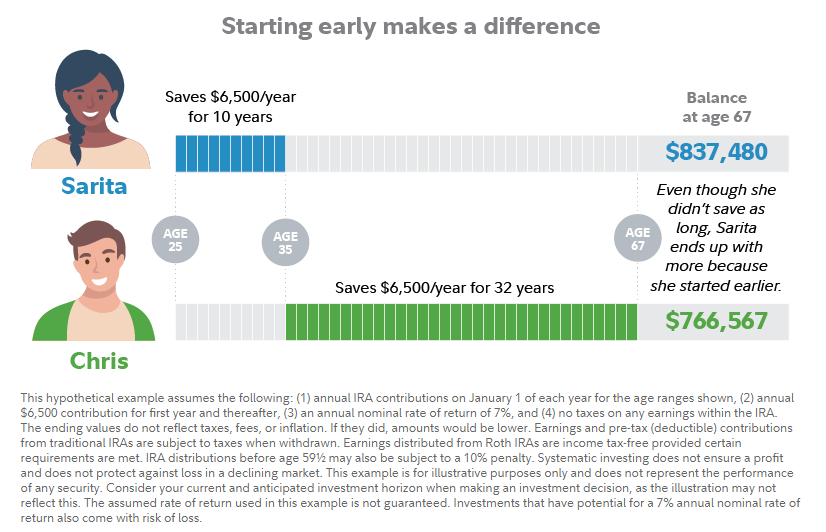

Another benefit of compounding is that it can help you pursue financial goals along the way, like making a down payment on a home. But don’t worry if you spent your whole college fund or took out student loans. Start with a little and get in the habit of adding when you can. As you can see from this snowballing, having a lot of time can help make up for not having a lot of money. As shown in the image below, the key is to start EARLY, no matter how much you’re able to start with.

In addition to increasing the value of your investments, compounding can also be a valuable force in life. For example, you’ve made an investment in time and money over the last few years that may have an enormous effect on the rest of your life. How much money are we talking about? College graduates, on average, earn 84% more than those with a high-school education, and that adds up to an extra $1.2 million over a lifetime.3 Parents, I hope you’re feeling a little better about your investment too.

But it’s more than just money. In time you will see that you are the result of the compounding of your life’s decisions, both good and bad. You may have graduated as a biology major but end up working in tech or finance. This one career path switch will continue to have a profound impact on the rest of your life. Life is full of surprises, and many of them can come from how your decisions compound over decades.

So, start rolling your snowball, both in life and in investing. Let the compounding commence!

Disclosure

1Laura Saunders, “Your Child Picked a College! Tee Up Your 529 Plan,” Wall Street Journal, May 5, 2023.

2In US dollars. Based on S&P 500 Index annual returns, 1926–2022. S&P data © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

3“How Does a College Degree Improve Graduates’ Employment and Earnings Potential?” Association of Public and Land-Grant Universities.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.