It’s been said that the stock market does not like surprises…

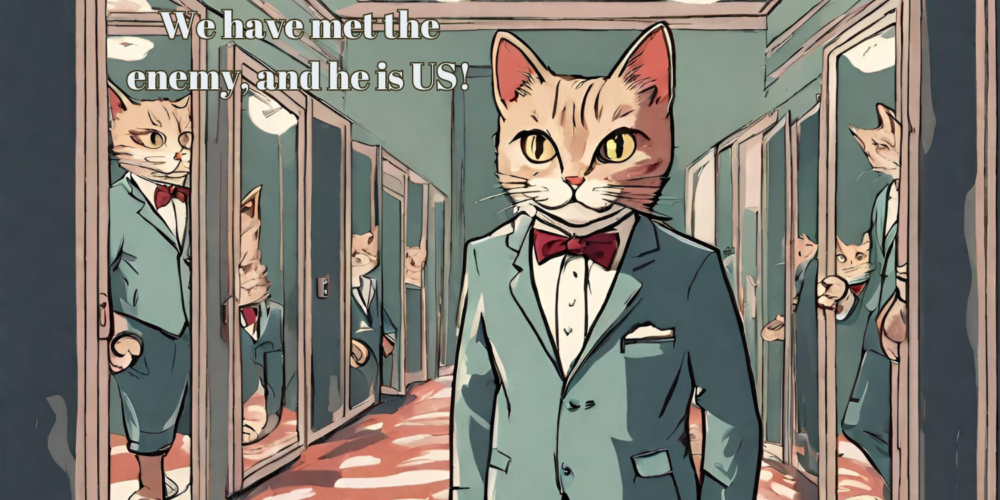

We have met the enemy, and he is STILL us

Heading into 2023, it was hard to describe the economic picture as anything other than bleak. The inflation rate was still near a 40-year high. Major stock indices were near or in bear market territory. And the presence of a recession in the coming year seemed likely, if not a certainty.

According to a Bloomberg survey of economists in December 2022, the consensus forecast was a 70% chance of a recession in 2023. The median forecast for the U.S. economy in 2023 in that same survey was a measly 0.3% GDP.

And so, predictably…the economy grew substantially, inflation declined, and stocks soared in 2023.

We say “predictably” because this is the same song, different verse for Wall Street analysts and economists. Like everyone else, the talking heads who issue their economic predictions about the near-term direction of the economy and the stock market are heavily influenced by “recency bias,” which is the tendency to project current conditions into the future.

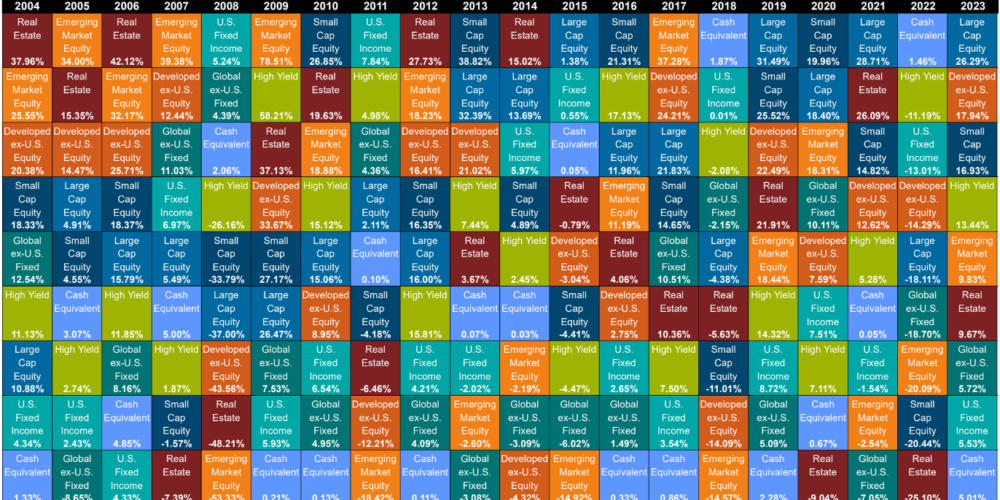

Because the future is inherently unknowable and unpredictable, this kind of subjective guessing on the part of analysts and economists often ends up dead wrong, as it did in 2023. Investors who fell sway to these gloomy predictions and reduced their equity portfolios accordingly missed out on robust gains that stocks enjoyed in 2023, with the S&P 500 gaining a hefty 26.29% and the Russell 2000 small cap index gaining 16.93%.

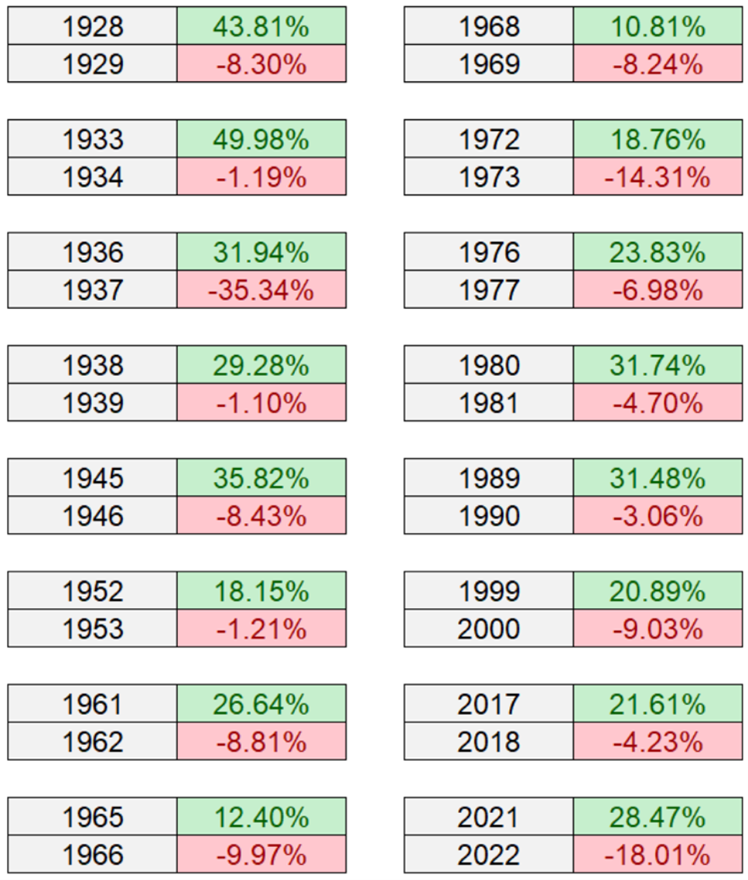

And yet too often, human psychology causes many of us to constantly worry something bad must happen after something good happens, or the good times can’t last, or this time it’s different.

S&P 500 Bad Years After Good Years

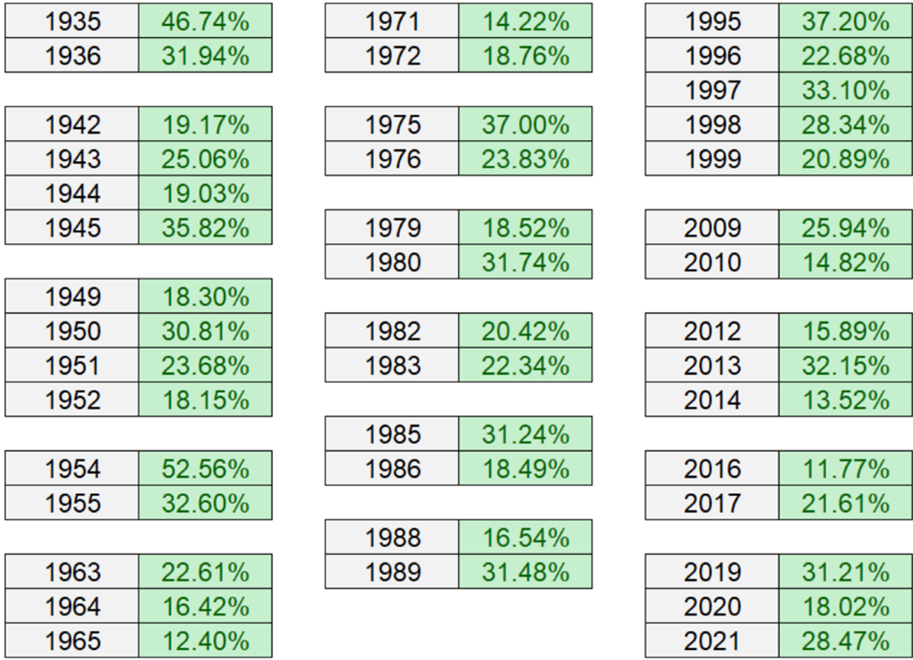

True, things don’t last forever but remember the market is not rational and the good times can last longer than you think. Even following double-digit up years in the market.

Good Years in the S&P 500 Tend to Cluster

A Wealth of Common Sense

As we have noted in this before, the most vexing thing about the stock market is that it often pulls out of a slump well in advance of any improvement in the economic news cycle. The gains in the bull market that follows the end of any bear market are often heavily front-loaded. Stocks tend to soar dramatically at the beginning of a bull market and then settle into a more historically typical range in the months and years that follow.

That was the story in 2023, just as it has been so many times before. Missing out on even just a few weeks or months of a market rebound can spell the difference between a successful investment outcome and one that falls well short of where it needs to be. And where it could have been by simply ignoring the Wall Street hype machine and staying the course.

Some may ask, why is understanding all of this this so important in order to have a successful investment experience?

Rex Sinquefield, co-founder of Dimensional, Inc., once graciously said:

The important thing about an investment strategy is that you have one.

Why have an investment philosophy?

His point is that the first order of business should always be to decide what you believe to be true about investing. Then develop a rigorous, disciplined investment strategy that encapsulates those beliefs.

Obviously, the effectiveness of your (or your wealth advisor’s) investment strategy will determine a great deal about the investment returns you earn. But having no strategy at all is a recipe for disaster.

Scroll through the investment forums on platforms like Facebook, Twitter and Reddit. You’ll quickly see what the hazards of not having an investment philosophy look like. Fearful investors who are completely out of the stock market and arguing amongst themselves about which money market fund or government bond is best positioned for the coming quarter. Greedy investors offering their free advice about which stock or sector is the best to get in on the “action.”

It’s eye-opening, and a little heartbreaking, because these short-sighted investors often incur significant losses that were easily avoidable and are difficult to recover from. Just ask the thousands of investors who got swept up in the GameStop stock mania in 2021 and have seen the share price of that stock plunge more than 80% since then.

Once you embrace the need to have a disciplined investment strategy, the next decision is a crucial one: You must decide whether or not to make your investment decisions based on subjective assumptions about where the market is heading. In other words, will your investment strategy be focused on trying to capitalize on (or avoid) anticipated future events? Or will you focus only on the things you can control and accept the things you can’t control as being part of the territory that comes with stock investing?

Evidence-based Investing

This is where the Great Divide in investment strategies comes into play. Active managers try to anticipate the future and position their portfolios according to their assumptions. In contrast, evidence-based investors, like those of us at CAM, structure our portfolios to try and capture as much of the market’s expected future return as possible and avoid the subjective assumptions that often lead to underperformance.

Evidence-based investing is fundamentally about three things:

- Embracing diversification as being the best way to reduce volatility and avoid the risk that comes from having a portfolio concentrated in just a few stocks or sectors

- Reducing investment expenses such as fund fees and portfolio turnover (trading) to try and maximize net returns

- Focusing on the long term and rejecting the temptation to change the investment strategy based on short-term market conditions

The market rewards patience

The evidence is overwhelming that actively attempting to beat the market by making proactive moves ahead of time doesn’t work. According to the S&P SPIVA mid-year 2023 scorecard, for the 20-year period ending June 30, 2023, 93.12% of actively managed U.S. equity funds underperformed their target benchmark.

Likewise, the evidence is overwhelming that the stock market rewards the patience of those who accept short-term volatility as being part of the deal and not something to try and avoid. Consider that, on December 31, 1993, the Dow Jones Industrial Average stood at 3,754. Thirty years later, on December 31, 2023, it stood at 37,689.

Despite all the chaos and turmoil, the world has seen in the past three decades: currency crises, asset bubbles and busts, terrorist attacks, pandemics, and on and on, the Dow Jones today is about ten-fold higher than it was in 1993.

It turns out that all of the stuff that came in between those start and end points didn’t matter, at least from an investment perspective.

It’s so easy to see in hindsight, and yet it’s so hard to keep in mind when thinking about the future. Emotions and assumptions about the future cloud the judgement of both amateur and professional alike. That’s why a disciplined, evidence-based investment strategy is, in our experience, by far the best way to take subjective guesswork out of the equation.

As Pogo once famously said in the comic strip of the same name: “We have met the enemy, and he is us.”

As always, we are here to help.

Disclosure

Sources: Bloomberg; S&P Dow Jones Indices, LLC, 2023 SPIVA U.S. Scorecard; CRSP; NYU Historical Returns on Stocks, Bonds and Bills: 1928-2023; A Wealth of Common Sense, “What Comes After a Good Year in the Stock Market?” January 2nd, 2024; Savant Wealth; Dimensional Fund Advisors.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.