"Do not mistake a confident explanation for an accurate prediction" - James Clear. It's important to remember this when reading the news.

The Stories of 2023

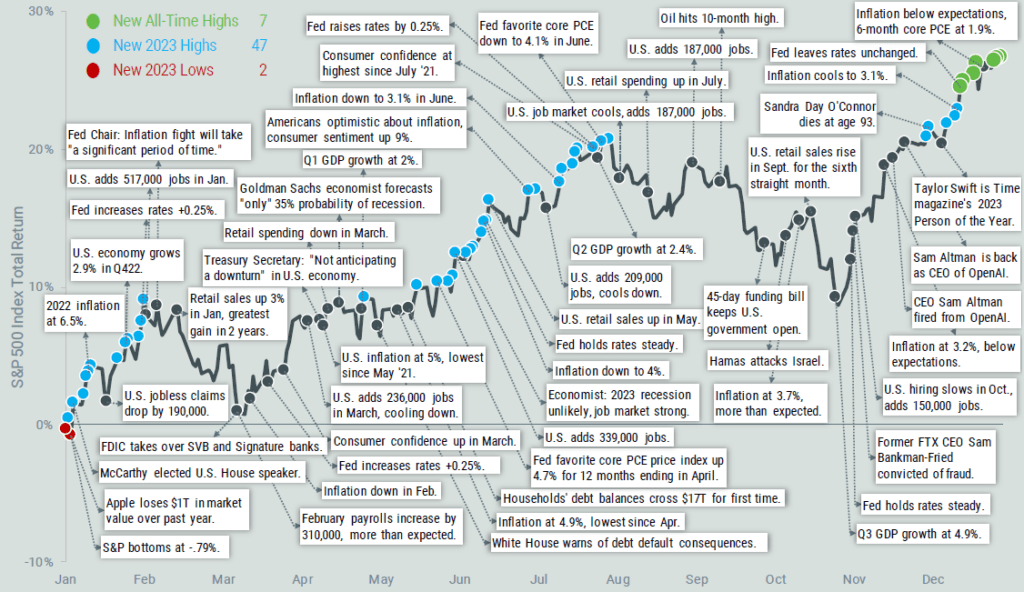

How could we sum up the market in a year like 2023? If given only a word, resilient might do. The year began with many reasons that investors might doubt the market. There was anxiety over high inflation, rising interest rates, and widespread “hard landing” and recession forecasts.

Later, we endured regional banking turmoil and witnessed the onset of war in the Middle East. Yet, despite it all, the market delivered big, with the S&P 500® Index returning over 26%. For a more in-depth trip down memory lane, Figure 1 captures as much as we could fit of the good and not-so-good news from 2023, presented against the cumulative return of the S&P 500. Market highs and lows are highlighted to illustrate further what a tremendous year it was (blue and red dots for highs and lows and green for new all-time highs).

Amazingly, a dollar tracking the index beginning with the start of the year would have reached the low mark by January 5 and experienced 47 new highs by the end of 2023.

Figure 1 | S&P 500 Index Return and Headlines in 2023

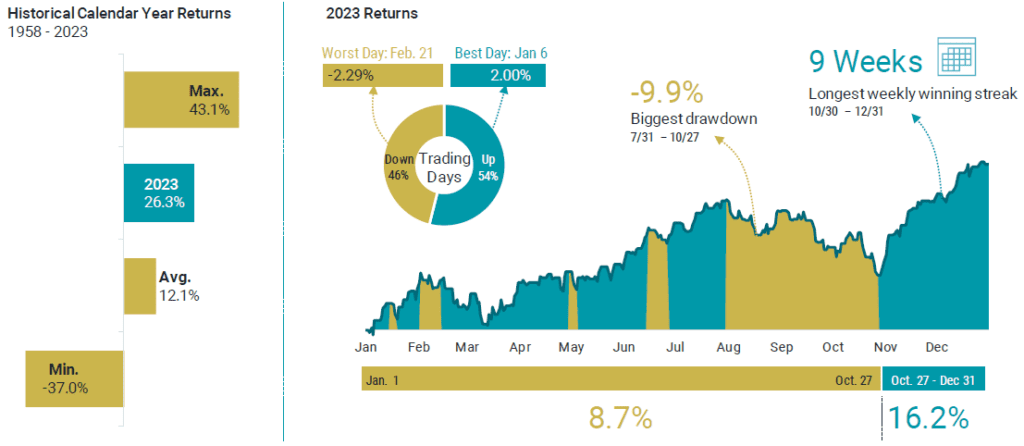

To offer a sense of just how impressive the market return was in 2023, if you compare it against the average of all calendar year returns since the S&P 500 was incepted in 1957, it’s more than double (26.3% vs. 12.1%) as shown in the left panel of Figure 2.

That we can’t see in the 2023 total return figure is that the day-to-day experience for investors was more complex.

The right panel of Figure 2 shows a few more statistics for the S&P 500 in 2023. Even in a big up year, there were plenty of ups and downs. Missing out on short periods in the market, like the last nine weeks when stocks rose 16%, could have led to much lower returns (8.7% YTD as of Oct. 27 vs. 26.3% by year end) — another reminder of how trying to time the market is unlikely to leave us better off than just staying the course.

Figure 2 | S&P 500 Index by the Numbers

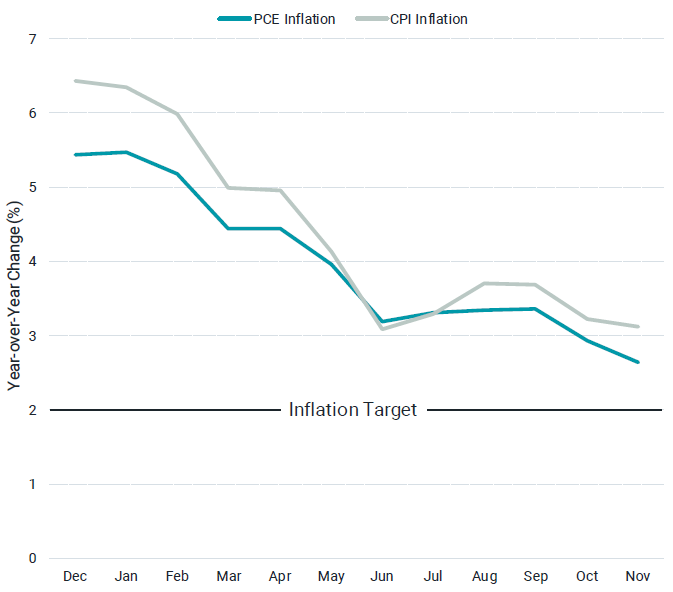

Beyond stock returns, a few other storylines stood out in 2023. Coming into last January, the rate of inflation still stood around three times the Federal Reserve’s (Fed’s) 2% target. Over the year, the gap between actual and target inflation narrowed considerably.

Figure 3 paints the picture, presenting two common measures of inflation: the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) price index. Both measures show a similar trend over the year.

Figure 3 | Inflation Closed in on the Fed’s Target Inflation Rate in 2023

The Consumer Price Index (CPI) and Personal Consumption Expenditures Price Index (PCE) are two U.S. inflation metrics that use different methodologies, and therefore produce different estimates. The CPI measures the change in the out-of-pocket expenditures of all urban households. The PCE index measures the change in goods and services consumed by all households and nonprofit institutions serving those households.

A few other recent milestones continued to inspire hope that inflation is coming under control. In November, the PCE index level fell from where it stood in October. We often hear inflation numbers reported in percentage change from the prior year.

In this case, we’re talking about the underlying price level measured by the index, which suggests prices declined in November (not just the rate of change). This marked the first time the index registered a month-over-month decline since early 2020. Also notable: Core PCE, which excludes food and energy costs, increased by just 1.9% over the last six months. That’s just below the Fed’s target.

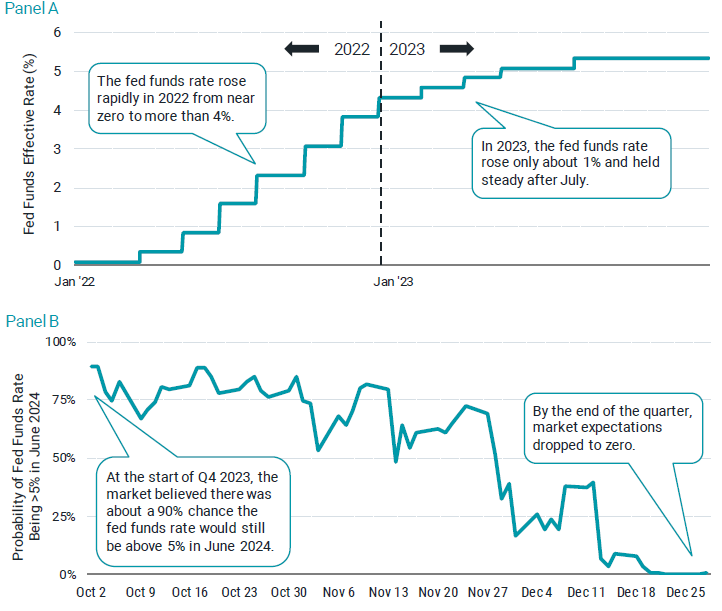

Of course, alongside inflation, investors paid close attention to the path of interest rates and the actions taken by the Fed in 2023. We can see in Figure 4 Panel A that the federal funds rate rose about 1% over the first seven months of 2023 to eclipse the 5% mark and held steady after that. Data from the start of 2022 highlights that 2023 looked quite different than 2022 when rates rose rapidly from near zero to above 4% in a single year.

Figure 4 | The Pace of Interest Rate Increases Slowed in 2023,

with Rate Cuts Now Expected in 2024

As we got closer to the end of the year, comments from the Fed suggested plans to shift in the other direction with likely rate cuts in 2024. Market-implied expectations for rates in 2024 shifted dramatically, particularly over the final three months of 2023.

Figure 4 Panel B shows that at the start of the fourth quarter, the market placed about a 90% chance on rates being above 5% in June 2024 (as implied by prices on fed futures contracts). By December, that expectation effectively dropped to zero. In other words, the market is now pricing in rate cuts to begin in the first half of 2024 — illustrating a remarkable shift in expectations. A year ago, few predicted that the Fed could keep inflation in check and begin to cut rates without causing economic recession. The fact that we have yet to see a recession suggests that our earlier “resilient” descriptor can also be applied to the economy.

2023 was Unexpected

Taken altogether, these stories from 2023 — big returns from stocks, improving inflation, a slowing pace of rate hikes, and avoiding recession — highlight what a remarkable year it was. It was a year of so many memorable and unexpected stories and news events, but also one that offered powerful lessons for investors. There will always be noise and distractions that can challenge you to stay invested in your financial plan. There will also be times when many predict market declines with no shortage of compelling arguments for why you should heed these warnings. Doing so in 2023 would likely have done far more harm than good.

If we stay focused on our long-term goals and the fact that our financial plan can account for the ups and downs, we will inevitably see in markets, we can be better prepared to tune out the noise in the short term (and maybe experience less stress about our portfolios along the way). Those who held that philosophy throughout 2023 were likely rewarded. We think that approach is just as important in 2024 and the future.

Disclosure

Sources:

Figure 1 Data from 1/1/2023 – 12/29/2023. Source: FactSet, Avantis Investors.

Figure 2 Calendar year return data from 1/1/1958-12/31/2023. The S&P 500® Index incepted in March 1957. Remaining data from 1/1/2023 – 12/31/2023. Source: Bloomberg and Avantis Investors. Past performance is no guarantee of future results.

Figure 3 Data from 12/1/2022 – 11/30/2023. Source: U.S. Bureau of Economic Analysis from FRED.

Figure 4 Panel A data from 1/1/2022 – 12/31/2023. Source: FRED. Panel B data from 10/1/2023 – 12/31/2023. Source: CME FedWatch.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.