What is happening with Insurance premiums lately? Read more to get tips on how to ensure you have the right coverage.

Avoid this Scary Tax Penalty! What to know about Medicare Part D

As the leaves turn and the days grow shorter, it’s time to embrace the spooky season. While you’re busy picking out costumes and stocking up on candy, let’s chat about a haunting topic that could creep up on you faster than a ghost in the night: Medicare Part D and its pesky penalty tax.

Turning 65 is a big milestone—filled with new adventures, freedom, and… well, a few tricks! If you’re not careful, you might find yourself facing a chilling surprise: an unnecessary penalty tax for not enrolling in Medicare Part D when you first become eligible (i.e. at age 65). Don’t let this phantom fee haunt your finances! Join me as we unravel the mysteries of Medicare, ensuring that you’re ready to enjoy your golden years without any frightful financial tricks.

What is Medicare Part D?

Like it or not, we will all be on medication at some point in our lives. If we’re lucky – it won’t be permanent. But for most, medication will be a constant as we age. Medicare Part D is a crucial component of the Medicare program, providing prescription drug coverage to eligible individuals. Launched in 2006, it aims to help seniors and certain disabled individuals manage their medication costs, thereby improving their overall health and well-being.

Medicare Part D is an optional benefit that adds prescription drug coverage to Original Medicare (Part A and Part B). Enrollees choose from various plans offered by private insurance companies, allowing them to select coverage that best meets their needs. Plans vary in premiums, deductibles, and copayments, so it’s essential to compare options based on individual medication needs.

While Part D can offer significant financial relief, it’s important to understand its timing and the tax implications.

When Can You Sign Up for Medicare Part D?

Eligibility for Medicare generally begins at age 65. To avoid late enrollment penalties, it’s critical to sign up for Part D (prescription drug coverage) when you first become eligible. The initial enrollment period spans seven months—three months before your 65th birthday, the month of your birthday, and three months after.

If you miss this window, you may face a penalty premium increase for as long as you remain enrolled in Part D (i.e. the REST of your life!). The penalty is calculated as 1% of the national base beneficiary premium for each month you were eligible but didn’t enroll. This can lead to significantly higher costs over time.

What’s the cost of being late?

Let’s look at an example of how the penalty for not signing up for Medicare Part D at age 65 can impact you.

As of 2023, the national base premium was around $32.74. If you missed enrollment for 3 years (36 months), here’s how the penalty would work:

- Calculate the penalty:

1% of $32.74 = $0.3274

For 36 months: $0.3274 × 36 = $11.77 - Monthly premium:

If you then enrolled in Medicare Part D, you would add this penalty to your monthly premium. For example, if you choose a plan with a premium of $30, your total monthly cost would be $30 + $11.77 = $41.77. - Lifetime penalty premium:

You waited 3 years to sign up for Part D, so now you’re 68. If you live to age 88 and need prescription medication this entire time, that’s 20 years of paying the monthly penalty on top of the plan premium.

$11.77 monthly × (20 years × 12 months) = $2,824.80

So, missing your enrollment by 3 years could mean paying an extra $11.77 each month for the duration you’re enrolled in a Part D plan. As you can see, if you miss your enrollment by many many years, the penalty can be crippling. Over time, that adds up to a spooky sum in the thousands of dollars!

Additional Unforeseen Tax Consequences

Failing to enroll in Medicare Part D when eligible can have more than just immediate financial consequences. It can also affect your tax situation in other ways.

- Need for more income: The late enrollment penalty can raise your overall healthcare expenses, which may mean you need more income than before. This additional income may come from your 401(k) or IRA, which would create more taxable income for you.

- Tax Brackets & IRMAA Fees: If your income rises above certain thresholds, you may be pushed into a higher tax bracket on your basic income. You may also be moved into a higher backet for your Medicare Part B and Part D premiums. This could require that you pay the higher IRMAA premium. It’s essential to monitor your income levels to avoid unnecessary penalties.

What’s Changing for Medicare Part D in 2025?

Don’t be caught off guard by letting your Medicare Part D plan renew without first knowing about the 2025 changes. You need to be aware of these updates to help you navigate open enrollment happening NOW (October 15 through December 7).

The five upcoming changes to Medicare Part D for next year are:

- Many plans are merging or ending

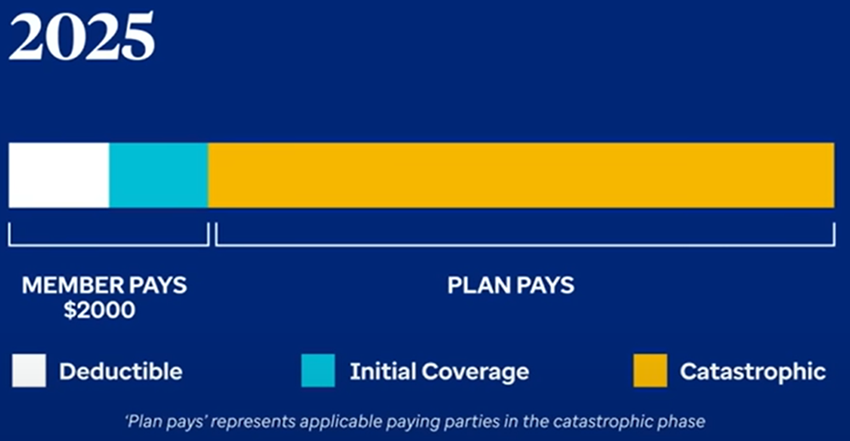

Medicare Part D plans for millions of members are being discontinued or merging with another plan in 2025 — especially for people with Aetna, AARP/UnitedHealthcare and Mutual of Omaha plans. - A new $2,000 out-of-pocket cap

Out-of-pocket costs for Medicare Part D are capped at $2,000 in 2025. That means once you’ve spent a total of $2,000 in 2025 on Part D deductibles, copays and/or coinsurance, you’re done paying out of pocket for the rest of the year. - No more “donut hole” (aka coverage gap)

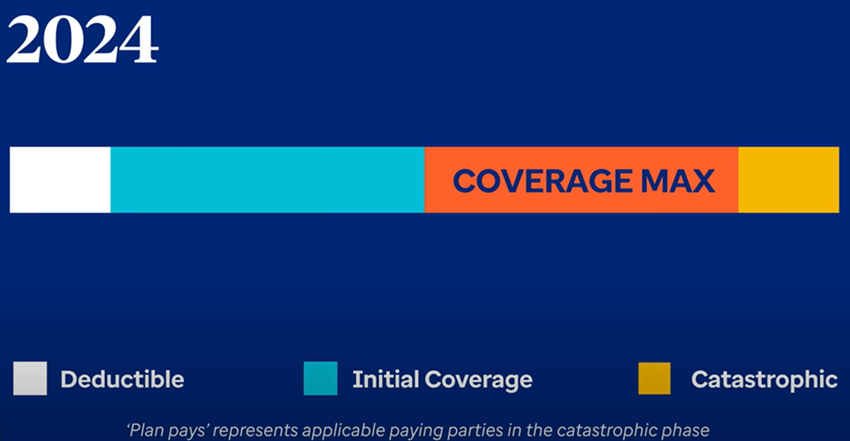

The Medicare Part D “donut hole,” or coverage gap, will go away after 2024. Through 2024, the donut hole is a phase of Part D coverage when you owe up to 25% of the cost of medications rather than your plan’s copays and/or coinsurance. This is indicated by the “Coverage Max” section in the 2024 image below.

Starting in 2025, there will no longer be a Medicare Part D coverage gap. You’ll pay your plan’s deductible, copays and/or coinsurance until you reach the new annual cap ($2,000 in 2025), then you’ll owe nothing out of pocket for the remainder of the year. This video clearly explains this change.

- A payment plan for prescription drugs

The Medicare Prescription Payment Plan is a new, optional way to spread out your out-of-pocket costs over time instead of paying them all at once. Think of it as a “buy now, pay later” option for Medicare Part D deductibles, copays, and coinsurance.

Keep in mind that while this payment plan can help with budgeting, it won’t actually save you any money. Your total expenses will remain unchanged, and plans can’t charge any fees or interest just for using the plan. - Premiums are all over the place

Most of these changes are great in theory – but the insurance companies are not going to just eat these additional costs. It is very important you reach out to your current provider to ask what your 2025 premium will be. You will also want to ask what the cost(s) will be for your medications in 2025.

Don’t Be Spooked – Be Informed!

Medicare Part D is essential for managing prescription drug costs for those eligible. But beware: timing your enrollment is crucial to dodge those frightful penalties that can haunt your budget and tax situation.

If you’re nearing the age of 65 or know someone who is, make sure they’re in the know about the enrollment windows (Oct 15 – Dec 7th) and explore their options are Medicare.gov. Signing up on time is the key to warding off financial ghosts and ensuring a healthier future. This proactive approach can lead to better financial stability and help keep those healthcare monsters at bay!

CAM Disclosure

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.