It’s been said that the stock market does not like surprises…

Financial Literacy Beyond the Basics

You may have seen in the headlines that April is Financial Literacy Month. You may have thought – that’s great, younger people need to learn more about finances. The typical basics that most financial literacy programs are teaching to school-aged students revolve around saving, spending and growing their money (i.e. how interest works). These are great basics and everyone should learn how to have good money habits by the time they leave their parents house. But what are some things working adults need to know BEYOND these initial financial principals?

Employer Benefits

Within your entire working career, you are likely to switch employers at least a few times. Each new job is an opportunity to increase your earnings and potentially receive new benefits. Even if you don’t switch employers, benefits are updated annually and should be reviewed carefully.

Have you found navigating through the complex details of your employers benefits daunting? Who do you turn to when you need help reviewing what you absolutely need vs what offerings you could pass on? A Wealth Advisor can be a great resource when reviewing benefits! They have likely reviewed benefit plans across many employers, may work closely with insurance providers and estate planners. Their vast knowledge can ensure you’re making the most of your employer benefits.

Insurance

Sometimes insurance has a bad reputation. However, the purpose of insurance is to protect yourself (and your family) and your assets in the unlikely event that something bad happens. During stressful times the last thing you want to worry about is the cost. So what types of insurance do you need and where should you buy it?

- Medical – your employer if possible. If your employer does not offer healthcare, you should check the marketplace. Depending on your income level, you may qualify for a reduced rate on your marketplace premium and/or deductibles.

- Life – if offered, accept your employers standard group policy. For any “additional” life insurance needs, you should look outside your employer plan. For most people, a simple Term Life Insurance policy is enough. Exactly how much you need will vary. Speak with a Wealth Advisor to determine how much you need to ensure your family is taken care of. Using an independent broker who shops around can help you find the best rates.

- P & C (Property and Casualty) – this covers your automobiles and real estate. Again, using an independent broker who shops most of the providers will help you find better rates. Some brokers will help you review your policies annually to ensure you’re still adequately covered and your premiums aren’t being raised beyond other current rates. Having an annual review is very important to ensure you and your assets stay fully protected.

- Umbrella – this is an additional liability insurance to help cover you beyond what your home and auto policies cover. With rising medical bills and the cost to repair/replace automobiles, standard P&C policies may not cover the entire bill. Without Umbrella insurance, the person “at-fault” will be left to personally cover the rest! Having a $1 million policy is inexpensive and provides a lot of peace of mind and protection. Your Wealth Advisor will be able to advise how much your Umbrella policy should cover.

- Specialty – for any assets not covered by a standard policy. If you own expensive art, watches and jewelry, boats, recreational vehicles, etc you will most likely need insurance to cover those specific items. Don’t assume your homeowners policy will cover that Rolex! Call your insurance provider to find out what extras are covered.

Retirement Savings

Do you think Social Security will be enough to cover your retirement income needs? Social Security was never meant to be the ONLY source of retirement income. And the younger you start taking Social Security (i.e. before full retirement age), you will permanently receive less.

The solution to having enough income in retirement lies in personal savings. Most employers offer various kinds of retirement plans that either the employee or employer, or both, can contribute to. If your employer does not offer a plan, you can still save for retirement through an IRA or Roth IRA, or a taxable brokerage account.

Knowing how much you can save each year to these various account types is crucial. Each year the limits increase so you should also be increasing your contributions annually. This quick guide provides the 2024 limits.

Having a retirement savings strategy is crucial to ensuring you have enough income when you stop working. Should you only save in your 401(k)? Will it be enough? Theirs lots of talk about Roth accounts. Should you have one of those? Creating a plan specific to your retirement dreams and goals is the best place to start.

Social Security

If you’re a financial nerd like us, you may find the history of Social Security fascinating. Did you know it is less than 100 years old in the U.S.?

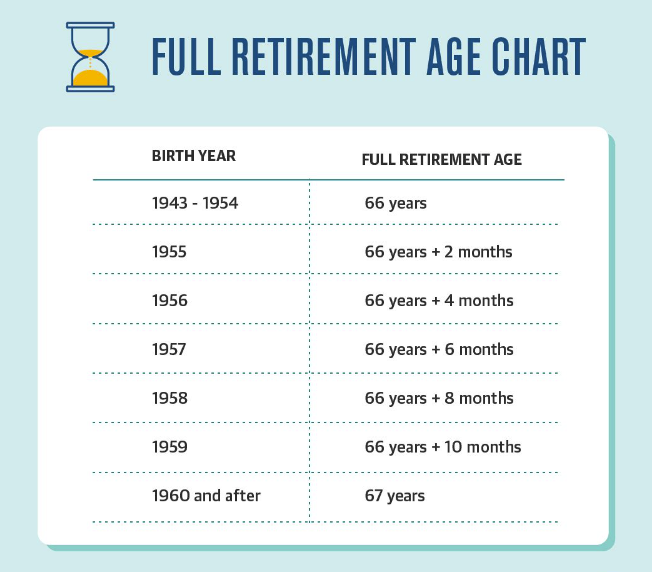

You can log in to SSA.gov to see what your current estimated monthly benefits will be from age 62 to 70. Depending on when you were born, your full retirement age will vary:

If you choose to take benefits before you reach the full retirement age, your monthly benefit will be permanently reduced. The amount reduced varies based on the age at which you start your monthly payments.

If you delay your retirement past the full retirement age, your benefit payment will increase by a percentage for each month that you delay taking your benefit, up to 8 percent per year. You can continue to accrue benefit increases each month until you turn 70, at which point you’ll no longer be eligible for any additional increases even if you continue to delay taking benefit payments.

You can also receive social security for certain disabilities, if your spouse passes or for dependents still living. Knowing what your benefits are and when to take them can greatly impact your financial health. Speak with a Wealth Advisor or read more about all the benefits from SSA.GOV.

Long-term Care

70% of people turning age 65 will develop a severe long-term care (LTC) need in their lifetime. That may mean in-home care or full-time assisted living care. Whether you plan to self-pay or through a LTC policy, the costs are only going up. Having a plan well before you need care will give you and your loved ones peace of mind.

LTC insurance has come a long way, with many different options offered. Working with an independent broker in your 50s is the best time to start considering a policy. If you have a family history of long-term needs, it’s important to start planning for your own care even sooner. Having the proper estate documents and power of attorney forms in place will also be crucial before your health declines.

As you can see, we just barely touched the surface across many topics! Knowing financial basics is a great place to start, as these basics will help you understand the more complex “necessities” discussed in this blog. However, so many areas in our lives have financial impacts – it’s hard to keep up or be an expert. As Wealth Advisors it’s our responsibility to keep up to date with the latest laws, industry changes and solutions. We are here to help educate and guide you through life’s complexities and decisions.

Disclosure

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.