It’s been said that the stock market does not like surprises…

An income strategy to weather interest rate changes

There is a lot of noise in the world today. Whether the media is drowning us with information about politics, global issues, weather, pop culture or the economy – the message usually has some undertone of anxiety, fear or anger. In financial news the persistent “anxiety” inducing question is about interest rates. Everyone wants to know when the Fed will cut them. People are concerned with how rate cuts rates will affect their portfolios, money market rates and ability to take on new “cheaper” debt. What if there was a better way to manage all this noise and uncertainty? Why not design a portfolio strategy that can weather interest rate changes, so you don’t have to worry what the Fed is going to do?

Traditional income strategies

Once you stop working you will need to find a new source of income to support your basic needs and hopefully more for your best “post work” life. The security blanket of your employer’s paycheck will no longer be something you can rely on. Have you thought about where this monthly paycheck will come from or how much it will be? It takes some planning and foresight to ensure you have enough month to month, or you can quickly find yourself in a bind. If you don’t plan ahead, you may not like your options.

So what are some traditional ways people have created an “income source” when they’re no longer working?

- Social Security: This is the most obvious income source people expect to support them when they’re not working. But do you know how much you’re going to actually receive each month from the government? Did you know that the amount changes depending on when you start taking it, anywhere from age 62 to 70? You should look up your Social Security statement to ensure it will be enough. And if it’s not, make a plan for where the extra cash will come from.

- Pensions: In the past, the pension was the main source of income for retirees. Now it’s been replaced with many other retirement options that are mainly funded by the employee. If you have a pension, you’ll want to know the amount and how long you need to work to grow your pension enough to support or supplement your retirement cash flow needs. Obtain the latest copy of your pension statement and review the pay out options and amounts.

- Annuities: This investment product type is as wide and varied as the nature found in the Amazon rainforest. Hardly any two annuity products from different companies look or act the same. These can be complex to understand, but give many people a sense of peace. Annuities can provide a “paycheck” or income stream, just like when you were working. They also provide peace of mind that the money won’t run out.

- Retirement accounts: Once you reach age 59 1/2 you can start taking withdrawals from your IRA, 401(k), 403(b), Roth and many other types of retirement accounts without tax penalties. You will still most likely have to pay income tax on these withdrawals (unless it’s a Roth account). Many fear spending this money because once it runs out, that’s it. Often times we see that people don’t spend enough of it and may leave this world with a lot left over.

- Self-employment: For some full retirement may not be for them. Or they may be too young to gain access to the traditional four options above without extreme financial penalties. If you have a hobby or skill you practice that can be monetized to provide for your income needs, you may be able to make work optional a lot sooner.

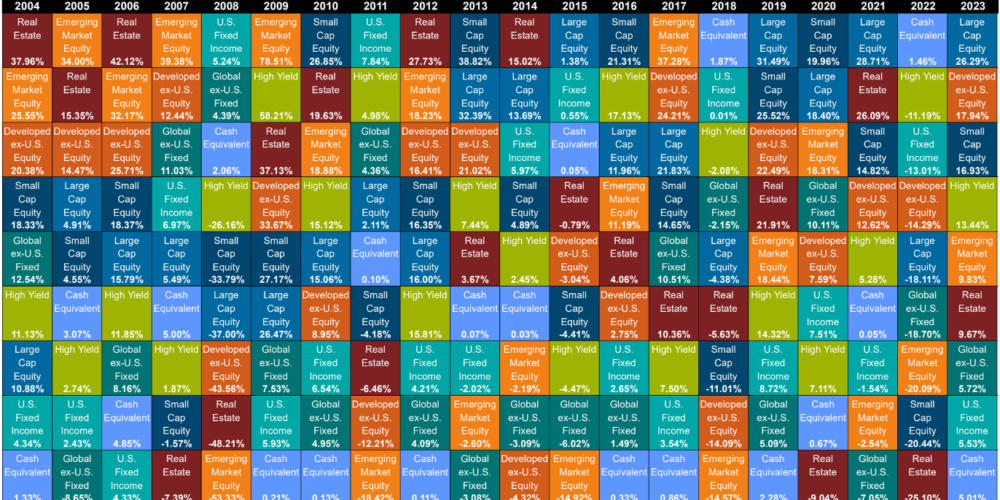

- Investment income: A traditional way to receive needed income is through investments like dividend paying stocks or real estate. Some will even use traditional fixed income that pays enough yield (i.e. income) to meet their needs. Or set up a bond ladder that has bonds maturing at just the times when they will need income next. This approach can work but may expose you to excess equity risk or interest rate risk. Depending on when you decide to retire, sequence of return risk may also be a conern.

No matter which of the above is used, they are often affected by changes in interest rates and rising GDP. So how do you create an income stream that can get you through one of these economic storms without ruining your retirement resources or your income strategy?

More income, less risk

For years interest rates were so low that it wasn’t worth holding your cash in the bank. And investing in “safe” fixed income products didn’t get you enough interest or income to keep up with inflation. Now we’re in a cycle where holding cash in a high yield savings account (HYSA) or money market (MM) is worth it. Even traditional fixed income is offering decent income that hasn’t been seen in a long time. But what do you do if rates go down again?

It has always been our mission to help clients achieve their life goals and financial goals. To do this we don’t believe we can be complacent when there are changes in the fixed income world. For example, when traditional fixed income was yielding almost nothing in 2019 and early 2020 we did not give in to accepting such abysmal income or put our clients at higher risk by moving their “safe” money to equities. Instead, we turned to alternative fixed income strategies that helped clients continue to diversify and achieve higher yields than what traditional fixed income was offering. This didn’t involve taking on more risk in the equity markets.

The income strategy

Through customization, we’ve seen this work firsthand for many clients. Through constructing these unique portfolios for clients over the last five years, it has provided us with the framework to now offer this approach more broadly to current clients and new clients alike. The strategy bundles higher yielding assets and provides a sort of paycheck-equivalent, without the high costs of some solutions that might exist today in the market place.

This strategy can help clients achieve more income and potentially deliver more stable investment returns depending on the needs of the client. It is not a replacement for traditional equity or stock market exposure. It is a replacement or compliment to some traditional fixed income. The strategy is designed to diversify investments while hedging against long term inflation and rising GDP. It could be a good option for those who don’t want to or can’t take on full equity risk.

How does this strategy work when rates change? If rates go higher, then this strategy could generate more yield (income). If rates go lower, then this approach may be better positioned to lock in higher yields for longer. One very important thing to keep in mind, HYSA and MM rates will come down and will no longer be attractive options for income or inflation protection. Regardless, as interest rate changes occur in 2024 and beyond, we will not be not be complacent. We will will make portfolio adjustments that seek to continue to generate higher yields and take advantage of opportunities that may present themselves.

Would you like to turn off the news and not worry about your income stream when it comes to interest rate changes? This may also be a great opportunity for you to start gifting now, during your lifetime. No need to wait to pass on your wealth in a will or trust. Partake in the joy of those you share your income with! Or just take a big breath and let the stress go of worrying “will I have enough?”.

Disclosure

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.