As we approach year end, Marc Jimenez - founder of CAM Investor Solutions - shares some helpful investment reminders.

CAM 2020 Investor Letter

2020 was a year that investors will not soon forget and it’s clear, few of us were sad to say goodbye.

We can’t be complacent.

2020 was a year that investors will not soon forget and it’s clear, few of us were sad to say goodbye. A pandemic, a recession, the end of a more than decade-long bull market (and the beginning of another bull market), all-time highs for the VIX, lockdowns impacting families and businesses around the world, the prices of oil futures turning negative, a tense U.S. presidential election cycle, unemployment spiking more than 10 percentage points in a matter of months—the list could go on for some time. And after all of it, an above-average calendar year return for U.S. stocks.

Staying the course and lessons from 2020

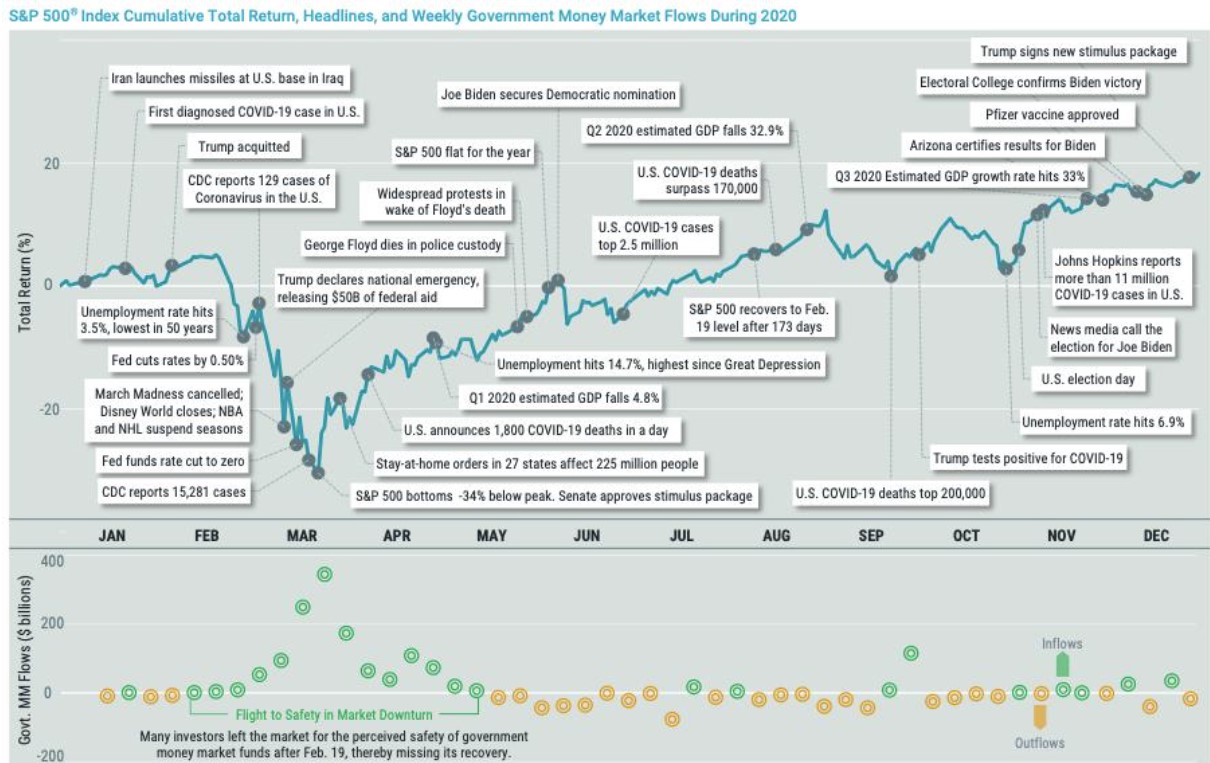

Figure 1 below plots the cumulative return of the S&P 500® Index throughout 2020, along with some corresponding news headlines (at least as many highlights that fit on one page). The index finished the year up more than 18%, but as you can see in the chart, it wasn’t a smooth ride. After hitting all-time highs in February, stock prices plunged as the seriousness of COVID-19 became more apparent and fear levels skyrocketed about its impact on the economy. Volatility levels spiked amid the downturn, and data from the Investment Company Institute shows many investors flew to government money market funds. See the bottom section of Figure 1 that plots weekly government money market fund flows. Figure 1

Data from 1/1/2020 –12/31/2020. Source: ICI, FactSet, Avantis Investors. Past performance is no guarantee of future results.

Data from 1/1/2020 –12/31/2020. Source: ICI, FactSet, Avantis Investors. Past performance is no guarantee of future results.

Risk is what you don’t see.

On Monday, March 9th, 2020, I was sitting on a flight from Denver bound for New York’s LaGuardia Airport. It was expected to be a busy week of meetings, even though one of my favorite conferences I look forward to each year had been canceled the week before out of concern for the spread of Covid-19.

Over the course of the next 3 days, New York City began to prepare for the inevitable shutdown. While I still had several meetings, each day the mood was more uncertain as reported virus cases around the world began to grow. To my surprise, I received a last-minute invite from an institutional partner to ring the closing bell of the New York Stock Exchange (NYSE) on Thursday March 12th.

I always thought it would be an experience to do this, and it truly was. Talk about being in the right place at the right time. It was also the last “normal” day on the floor of the NYSE before Covid-19 would change things for the foreseeable future. To add to history, it turned out to be the biggest down day in the market since the 1987 crash. With so much uncertainty, nobody could have seen or forecasted the risks related to the growing virus, its implications, or what was to follow.

As I finally traveled back to Denver, cities and schools were shutting down and things were going to look different for a while. But like many of you, we didn’t expect the length nor magnitude of what was to come. The one thing that the CAM Team did expect was that many clients and investors were going to be home now with 24/7 access to the news which could be less than ideal for some.

Given multiple offices and the location of many clients, CAM’s virtual abilities and cybersecurity were in place as we continued to serve. As some may recall back in March and April (which seems like years ago), we held regular webinars, Q & A sessions, and conducted many virtual meetings to ensure clients were in a good place. As clients shared their challenges, frustrations, and fears with us in light of the pandemic, a lot of the discussion was not related to finance or money. But instead, it was more personal, especially around family and those they care about most. The feedback was tremendous as it allowed us to identify and introduce additional experts and resources to assist our clients.

Do we remember April?

Our client letter this past April was published just as the world was coming to grips with the stark realities of the Covid-19 pandemic. Shelter-in-place orders had just been issued for all of the world’s major population centers. Sports leagues suddenly canceled their seasons. Schools shut down. And the economy was grinding to a halt. The stock market had already anticipated the impacts of these dramatic events, with the S&P 500 plunging 30% from mid-February to mid-March.

At that time, much was unknown about how the rest of the year would unfold. Indeed, much remains unknown today about how and when this pandemic will end. But in that April 2020 letter, we did express some of our long-held convictions about why investors should not abandon all hope in stocks despite the unprecedented events of the prior six weeks:

1. Investors in well-diversified portfolios can be confident in the overall stock market, even while the market sorts out the winners and losers from the pandemic’s economic impacts

2. Stocks often turn around when we least expect it and make a rapid and dramatic recovery

3. Human ingenuity is a tremendous resource and often underappreciated in times of crisis

In hindsight, it’s interesting to see how vividly these points were illustrated during the remaining nine months of 2020. We have examples of each we can discuss, and please know we don’t present them to gloat or to claim we had some divine insight as to how the rest of 2020 would play out. These are, in fact, the same convictions held by many investors, both professionals and individuals. But they are easy to forget in the fog of momentous events, and we feel it is worth re-examining them now because they proved to be solid principles once again in 2020.

We assume that tomorrow won’t be like yesterday.

2020 will influence all of us in different ways as we move forward, and it’s likely some things will look a little different. At CAM, it doesn’t mean we are looking to implement mass financial planning and investment strategy changes. But instead, use what we know today to help clients make the best decisions for the future.

In a February 2013 interview with Charlie Rose, Michael Moritz, the well-known head of Sequoia Capital, was asked why Sequoia was so successful over a span of four decades. Mr. Moritz discussed firm longevity as a primary reason and Mr. Rose asked why that was:

Moritz: I think we’ve always been afraid of going out of business.

Rose: Really? So it’s fear? Only the paranoid survive?

Moritz: There’s a lot of truth to that…We assume that tomorrow won’t be like yesterday. We can’t afford to rest on our laurels. We can’t be complacent. We can’t assume that yesterday’s success translates into tomorrow’s good fortune.

As you’ve often heard me say, I try to stay in my own lane for most things. I have no idea about the length or impact of Covid-19, its economic impact, or how the stock market should perform, which so many ask about. What I do know is that there will always be uncertainty in every environment. Over time, there is always a crisis of the day. Yes, Covid-19 is something different we have never faced, but any good investor who manages risk well, knows to always plan for the unexpected. Because sometimes, and to quote Morgan Housel, the author of The Psychology of Money, “Risk is what you don’t see”.

What can we control?

While market risk can’t be avoided, it can be managed. Besides having a well-constructed portfolio, the most effective way to manage market risk is by staying invested and resisting the urge to flee stocks when the market goes into a tailspin. We made the point in our April 2020 client letter that stocks often recover rapidly and unexpectedly from such downturns, well before the news cycle has turned positive.

We saw this yet again in 2020. Looking at the performance of the major market indices and asset classes from 3/31/20 to 12/31/20, stocks climbed at a pace last seen (not coincidentally) in 2009: Figure 2 Source: Dimensional Fund Advisors ReturnsWeb

Source: Dimensional Fund Advisors ReturnsWeb

Human ingenuity is a vastly underappreciated asset when it comes to solving problems. The bigger and more urgent the problem, the more human capital that is devoted to solving it. In the case of the Covid-19 pandemic, more human capital has been deployed to this very urgent problem than any other event in history.

The fruits of that effort are already evident. The previous record for developing a vaccine approved for widespread use in this country was four years (for the mumps). Yet, in less than a year, we have two vaccines for Covid-19 approved for use in the United States; others are in use in developed countries in Europe and Asia. There are also another 64 vaccines in clinical trials on humans that have not yet been approved. (Source: New York Times Covid-19 Vaccine Tracker, January 6, 2021).

Vaccine development is the most high-profile indicator of mankind’s ability to tackle the most challenging of problems, but it is hardly the only one. We all have seen countless examples of individuals, companies, civic and charitable organizations, etc., finding ways to adapt to the challenges of the pandemic.

There are risks we can see.

This is why we can’t be complacent, and for some things, we should assume that tomorrow may not be like yesterday. There are several that come to mind, but in terms of priority, I’ll share 3 that many should consider:

Bonds – The uncertainty around the recovery and policy changes in Washington may lead to higher volatility in fixed income portfolios. This may bring risk to bond strategies that have longer duration exposure. For example, the risk of owning otherwise “risk-free” U.S. Treasuries comes from the bonds’ duration. The longer the duration, the greater the risk. An investor who owns 10-year U.S. Treasuries at today’s rates should expect to lose around 9% on the mark-to-market of their bonds if the 10-year yield rises by 1%. (see Figure 3 below for examples). Figure 3

Source: Quadratic Capital

Source: Quadratic Capital

With interest rates at generational lows following nearly forty years of decline, the risk of rising rates is becoming a reality for many investors. They have tried to mitigate their duration risk by moving from longer-dated bonds and into short duration bonds (2 years or less). This helps but may not eliminate the risk of losing money.

10 Year Treasury Rates (1871 – 2020)

Inflation – Many investors have been concerned about inflation during the pandemic given all the federal and fiscal stimulus. Some have also noticed basic goods, services and groceries increase. Others have expressed concern about pent up demand and its impact once we move on from the pandemic. Some concerned bond and treasury holders have been rotating into Treasury Inflation-Protected Securities (TIPS). TIPs are calculated using the Consumer Price Index (CPI) and we too appreciate the potential benefits of TIPS as they can form a foundation for any good inflation-protection strategy. But its also important to know TIPS alone may be incomplete when it comes to inflation protection.

TIPS reset their values based on CPI. CPI is a calculation performed by the US Bureau of Labor Statistics (BLS). Its single biggest component, which is roughly one-third of the entire measure, is the cost of shelter of which it uses rent as a proxy. (Source: Quadratic Capital, Year-end Update; January 2021). As a result, it’s possible CPI is not the most appropriate measure of inflation for fixed income investors.

Making Room for Error – For CAM clients, financial planning is key for many in addition to managing their investment goals. But we also know things don’t always go as planned. We can plan for retirement or some other goal, but can’t plan for what the future may bring us. I think 2020 has reminded us of that, let alone the last twenty years. Think about how much has changed. I’ll pick an obvious one: interest rates. Many financial plans and investment strategies use assumptions, especially around savings rates, future income, and market returns just to name a few. The level of interest rates impact all of these and almost nobody expected today’s yield curve to look the way it does now.

This is an example of why it’s important to always build in a bit more margin of safety in case things don’t always go according to plan. By taking this approach, it creates greater flexibility, avoids being forced to make ill-timed decisions, and allows you to still reach your goals in the future. It might also provide the ability to capture opportunities when they present themselves.

When you see a good move, look for a better one.

In real-time, maintaining faith in our ability to resolve complex problems can be difficult to muster. After all, a crisis is a known entity, while the future resolution is unknown. And yet we can see, throughout the course of history, that we always find a way. Even though we may not have found our way out of the Covid-19 pandemic yet, we have made tremendous progress. Those who keep their faith in human ingenuity will be rewarded for it.

Nothing in life is easy and 2020 certainly didn’t change that. Over my 20+ years in the industry, I’ve experienced major events such as the Asian Contagion Crisis, the Dot.com Bubble, 9/11, the Global Financial Crisis, and now the Covid-19 pandemic. Experience certainly matters but we must never stop learning because there will be more crises in the future. Not if, but when.

At CAM, each team member has a critical role in the firm and shares a common purpose to always help our clients in any way possible. We all have a story. We all are committed to lifelong learning. This makes us who we are and why we enjoy showing up every day ready to help current and future clients. I am forever grateful for my team’s tireless efforts and look forward to what the New Year will bring for them. And a special thank you goes out to all of our clients who checked in on us during some of those “longer” months of 2020. You all are amazing.

As we sprint into 2021, we are excited to share some new initiatives. At CAM, we haven’t forgotten about all those great discussion and feedback sessions with so many of you from last April and May. These validated why we love what we do and other ways we can help. As a result, we’ve been working extremely hard behind the scenes and since late summer/early fall begin building out additional client resources and solutions for the future. It will be fun to watch these initiatives evolve. We will not be complacent.

On behalf of the CAM Team, we thank our families and significant others for all their love and support. Everyone is looking forward to something special in the New Year.

Looking forward to seeing you soon.

Best,

Marc Jimenez

Founder and Managing Principal

Source: Bloomberg; Investment Company Institute; FactSet; Dimensional Fund Advisors; Avantis Investors; Quadratic Capital; Stone Ridge Asset Management; Robert Shiller Website; Capital Directions; Morgan Housel, The Psychology of Money. M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees. This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Any stated performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Charts and graphs provided herein are for illustrative purposes only. There are many different interpretations of investment statistics and many different ideas about how to best use them. Nothing in this presentation should be interpreted to state or imply that past results are an indication of future performance. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.